India is known for its large population and growing economy. Many emerging countries are not investment targets. However, India is an exception and will surely become one of the top countries in the world. Therefore, it is an excellent investment opportunity.

By investing in India, you can significantly increase your assets. While there is a high probability of loss in short-term investment, long-term investment will increase your assets.

However, there are some precautions when investing in India. By investing in Indian stocks properly, you can increase your assets.

So how can you invest in Indian stocks and manage your assets? Let’s take a look at India, one of the best investment destinations among the emerging economies.

Table of Contents

India Is the Best Destination for Investing in Emerging Markets

The most common way to invest in stocks is to invest in the United States. Even if you invest in developed countries or emerging countries other than the US, you will not be able to increase your assets by investing in these countries because the stock prices have not risen much.

Since emerging countries have high economic growth rates, people tend to think that they can increase their assets significantly by investing in them. However, these countries have failed to become developed countries for some reason, and in most cases, they have serious political and economic problems. For this reason, most emerging countries do not have rising stock prices.

The only exception to this is India. India has a large population. Just as China once developed rapidly because of its large population, India is guaranteed to become a strong economy.

In China, most people are still poor and the average annual income is low, except for a few wealthy people. However, because of its large population, its GDP is huge. In the same way, India’s GDP will be huge even if the average annual income rises a little. The country’s economy will develop accordingly.

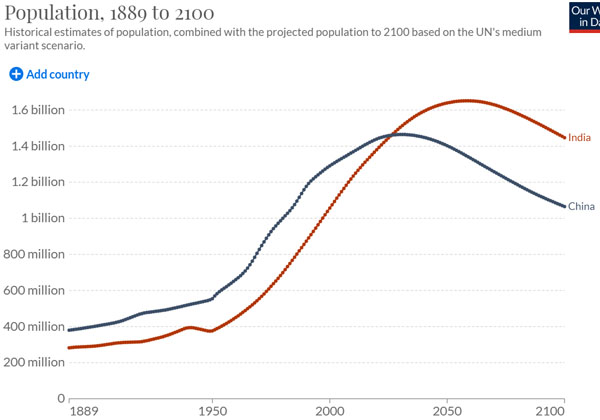

For your reference, the following is the population projection for India (red line) and China (blue line).

China’s population will not increase. On the other hand, India’s population will increase. Also, India’s GDP ranking is already high, and India has a very large population, so investing in India will greatly increase your assets.

India Has High Growth Potential

Why is it a good idea to invest in India instead of the US? While US stocks should be your main investment, investing in India may give you a better return than US stocks.

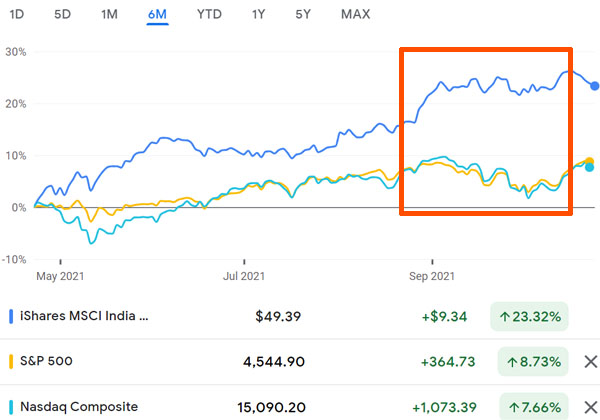

For reference, below is a chart comparing US stocks (yellow line: S&P 500) and Indian stocks (blue line: INDA) over the past five years.

As you can see, investing in the S&P 500, which represents the top 500 US companies, will give you a better return than investing in Indian stocks.

When you look at this, it seems that it is better to invest in US stocks instead of Indian stocks. Nevertheless, why might investing in Indian stocks give you better returns? One reason is that Chinese stocks have become less attractive as an investment in 2021.

Chinese Stocks Have Political Risks, Investment Money Flocks to India

The situation in China and India is similar. Both have large populations and high economic growth rates. However, China has a political risk which is a fatal disadvantage. The Chinese Communist Party is the evilest organization in the world, and the government is free to destroy the giant corporations in the country.

A particularly important trigger for investors is the events in 2021. In that year, the Chinese government issued a series of fines and regulations against giant corporations in the country for no reason. The following is part of the actual news.

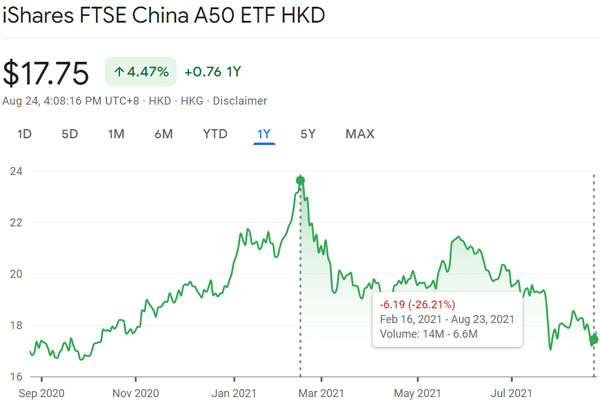

The regulations cover a wide range of industries, such as IT, education, real estate, and gaming. As a result, many huge companies went bankrupt and the stock prices of Chinese companies plummeted. The following is the stock price trend at that time.

The Chinese government wants to control all industries in the country. Therefore, as a result of the development of giant corporations, it is undesirable for the government to be unable to control the Chinese people. Thus, they actively pushed for the weakening of the giant corporations in their country.

As a result, Chinese stocks are no longer a good investment for investors. In fact, there are almost no institutional investors investing in China. The only people who invest in Chinese stocks are amateur retail investors. The reason for this is that there is always the risk of a sharp drop in stock prices due to political risks.

India, on the other hand, is a democratic country and has little political risk. It used to be a colony of the United Kingdom, and its politics is governed by democracy. As a result, the government cannot freely shut down large corporations in India as in China.

As a result, investment money from China has been flowing into India since 2021. As mentioned earlier, India and China have a lot in common economically. However, unlike China, India is a democratic country and there is no political risk. Therefore, as a result of more money flowing into India, the investment performance of Indian stocks is better than that of US stocks in 2021.

Few people are investing in China today. Therefore, India has become the only choice for investment in emerging countries, and we can expect a lot of investment money to be attracted to India in the future.

Before 2021, India was not an attractive investment destination. However, as Chinese stocks have become less attractive, investment money has been flowing into India, making it very attractive to invest in Indian stocks.

Market Capitalization Is Low, and a Little Investment Money Can Make the Stock Price Soar

Also, unlike the US, the market capitalization of Indian stocks is low. For example, here are the market capitalization figures for domestic listed stocks in 2020.

- US: about US$30 trillion

- China: about US$2.7 trillion

- India: about US$600 billion

*This does not include shares that cannot be traded by the general public, such as those held by the founders.

This shows that India’s market capitalization is quite low. When the market capitalization is small, a little investment money can increase the stock price. When investment money from China moves to India, the market capitalization of the company increases and the stock price soars.

The trick to making a lot of money from investments is to invest in a rapidly growing company when its market capitalization is small. This is similar to investing in Indian stocks.

Investing in Indian Stocks Using Indexes

While investing in Indian stocks, it is not advisable to invest in individual stocks. This is because it is difficult to predict which companies will grow when investing in Indian companies.

For US companies, investing in individual stocks in high-tech companies with small market capitalization can yield large profits. For US companies, it is very profitable to do business even in the US alone, and they can also easily expand globally by partnering with giant companies in the US.

For Indian companies, on the other hand, the situation is quite different from that of the US. In an emerging country, it is difficult to predict which small-cap stocks will grow significantly in the future. In addition, even if you invest in the top companies in India, they are small and medium-sized enterprises compared to American companies. In fact, even a company with a market capitalization of $100 billion in the US is a small business.

Also, as mentioned earlier, it is difficult to predict which Indian company’s market capitalization will rise. Therefore, you should invest in an index of Indian stocks.

Index investing allows you to automatically invest in companies with large market capitalization. Also, with index investing, you don’t have to think about which Indian companies to invest in, as the companies are replaced over time.

The Most Recommended ETF Is INDA

There are several types of mutual funds (ETFs) that invest in Indian companies. One of the most recommended is INDA. The most famous ETF that invests in Indian stocks is INDA.

- iShares MSCI India ETF (INDA)

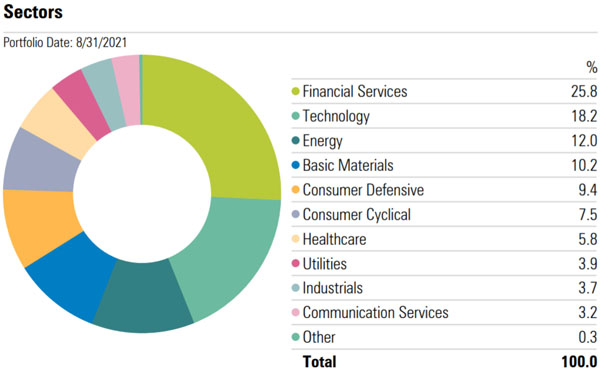

When investing in American companies, most of the top companies are high-tech companies. In the case of Indian companies, on the other hand, most of the top companies are in banking and other financial sectors.

The following is the percentage of investment in each sector in the iShares MSCI India ETF (INDA).

As you can see, the percentage of financial services is large. The market capitalization of high-tech companies is not as large as in developed countries. Also, energy stocks account for a large percentage.

Therefore, there is a lot of potential for growth in Indian stocks. Also, if you invest in an index, as mentioned earlier, the companies you invest in will automatically change as the industry grows. In other words, over time, the percentage of investment in the best Indian technology companies will increase. So, use INDA to invest in Indian stocks.

Indian Stocks Have Low Correlation with US Stocks

Investing in Indian stocks as well as US stocks is a good way to diversify your risk. This is because the correlation between Indian stocks and US stocks is low.

Even if US stocks fall due to the poor performance of US companies, there are many cases where Indian stocks are not affected. For example, the following is a comparison of INDA, S&P 500, and Nasdaq.

The S&P 500 (yellow line) and Nasdaq (green line) are US stocks and have similar chart shapes. On the other hand, INDA (blue line) has a different chart shape from the US stocks. Also, if you look at the orange frame line, you can see that Indian stocks are rising even when US stocks are falling.

The reason why investing in Indian stocks is a good way to diversify risk is because of its low correlation with US stocks.

Long-Term Investment Is the Key to Investing in Indian Stocks

The main principle of investing in Indian stocks is to invest for the long term, not the short term. If you are looking for short-term investment of one year or less, I would not recommend investing in Indian stocks.

In the past, when China’s GDP grew rapidly, it took more than five years for its market capitalization to grow. Similarly, when investing in India, try to invest for a longer period of time of 5-10 years. Otherwise, you will not be able to make money from Indian stocks.

Investing in Indian stocks means the same thing as expecting the country to grow. As the population grows and the country’s industries develop, the companies in India will grow. Many technology companies will be established, and they will become huge.

There is no such thing as within a year, India’s population will grow and Indian companies will start making money rapidly. As mentioned above, the companies with the largest market capitalization in India are in the financial industry such as banks. Therefore, investment in Indian stocks should only be considered if you can invest for a long period of time, such as five or ten years, rather than less than one year.

Invest Using US dollars, not the Local Currency

Even though you are investing in Indian stocks, you should not invest using the local currency. Buying and investing in the Indian rupee is risky.

Few investors want to hold the currency of an emerging country. For example, you would not want to own the Chinese yuan. The Chinese yuan is not trustworthy as a currency and has a small global market share. Similarly, the value of the Indian rupee is also low.

So be sure to invest in US dollars instead of the local currency. There are several ETFs that you can invest in using US dollars. The INDA that I mentioned earlier can also be invested in US dollars.

It is common practice to use the US dollar for overseas investments. Therefore, when investing in Indian stocks, use US dollars instead of Indian rupees.

Investing in India, a Country with Excellent Future Prospects

Investing in a country where the stock market is expected to grow significantly will allow you to increase your assets significantly. This is why many people invest in US stocks. However, if you want to invest in a country other than the US, India is the next best choice.

Compared to other countries, India has a large population and a high economic growth rate. Even a small increase in the average annual income of its citizens will result in a larger GDP, and domestic companies will be able to make large profits. Also, since China is not an attractive investment destination, investment money tends to be attracted to India as an alternative to China.

Also, since India’s market capitalization is small, a small amount of investment money can increase the stock price many times. Many investors are predicting that India will grow rapidly, just as China once grew rapidly and created a lot of huge companies.

Investing in emerging countries is not a great idea. However, India is an exceptionally good investment destination. If you can invest for the long term, consider investing in India.