When you invest overseas, you have to send money to another country. This is an international money transfer, so it is more complicated than domestic money transfers.

However, when you invest offshore, you can make better investments than you can in your home country. This is why many people invest overseas, even if the process of sending money overseas is troublesome. Also, if you learn how to send money overseas, you will be able to do so easily.

For many people who live in their home countries, overseas remittances are not familiar. However, if you want to invest overseas, you need to send money overseas.

When investing offshore, there are several ways to send money overseas. While the possible methods of overseas remittance differ depending on the investment method, I will explain how to send money to a foreign country.

Table of Contents

Overseas Investments Are Made in US Dollars

In most cases, when you invest overseas, you will be investing in US dollars. Even if you don’t live in the US, you will send money in US dollars.

It is common to invest in major currencies when investing abroad. That’s why you have to invest in US dollars. Although you can invest in euros or British pounds, even if you live in Europe, you generally invest in US dollars when you invest overseas.

The main principle of investing is to invest in the most trusted currency in the world.

Since you are investing in US dollars, you will have to convert your home currency to US dollars. Therefore, you need to learn how to transfer money overseas at a low cost.

You Need to Send Money to an Overseas Financial Institution

When you invest overseas, you must send your money to an offshore financial institution. To be more precise, you need to send your money to a financial institution located in an offshore tax haven where there is almost no tax.

Some of the famous tax havens are Singapore, Cayman Islands, Hong Kong, and Dubai. Also, since the US is the world’s largest tax haven, you may have to send your money to the US for overseas investments.

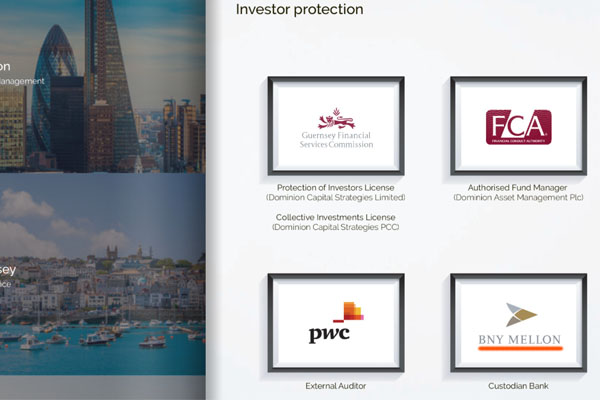

For example, below is a brochure from a company called Dominion Capital Strategies.

This is an investment company that allows you to earn an annual interest rate of 10% or more. When you invest overseas with this investment company, your investment funds will be segregated at BNY Mellon (Bank of New York Mellon), as stated in the brochure. This means that you will need to send your money to BNY Mellon.

Dominion Capital Strategies is headquartered on the island of Guernsey, which is known as a tax haven. However, the bank that is segregating the money is BNY Mellon, and BNY Mellon is headquartered in the United States. Therefore, when you use Dominion for regular investment (or lump-sum investment), you will have to send money to the US.

In any case, overseas remittance is necessary for offshore investment.

What Are the Methods of Sending Money for Offshore Investment?

When you invest overseas, what methods should you use to send money? The following are the main methods.

- Payment by credit card.

- Using Wise to send money overseas.

- Overseas remittance using a bank.

If you use a bank to send money overseas, the fees are very high. Therefore, if possible, you should use other methods to send money overseas.

The following is an explanation of each method.

The Most Common Overseas Transfer Method Is Credit Card Payment

There Are two ways for offshore investment: regular investment and lump-sum investment. The most common method of investment is a regular investment, and many people invest by paying monthly.

If you want to make a regular investment overseas, you should think that you will be paying by credit card. Overseas remittance fees at banks are very expensive, and you will lose a lot of money due to remittance fees if you make an overseas remittance at a bank every month.

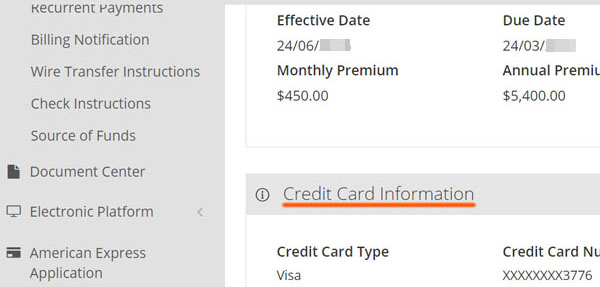

For this reason, all offshore investment companies accept credit card payments for regular investments. For example, the following is the management screen of my offshore investment.

As you can see, I make my monthly payments by credit card. The money is automatically deducted from my credit card every month and transferred to the overseas financial institution.

Also, the overseas financial institutions I use for my investments charge no fees for credit card payments. In other words, the entire amount of money I pay by credit card is reflected in my investment account without any fees. Credit card payments are the easiest way to invest overseas, with no overseas remittance fees.

In many cases, lump-sum payments can also be made by credit card. If an overseas financial institution accepts credit card payments, be sure to make the remittance by credit card.

Sending Money with Wise Is a Low-Cost Option

On the other hand, in some cases, people prefer to pay by other methods rather than by credit card. Many people prefer to send money directly, especially when paying large sums of money.

However, as mentioned above, the fees for sending money overseas from a bank are very high. Not only are you charged a high transfer fee, but the exchange rate offered by banks is poor.

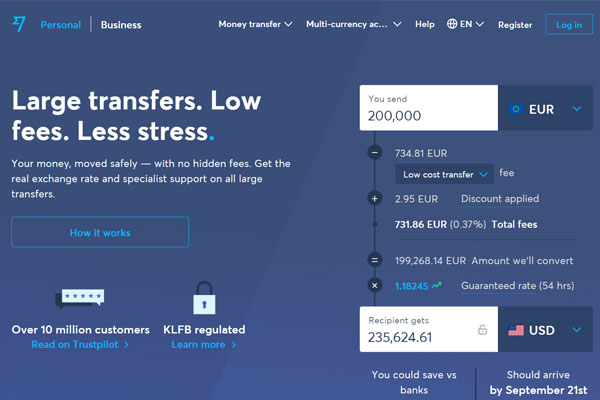

In contrast, Wise is known as a platform that allows you to send money overseas with extremely low fees. Wise is an international money transfer service used by most people living abroad.

When you use Wise, you do not have to pay the high exchange rate fees that banks charge. You can send money in US dollars without exchange fees. All you need to pay is the service fee, which is roughly 1% of the amount you send. Therefore, you can send money overseas at low fees.

Compared to paying by credit card without fees, using Wise is disadvantageous because it incurs fees. However, if you want to send a large amount of money, you can use Wise to send money overseas. If you want to use Wise, please register from “the official Wise website.”

Sending Money Overseas Using Banks with High Fees

On the other hand, the traditional way to send money overseas is to use a bank. You can make an international money transfer at your bank. You can do this through online banking or at a bank counter.

If you are making monthly payments, such as a regular investment, using a bank is not suitable because of the high transfer fees. On the other hand, if you want to send a large amount of money in a lump sum and invest offshore, you can use a bank to send money overseas.

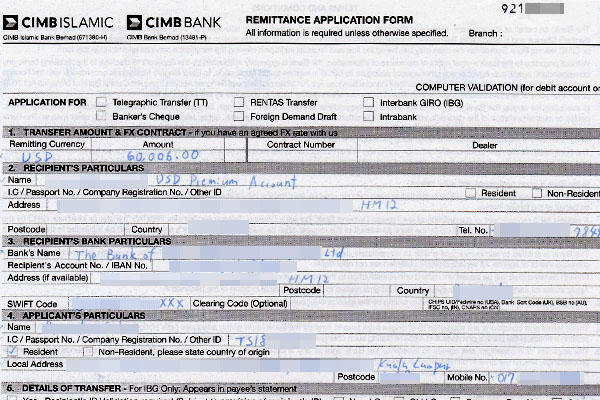

For example, the following is a document of my overseas remittance at a bank for a lump sum investment.

I made a lump sum investment to invest offshore with a Bermuda registered investment company. Although bank transfer fees are high, even large amounts of money can be transferred.

Unlike Domestic Remittances, International Remittances Through Banks Are Complicated

Unlike domestic remittances, the procedure for international remittances at banks is more complicated. This is because you have to enter a lot of information when you send money overseas. For domestic remittances, you only need to know a little bit of information, such as the account number and the bank name of the payee. On the other hand, when you make an international money transfer, you need to know the following information.

- Bank name of the payee bank

- Branch name of the payee bank

- Address of the payee bank

- Payee’s account number

- SWIFT code of the bank

- Payee’s name

- Payee’s address

- Payee’s phone number

- Purpose of the remittance

In overseas remittances, banks hate money laundering, such as tax evasion and criminal money transfer. Therefore, you have to fill in a lot of information.

The most expensive and troublesome way to send money is to use a bank to send money overseas. However, since you can send large amounts of money, if you want to invest offshore in a lump sum, you should consider sending money overseas using a bank.

Understanding How to Send Money Overseas

When you make an offshore investment, you will need to send money overseas. Since you will be managing assets in tax havens, you must send money overseas when you invest abroad.

Therefore, it is important to understand how to send money overseas. The best way to send money is by using a credit card. In most cases, you will not be charged a credit card fee even if you pay by credit card. This is why it is the best way to send money overseas.

On the other hand, if you want to make an international money transfer using a method other than credit card payment, you can use Wise. This is a service that allows you to send money overseas with low fees. Or, if you want to send a large sum of money, use a bank.

When investing overseas, there are several ways to send money abroad. Let’s understand which method is best for you and start your offshore investment by sending money overseas.