Hedge funds are an excellent investment option for individual investors. It is not possible to invest in hedge funds by opening an account with a brokerage firm. Individuals can invest in hedge funds by using offshore tax havens where there is almost no tax.

However, if you want to invest in hedge funds, you may think that you will need a lot of money.

You can invest as little as a small amount. Of course, you can’t invest in hedge funds with as little as US$100 like stocks or ETFs. Although you will need more than US$10,000, you don’t have to be wealthy to invest in hedge funds.

However, the minimum investment amount will vary depending on which insurance company in the tax haven you choose to use. Therefore, I will explain what the minimum investment amount in hedge funds is.

Table of Contents

Hedge Funds Allow You to Invest in Small Amounts

Many people misunderstand the minimum investment amount when investing in hedge funds. They think that they have to be a wealthy person to invest in hedge funds, such as the $1 million minimum investment.

However, it is possible to invest in hedge funds even for ordinary people. Even if you are not a wealthy person with a lot of assets, you can invest in hedge funds in small amounts.

However, as mentioned above, you need to prepare tens of thousands of dollars. If you invest through a brokerage firm, you can buy stocks or ETFs for as little as $100. Hedge funds, on the other hand, do not allow you to invest as little as $100.

You Can Open an Offshore Investment Account and Invest as Little as $10,000

What is the minimum investment amount for hedge fund investments? Each hedge fund has a different minimum investment amount. Generally speaking, the minimum investment amount is US$10,000.

Since you can invest in hedge funds with as little as $10,000, you will find that you can invest even if you are not wealthy.

The specific method is to use an insurance company that is registered in a tax haven. In order to open an offshore investment account to invest in hedge funds, you have to use an investment company in a tax haven. You cannot invest in hedge funds from a general brokerage firm.

Brokerage firms are always subject to government regulations. This means that your investment options are limited. On the other hand, investment companies registered in tax havens have no restrictions on their investments. Therefore, retail investors are able to invest in hedge funds.

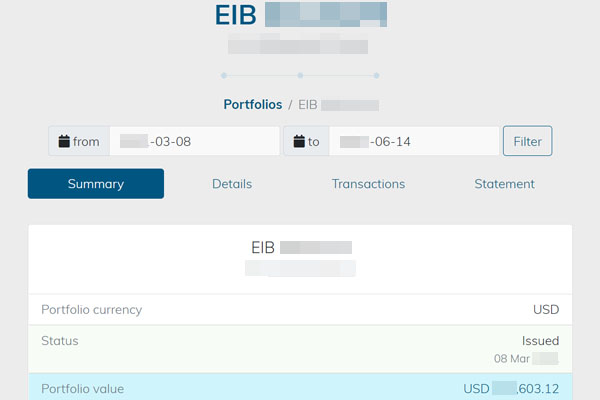

For your reference, the following is the management screen of my offshore investment account.

As you can see, I use an offshore investment account to invest in hedge funds.

The Minimum Amount for Direct Investment is US$100,000

When investing in hedge funds, you can choose to invest directly instead of using an offshore investment account. In other words, you can send money directly to the hedge funds and have them manage your assets.

In the case of direct investment, the minimum investment amount varies from hedge fund to hedge fund, but in most cases, the minimum investment amount is US$100,000.

There used to be a time when we had to send more than one million dollars to invest in a hedge fund. However, there are now so many hedge funds that if the minimum investment amount is too high, it will be difficult to attract investment funds. Therefore, the minimum investment amount for direct investment is usually $100,000.

On the other hand, if the minimum investment amount is set too low, there is a risk that investors who want to make short-term trades will subscribe to the investment, and these people must be excluded. This is why the minimum investment amount is set at $100,000.

The Minimum Investment Amount Is Lower Because It Is Not a New Investment but an Additional Investment

On the other hand, if you open an offshore investment account with an insurance company in a tax haven instead of investing directly, the minimum investment amount will be lowered to $10,000 instead of $100,000.

Why is the minimum investment amount lower when opening an offshore investment account compared to direct investment? The reason for this is that it is an additional investment.

Whether you invest directly or through an offshore investment account, the minimum investment for the first time is $100,000. However, if you are using an offshore investment account, you are not the only customer using it.

Therefore, even if you are investing in a hedge fund for the first time, you will be making an additional investment because other people have already invested in that hedge fund many times through the offshore investment account.

Even if the minimum initial investment is $100,000, most hedge funds set the additional investment at $10,000. Therefore, if you use an offshore investment account, you can invest in hedge funds from $10,000.

A Minimum of US$30,000 is Required to Open an Investment Account

However, it is important to note that US$10,000 is not enough to start investing. Even though the minimum investment amount to invest in hedge funds is $10,000, it is not the minimum investment amount required to open an offshore investment account.

If you want to open a securities account, there is no minimum investment required. Anyone can open a securities account. On the other hand, if you want to open an offshore investment account in a tax haven, you need to have at least $30,000.

There are several insurance companies that allow you to open an offshore investment account. Also, the minimum investment amount required to open an offshore investment account differs depending on the investment company. Among them, if you choose an insurance company with a low minimum investment amount, you can open an offshore investment account with as little as $30,000.

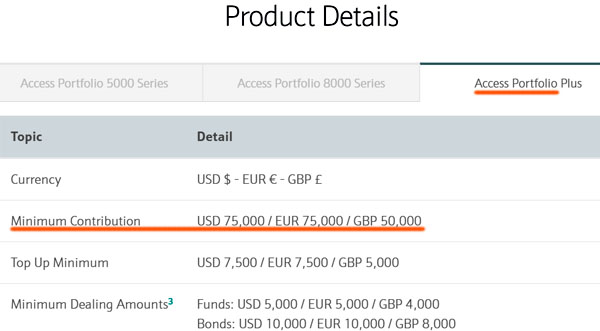

For example, here is the detail about EIB, an offshore investment account offered by a company called Custodian Life.

Custodian Life is registered in Bermuda, and Bermuda is famous for its tax havens. As you can see, you can open an offshore investment account for as little as $30,000.

The Minimum Investment Amount Varies Depending on the Insurance Company in the Tax Haven

As mentioned above, you can also open an offshore investment account with another insurance company that is registered in a tax haven. For example, in the case of other offshore investment companies, you can open an investment account with US$75,000 and invest in hedge funds as follows.

However, in the case of this offshore investment company, the hedge funds we can invest in are restricted to European hedge funds. It is not possible to invest in all hedge funds in the world. Therefore, it is not worth using, and you should not apply for the Access portfolio.

In any case, there is a different minimum investment amount when investing in hedge funds. Also, some insurance companies have self-imposed restrictions on the hedge funds that you can invest in. So you need to use an unregulated offshore investment account.

A Minimum of US$500,000 for Private Banking

Another way to invest in hedge funds is to use private banking. By using a bank registered in Switzerland, you will be able to invest in hedge funds all over the world.

There are huge banks in Singapore, Hong Kong, Dubai, Luxembourg, etc., but they do not offer real private banking services. Therefore, you will not be able to invest in a good hedge fund by using these banks.

On the other hand, if you use the private banking service in Switzerland, you can invest in hedge funds all over the world. However, the initial investment amount to open an account is high, with a minimum of US$500,000.

Also, it is assumed that you will make your investment amount to $1 million in the future. In short, you must deposit 1 million dollars at some point in the future. Since you must have more than 1 million dollars, you must be a wealthy person to use private banking.

Usually, Invest Through an Offshore Investment Account

When investing in hedge funds, there are several ways to do this. One of the most common ways is to open an offshore investment account and invest in hedge funds.

You can invest directly, but as the number of hedge funds you invest in increases, it becomes more difficult to manage. In addition, the minimum investment amount is $100,000, so you cannot diversify your investments.

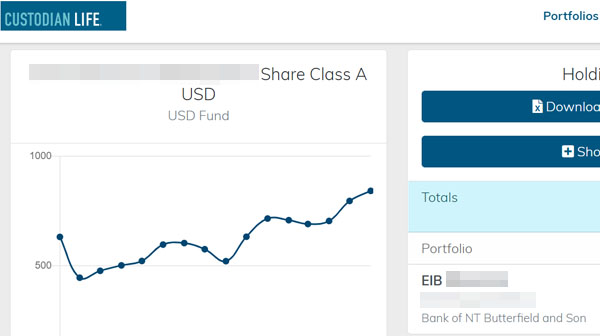

On the other hand, with an offshore investment account, you can monitor the asset management status of all hedge funds from a single management screen. You can also check how much your money is growing. For example, here is the result of a high-risk, high-return hedge fund that I have invested in.

As you can see, my assets are rising while their value is fluctuating. Not only can I manage all the hedge funds I invest in, but I can also invest as little as $10,000, which allows me to diversify my investments across several hedge funds.

Also, when you invest directly, your money is not always segregated. On the other hand, when you open an offshore investment account, your money will always be segregated. In other words, your money will not be used for any other purpose than investment. If you open an offshore investment account, the money will not be used for any other purpose, and your investment assets will be protected.

If you are a very wealthy person with more than a few million dollars in assets, you can invest using private banking instead of an offshore investment account. However, for the sake of convenience, it is generally recommended to open an offshore investment account instead of a private banking account, even if you are super-wealthy.

The Most Important Thing Is The IFA You Apply To

If you understand it correctly, you will find that the minimum investment amount is lower than you might think. If you don’t know anything about offshore investment, you may think that you need a few million dollars to invest in a hedge fund. However, the actual minimum investment amount is $30,000, and this is the amount required to open an offshore investment account.

However, the most important thing to consider is which hedge fund you invest in. There are countless hedge funds in the world, and an IFA (Independent Financial Advisor) is the agent who advises you on which hedge fund to invest in.

Therefore, if you do not sign up with a good IFA, you will not be able to invest in hedge funds with good performance. Investment companies registered in tax havens only provide investment accounts to invest in hedge funds; they do not manage your money.

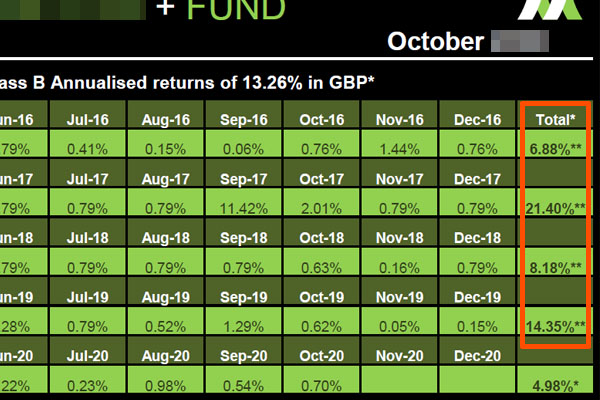

For reference, for example, here is a low-risk hedge fund that I invest in according to my IFA’s advice.

It is a hedge fund that deals in real estate loans in the UK and has an average annual interest rate of 13.26%. Since it is not a hedge fund that invests in stocks and bonds, it does not have negative returns even in a global recession. Also, since it invests in real estate loans, a low-risk product, it has never had a negative return year in the past.

It is impossible to aim for an annual interest rate of 20-30% like a high-risk, high-return hedge fund. However, it is possible to earn more than 10% annual interest with low risk.

This hedge fund is just one example, and which hedge fund you can invest in depends on the IFA you apply to. So, when you open an investment account as an offshore investment, make sure to ask your IFA which hedge funds you can invest in.

Investing Small Amounts in Hedge Funds and Growing Your Wealth with Offshore Investments

You don’t have to be wealthy to invest in hedge funds. Even if you don’t have hundreds of thousands of dollars in assets, you can start investing in hedge funds with just a few tens of thousands of dollars.

If you want to invest directly in a hedge fund, the minimum investment amount is $100,000. On the other hand, if you use an insurance company registered in a tax haven, the minimum investment amount will be lowered to $10,000 by opening an offshore investment account.

When investing in hedge funds, $10,000 is quite a small amount. Therefore, even ordinary people can invest. However, it is important to understand that a minimum of $30,000 is required to open an offshore investment account.

Once you understand the details so far, all you need to do is to find a good IFA. IFA is the most important factor when it comes to offshore investment, so be sure to apply for an IFA that allows you to invest in hedge funds with excellent investment performance and start managing your assets.