Diversified investment is the basis of asset management. By diversifying into several investments instead of just one, you can increase your money while protecting your assets.

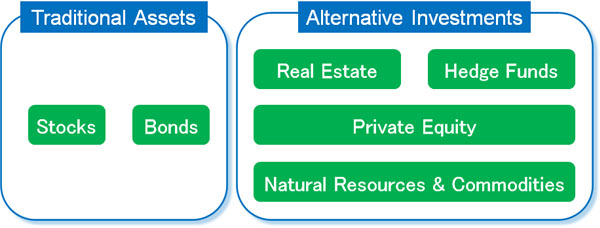

Many retail investors are unbalanced in their investment methods. Most of them invest only in stocks and bonds. So, just like institutional investors and family offices, you should incorporate alternative investments. By including alternative investments in your portfolio, you can improve your diversification.

However, individual investors should not use the same investment methods as institutional investors. When investing in alternatives, you should avoid investments that are too risky.

Therefore, I will explain how to incorporate alternative investments into your portfolio and diversify your investments.

Table of Contents

Diversification Effects of Alternative Investments Not Affected by the Economy

Stocks and bonds are called traditional assets and have existed for a long time. Even today, the majority of people invest in stocks and bonds when managing their assets. There are many people who have become millionaires by investing in stocks.

However, investing in traditional assets is always affected by the economy. There is always a major recession every few years, and it is normal for stock prices to drop by half or more.

On the other hand, alternative investments are methods that do not invest in traditional assets such as stocks and bonds. The reason why you should actively adopt alternative investments is that you can increase your assets even during a recession.

People who invest only in stocks and bonds are at risk. There is a risk that the value of your assets will drop significantly during a major recession, and you will quit investing as a result.

Institutional Investors Are Investing in Alternatives

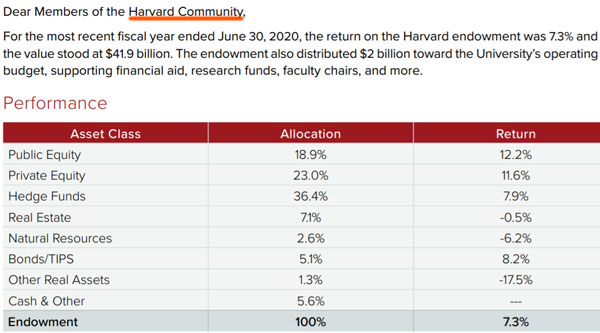

To avoid risk, institutional investors and family offices are actively investing in alternatives. In fact, the Harvard University Foundation is known to be an active investor in alternatives.

The following is an official document released by the Harvard University Foundation.

If you check the portfolio, you will see that there are more alternative investments than the percentage invested in stocks and bonds.

- Private equity

- Hedge funds

- Real estate

- Natural resources and commodities

These are known as alternative investments. Of course, many institutional investors and family offices, not just the Harvard University Foundation, are investing in alternatives.

The Advantages of Alternative Investments for Retail Investors

Even individual investors can invest in alternatives just like institutional investors. They should try to increase their assets regardless of the economy by adding financial products that are not affected by the economy to their portfolio.

However, there are some investment methods that are excellent for institutional investors but should not be done by retail investors. Private equity and commodities are two typical examples.

Private equity is a way to invest in unlisted companies. However, individual investors do not receive offers to invest in good unlisted companies. Institutional investors are asked to invest because they have billions of dollars.

Also, in private equity, you cannot convert your investment into cash unless the company you are investing in either merges or goes public. This means that the liquidity of the money is poor, and it is a very risky investment method.

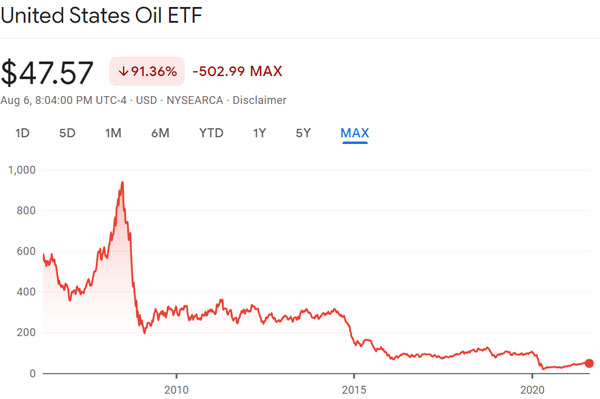

Another alternative investment that should not be used is commodities. When you invest in commodity futures, such as agricultural products or crude oil, you are not affected by the economy. However, investing in commodity futures can result in huge losses. This is because it is difficult to predict the future price of commodities.

For example, the following is an ETF (Exchange Traded Fund) linked to the price of crude oil called United States Oil ETF (USO).

As you can see, prices continue to fall. This fact shows that investing in commodities is risky for amateur investors.

You Should Invest in Physical Real Estate or Hedge Funds

While retail investors should also consider alternative investments, it is important to understand that there are certain investments that are not suitable for retail investors. Individual investors, who have far less information and connections than institutional investors, should not invest in private equity and commodities.

On the other hand, physical real estate and hedge funds are alternatives that can produce excellent performance even for individual investors.

When it comes to investing in physical real estate, individual investors have an advantage over institutional investors. For institutional investors with large assets, investing in a property worth US$1 million is not a big deal. As a result, institutional investors are inevitably limited to investing in extremely expensive real estate.

For individual investors, on the other hand, an investment of $1 million is very expensive. They can freely choose where to invest, and it is possible to earn 15-20% annual interest from rental income alone by investing in physical real estate.

Alternatively, you can increase your wealth by investing in hedge funds, which are available to retail investors if they can invest a lump sum of US$30,000 or more.

Individual investors can also invest in hedge funds by opening an investment account in an offshore tax haven where there is little or no tax. You can invest in the same hedge funds that institutional investors use and increase your assets with high yields.

For reference, I do not invest in physical real estate. This is because I do not understand the criteria for what kind of real estate is superior. I also don’t want to manage tenants because it is troublesome. On the other hand, I have invested in several hedge funds and am actively investing in alternatives.

Hedge Funds Have Different Investment Performance and Strategies

Incidentally, when investing in hedge funds, investment performance and strategies vary greatly from hedge fund to hedge fund. Therefore, when investing in hedge funds as an alternative investment, it is advisable to diversify your investment to multiple hedge funds.

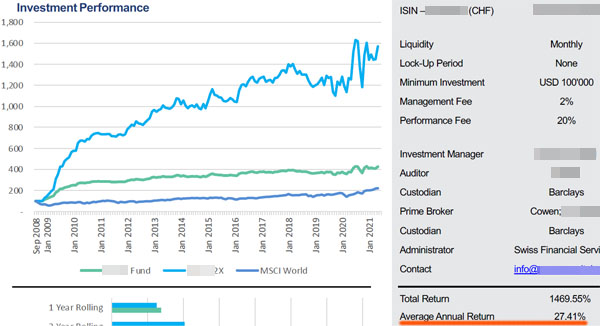

For example, the following is a high-risk, high-return hedge fund.

The average annual interest rate is 27.41%, and your assets can more than double in one year, while your assets can decrease by as much as 30% in one year.

On the other hand, there are low-risk hedge funds. Low-risk hedge funds do not invest in stocks and bonds. For example, they invest in the following.

- Mortgage loans

- Bridge loans

- Microfinance

For example, here is a fact sheet on a hedge fund that offers mortgage loans.

The average yield of this hedge fund is 9.27% per year. There have been no years with negative returns in the past, which allows for a stable increase in assets.

When investing in hedge funds, there are so many funds to choose from. So, when investing in alternatives, try to think in advance which hedge funds you want to invest in.

As a point of reference, make sure to check the past performance of the hedge funds. Checking the past five to ten years’ performance will help you understand what kind of returns the fund can provide. By checking the actual trading results in the fact sheet rather than simulations, you can determine if it is a hedge fund you should invest in.

The Importance of Alternative Investments Is Great

When individual investors invest their assets, most of them focus only on stocks and bonds. As a result, they lose a lot of money during a recession and quit investing. This is because, in a major recession, the value of assets usually decreases by less than half.

Alternative investments, on the other hand, are not affected by the economy. Therefore, institutional investors and family offices are actively incorporating alternative investments into their portfolios. Likewise, retail investors should also invest in alternatives to diversify their investments.

However, among alternative investments, private equity and commodities are not suitable for individual investors. There is a high risk of losing a lot of money rather than gaining diversification benefits. Therefore, invest in physical real estate or hedge funds.

When investing in real estate or hedge funds, there are many types. So, choose the best alternatives for you and diversify your investments.