When thinking about increasing your money through asset management, the most common investment method is mutual funds. By investing in index funds as mutual funds, you can increase your assets by investing in stocks or bonds.

On the other hand, you can also invest in hedge funds if you have a lump sum of US$30,000 to invest. You do not need to be wealthy to invest in hedge funds.

What is the difference between a hedge fund and a mutual fund? By comparing the differences in financial products, you will know how to invest in them.

Few people have a detailed understanding of investing in hedge funds. So, let’s check the differences between hedge funds and index funds.

Table of Contents

Mutual Funds Are Investment Products That Can Be Purchased at Brokerages

Before we check the difference between hedge funds and mutual funds, let’s first check what mutual funds are. When managing assets, most people open an account at a securities company. After that, they invest in mutual funds.

For those who are familiar with stock investment, some people invest in individual stocks. By purchasing shares of a particular company, they expect the price of the stock to rise.

However, for amateur investors, they do not know which company to invest in. Therefore, amateur investors buy mutual funds unless they have a specific reason. In short, they buy index funds that are a mixture of different stocks.

There are many different types of mutual funds. For example, here are some examples.

- Developed country stocks

- US stocks

- Global stocks

- Emerging market stocks

- Real estate (REITs)

- Bonds

- Gold

Of course, there are many other types of mutual funds. In any case, by opening a securities account and investing in these mutual funds, you can earn dividends and expect to benefit from price increases.

The Basic Premise of Mutual Funds Is to Invest in Index Funds

In mutual funds, it is common to invest in index funds. There are many types of indexes; for example, the following indexes exist for investing in US stocks.

- Dow Jones Industrial Average

- S&P 500

- Nasdaq

- Russell 2000

When investing in mutual funds, we have found that the best performance is achieved by investing in funds linked to an index.

For example, the S&P 500 index represents the stock prices of the top 500 companies in the US. If you invest in an index fund linked to the S&P 500, your stock price will increase as follows.

It is widely known that the S&P 500 has an average annual interest rate of 7-9%. Since dividends are added to this, the actual annual interest rate is about 9-10%. The best-known index fund for the S&P 500 is VOO (Vanguard S&P 500 ETF), and by investing in this fund, you can invest in the S&P 500.

Also, the Nasdaq 100 is an index that invests in the top 100 tech companies in the US. The Nasdaq 100 is known to have an average annual return of 13-15%.

The best-known index fund in the Nasdaq 100 is QQQ (Invesco QQQ Trust Series 1). Investing in QQQ will allow you to earn dividends and stock price gains linked to the Nasdaq 100.

Mutual Funds Have Extremely Low Fees

Investing in hedge funds is known to have very high fees. On the other hand, when you invest in mutual funds, the fees are very low.

Since you are investing in an index fund, the percentage of each individual stock you invest in is already determined. The companies you invest in are also predetermined, and when you buy an index fund, a specific percentage of shares of the target companies are automatically purchased.

Then, if there are dividends or stock price increases, your assets will increase by that amount.

In index investing, the companies and investment percentages are already determined, and the fund manager does not decide where to invest. As a result, management fees are very low. Not only are there no purchase or surrender fees, but other fees are also low.

For example, in the S&P 500 (VOO) I mentioned earlier, the annual management fee is less than 0.1% of the asset value. In addition, there are no purchase or surrender fees, so you can freely buy and sell at any time.

Another feature of mutual funds is that the minimum purchase amount is very low. If you want to invest in an index fund, you can invest as little as US$100.

You Can Invest in Hedge Funds in Tax Havens

Compared to mutual funds, what is the situation when investing in hedge funds?

If you want to invest in an index fund, you need to open an account with a securities company in your country, as mentioned above. On the other hand, if you want to invest in hedge funds, you cannot invest in them even if you open an account at a brokerage firm in the country where you live.

Therefore, open an investment account with an insurance company (investment company) in a tax haven, which is known as a region with almost no taxation. For example, the following is the management screen of an investment account I opened in a tax haven.

The Cayman Islands, Bermuda, Singapore, Switzerland, and Dubai are famous tax-havens. Although these countries have absolutely no natural resources, they attract investment money worldwide because of their very low taxes.

Also, since finance is the main industry in these countries, by opening an investment account, you can purchase financial products from all over the world. Hedge funds are also included in the financial products that can be invested. In other words, if you don’t open an account in a tax haven, you can’t invest in hedge funds.

Investing in a Lump Sum Instead of a Regular Investment

When investing in hedge funds, you must invest in a lump sum. Regular investments are not allowed. When investing in index funds, you can invest in a lump sum or invest a small amount every month by saving. On the other hand, hedge funds do not allow accumulative investment.

To be more precise, when you invest in a hedge fund, you can make a regular investment. However, if you want to make an additional investment in a hedge fund, you need to have a minimum of US$10,000.

No one, except the wealthy, can make a regular monthly investment of $10,000. Unlike mutual funds, you cannot invest in $100 per month, which is why you cannot make a savings investment in hedge funds.

-The Initial Investment Amount Is US$30,000 or More

In most cases, the minimum investment amount for each hedge fund is $10,000, as mentioned above.

On the other hand, if you want to open an offshore investment account with an investment company in a tax haven, you will need an initial investment of US$30,000. Therefore, if you want to invest in hedge funds, you need to prepare at least $30,000.

Higher Fees, but Higher Yields

Also, when investing in hedge funds, the fees are very high compared to index funds. In the case of hedge funds, the following fees are charged.

- Purchase fee: 0-5% of the invested amount.

- Management fee: 1-2% of the asset balance.

- Performance fees: 15-20% of the value gain.

For example, the following is the fee structure of a high-risk, high-return hedge fund.

As you can see, the fees are quite high: 5% purchase fee, 2% management fee, and 20% performance fee.

Because of the purchase (or surrender) fees, unlike mutual funds, investing in hedge funds is not suitable for short-term trading. Also, hedge funds do not like customers who buy and sell short-term and target investors who will invest for the long term. This is why their fees are so high.

But with such high fees, you may be thinking, “What is the point of investing in a hedge fund?” There is no problem with this. Many investors invest in hedge funds because their performance is better than investing in index funds.

A Low-Risk Investment with Stable Yield, Unaffected by the Economy

When investing in index funds, the economy is always an issue. Every few years, there is always a major recession and a stock market crash. When this happens, if you are investing in stocks or bonds as a mutual fund, there is a 100% chance that the value of your assets will drop significantly.

For example, the following is a stock chart of the S&P 500 during the financial crisis caused by the collapse of Lehman Brothers.

At that time, the price of the S&P 500 fell by more than 50%. In other words, the value of the asset was reduced to less than half. When investing in mutual funds, there is always the risk of being affected by the economy.

Hedge funds, on the other hand, can avoid this risk. When you invest in a low-risk hedge fund, the economy does not affect your investment. Low-risk hedge funds include, for example, funds that deal with real estate or bridge loans.

For example, the following is a fact sheet on hedge funds that provide bridge loans in Europe.

If you invest in this fund, the average annual interest rate will be 8-10%. After deducting fees, you can achieve this annual interest rate. Moreover, since it does not invest in stocks, it is not affected by the economy. In addition, since it is a low-risk investment as a bridge loan, there has never been a negative return in the past.

Many investors invest in this hedge fund because it offers almost the same average annual interest rate as investing in the S&P 500 and is not affected by the economy.

High-Risk Hedge Funds Provide High Returns During Recessions

It is not only low-risk hedge funds that are not affected by the economy. High-risk, high-return hedge funds are also independent of the economy.

Investing in an index fund will reduce your assets during a recession because you can only take long positions (buying). With mutual funds, you can buy stocks and bonds, and expect the value of your assets to rise.

On the other hand, in the case of high-risk, high-return hedge funds, they take not only long positions (buying) but also short positions (selling). As a result, they can generate large returns even when stock prices are falling.

In fact, these high-risk hedge funds are more likely to produce high returns during recessions. During a recession, all assets will crash, and after the crash, all stocks will be sold at a low price.

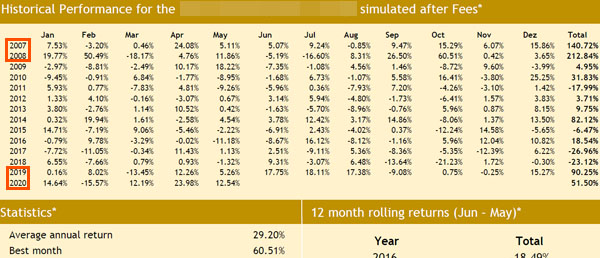

Therefore, it is easy to predict the movement of stock prices and can produce a high yield by leveraging many times. For example, below is a fact sheet on a high-risk, high-return hedge fund with an annual interest rate of 29.2%.

Reviewing the fact sheet, we see excellent yields for the following years.

- 2007: 140.72%

- 2008: 212.84%

- 2019: 90.25%

- 2020: 51.50% (results for the five months from January to May)

In 2007, the problems caused by subprime mortgages were discovered, and in 2008, Lehman Brothers collapsed, causing a financial crisis. The year 2020 was the year of the coronavirus shock. In the years before and after these stock market crashes, if a hedge fund is superior, it will be able to generate higher returns.

High-risk hedge funds aim for absolute returns. In other words, they aim to generate positive returns in recessions as well as in booms. Therefore, high-risk hedge funds are also independent of the economy. In any case, it is important to understand that investing in hedge funds is not affected by the economy.

Investing in Hedge Funds Is a Good Way to Diversify Risk

Even though they are not affected by the economy, even low-risk hedge funds can earn an average annual interest rate of about 10% after fees are deducted. This is the reason why many people invest in hedge funds.

Investing in hedge funds is a good way to diversify your risk. Even if there is a major recession, which happens every few years, your assets will grow regardless of the economy if you invest in hedge funds. In the case of high-risk hedge funds, it is easier to increase your assets in a recession.

If you invest only in index funds, the risk is very high. When the stock market crashes, the value of your assets can be reduced to less than half. Also, during a global recession, you have to endure a situation where the value of your assets is decreasing drastically every day.

On the other hand, if you invest in hedge funds, you can continue to invest without worry, even in a recession.

However, there are countless hedge funds in the world. There are good hedge funds, and there are bad hedge funds. Therefore, finding a good IFA (Independent Financial Advisor) is advisable to invest in hedge funds with good performance.

Listed Active Funds Are Not Hedge Funds

As mentioned above, mutual funds that can be traded at securities companies are not hedge funds. In addition to index funds, active funds are also listed at securities companies and can be invested in.

However, it is widely known that the investment performance of active funds is inferior to that of index funds. Also, active funds take long positions (buying) but do not take short positions (selling). This is why stock prices fall during recessions.

Hedge funds and active funds are completely different. Also, active funds are not worth investing in because they are widely known to have worse investment performance than index funds, despite their high management fees.

Instead of active funds that can be invested in a brokerage account, invest in hedge funds that can be invested in tax havens.

Mutual Funds and Hedge Funds Have Different Characteristics

So far, I have compared and explained the differences between mutual funds and hedge funds.

Hedge funds and mutual funds differ greatly in the nature of their investment products. For mutual funds, the basic principle is to invest in index funds, and by taking a long position (buying), you can earn dividend income and expect stock prices to rise. You can also invest from as low as $100.

On the other hand, hedge funds have higher fees but can increase assets without being affected by the economy. This makes it a good way to diversify risk, and many people are investing in them. In this case, it is a long-term investment with lump-sum investment, and savings-investment is not available. Also, it is important to know which hedge fund to invest in.

Hedge funds and mutual funds have quite different characteristics. It is important to understand these differences and use hedge fund investments for risk diversification.