There are many people who live outside their home countries. They may be working as expatriates or planning to live there permanently.

Living abroad provides an environment that allows you to grow your money. When you invest your money, you can increase your assets much more than those who live in your home country. This is because it is easier to invest offshore.

Offshore investment and offshore insurance are methods of managing assets in areas where there is little or no taxation, known as offshore tax havens.

If you are a resident of your home country, the number of overseas investment products you can choose from is limited. On the other hand, if you are a resident of a foreign country, you will be able to choose investment products and manage your assets as you like. So, I will explain the offshore investments that permanent residents and expatriates living abroad should make.

Table of Contents

Regular Investment and Offshore Insurance for Foreign Residents

The Cayman Islands, Dubai, and Singapore are famous as financial centers, and the reason for this is that they are tax havens with very low tax rates. Tax havens are also called offshore.

Not only is it an offshore region with almost no taxes, but moreover, there are no taxes on the money made from investments. As a result, investment money is coming from all over the world. Naturally, there are a large number of investment products.

In many countries, financial regulations are strict, and fees are high, making many products almost impossible to manage assets. On the other hand, overseas investment products offer at least a 4% annual interest rate, and after 20 years, your assets will have doubled in value.

In addition, it is common to aim for an annual interest rate of over 10% with offshore investments, and your money will grow much faster.

For those who live in their home country, the number of offshore products they can subscribe to is limited. On the other hand, if you are a non-resident of your home country, you can purchase foreign mutual funds and offshore insurance (life insurance) to increase your assets as you like without any restrictions in your home country.

You Should Stop Investing in Local Currency and Real Estate

There are other ways to invest that are possible for people living abroad. However, other than offshore investments, I would not recommend them. Of these, investing in the local currency is the worst.

If you are making a temporary bank deposit because the interest rate on the local bank’s fixed deposit is good, it is exceptionally fine. However, there are so many investments that are not recommended in foreign countries. For example, you can buy local stocks and invest in local real estate.

If you are a professional investor and have already earned a large amount of profit from stocks, then there is no problem. However, if you are not, it is impossible for an amateur to earn a large profit by investing in foreign stocks, which are very difficult to invest in.

Similarly, if you have a high-income record from real estate investment in your home country, there is no problem. However, if not, you should consider that it is impossible to make money by investing in real estate in the local country.

There are many uncertainties when investing in real estate overseas, and the possibility of losing money is quite high.

On the other hand, if you utilize insurance companies located in tax havens and use mutual funds or life insurance, you are assured that your assets will surely multiply many times over. Of course, while taking risks, it is possible to earn over 10% annual interest.

No Trouble in Moving Your Country of Residence

Also, the currency you should invest in is the US dollar, not some other currency that is less reliable. Investing in the currency of the region where you live is risky, but if your investment currency is the US dollar, the risk is low.

Moreover, in the case of mutual funds and life insurance sold in the local country, the receiving bank is limited to a local bank. It is not possible to specify a foreign bank. For non-residents of the home country, this is the reason why they have a high probability of regretting if they invest using the local financial system.

If you purchase financial products in the country where you live as a foreign resident, and then change your country of residence, you will be in trouble because you cannot specify a foreign bank to receive your money. It is normal to live in a different country at the time of maturity because asset management needs to look 10 or 20 years into the future.

On the other hand, when it comes to investing in tax havens, investments by foreigners are widely accepted. Naturally, the financial institution will send you the money at maturity, no matter which bank in the world it is.

The receiving currency is not limited to US dollars but can be any local currency. In short, all currencies are supported. The money is calculated at the current exchange rate and transferred to you. Therefore, considering the risk of future migration, financial products in offshore regions are superior to local financial products for expatriates and those living abroad.

Money Made from Investment Is Subject to the Local Tax System

When you start investing offshore, you will be subject to the taxation system of the local country. Even if the tax system in your home country is high, consider only the tax system of the country where you will live as an expatriate or resident abroad.

For example, in the following countries, there is no capital gains tax on money earned from trading stocks and other assets.

- Tax haven countries (such as Dubai and Singapore, etc.)

- New Zealand

- Malaysia

Even if you do not live in a tax haven country, there are countries such as Malaysia and New Zealand where there is no capital gains tax. Also, if you live in a developing country, there are cases where you do not have to pay taxes because the country does not have a well-developed tax system.

I don’t know what country you are living in. In any case, you should check what the capital gains tax is for foreign residents in your country.

Invest in Offshore Areas, Not in the US or UK

Another key point in overseas investment is that you should invest in offshore. In other words, you should invest in tax havens, where no taxes are charged. This does not mean that you invest in the United States or the United Kingdom.

If you invest in the US or UK, there are many financial products that are not allowed due to financial regulations, since they are developed countries. Instead, understand that high yields are possible if you buy financial products in countries where profits on investments are tax-free, and all investment methods are possible.

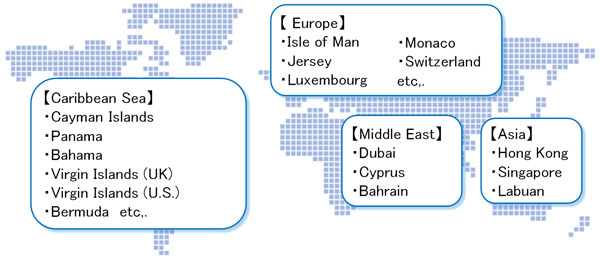

Basically, investing in developed countries such as the United States and the United Kingdom is the wrong way. As for offshore tax havens, they exist all over the world, as shown below.

In any case, investing in these areas will help your assets grow.

Understanding How People Living Abroad Can Make More Money

There are so many people who are active as expatriates or living abroad. There are various foreign residents in developed and developing countries.

For non-residents of their home country, this is very advantageous because they can freely invest in excellent financial products overseas.

Since offshore investment involves investing in large foreign financial institutions (e.g., insurance companies), you can manage your assets with a high level of security and high yield. Naturally, there is no risk of loss of assets as in the case of investments in local stocks or real estate.

It is important to note that you should not invest in the US or the UK but rather offshore. If you are an expatriate, you will be able to invest in excellent products. Make sure to grow your money in tax havens and increase your own assets while almost no paying taxes.