One of the most common investment strategies adopted by hedge funds is the long/short equity strategy. When investing in stocks, the long/short strategy involves both buy and sell.

Even retail investors can make a profit by short selling as well as buying. Naturally, hedge funds are also looking to make large profits through short selling.

In addition to stocks, there are other ways to invest in the long/short strategy. For example, there are hedge funds that invest in bonds or commodity futures. The long/short strategy is widely used not only for stocks but also for other investment products.

What are the characteristics of hedge funds that use the long/short strategy? I will explain the long/short strategy by reviewing examples of actual hedge funds.

Table of Contents

Investing in Stocks and Mutual Funds Is the Long/Short Equity Strategy

When hedge funds invest in stocks, the most common investment strategy is the long/short strategy. They make profits by investing in individual stocks, ETFs, and mutual funds.

If they think the stock price will go up, they buy the stock. On the other hand, if they expect the stock price to go down, they will sell short. This is how they make large profits.

In general, stock prices tend to rise. However, in some cases, we can predict that the stock price will fall. The following news is a clear example.

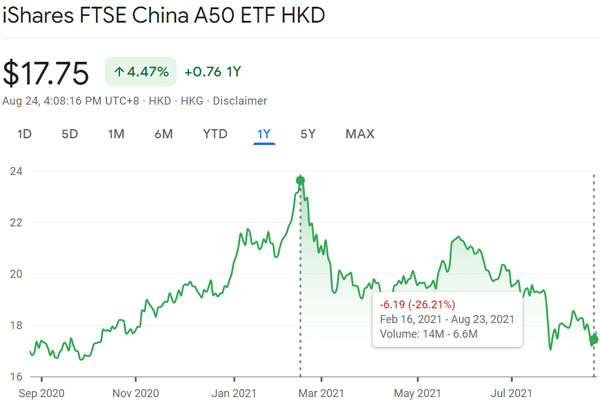

In the past, the Chinese government made huge IT companies pay fines without any reason and created a lot of regulations. At the same time, CCP imposed a series of regulations in many industries such as education, gaming, and real estate.

As a result, Chinese stocks plummeted, as shown below.

During this period, anyone could have predicted that Chinese stocks would plummet. Therefore, many people made money by shorting Chinese mutual funds. Naturally, not only individuals but also hedge funds profited from shorting Chinese stocks.

Usually, we profit from long positions (buying) in stocks. In addition to that, the long/short strategy is to make profits by short selling.

Benefits of Alternative Investments to Profit in a Recession

Why is the long/short equity strategy so good? One reason is that it allows us to profit even during a recession.

As mentioned earlier, stock prices generally continue to rise. For example, the following is a stock chart of the S&P 500.

The S&P 500 shows the stock prices of the 500 leading companies in the US. When investing in the S&P 500, it is widely known that the annual interest rate is 7-9%.

However, when investing in stocks, the stock price always falls during a recession. Therefore, a long position alone will always result in a loss of assets during a recession. The long/short equity strategy allows you to increase your assets even during a downturn by short selling.

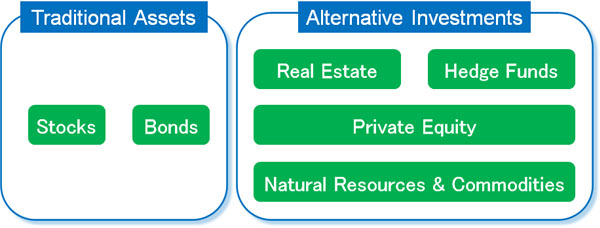

-Investing in Hedge Funds Is an Alternative Investment

When you invest in a hedge fund with a long/short equity strategy, it is known as an alternative investment. An alternative investment is a way to invest in something other than stocks and bonds. Alternative investments are investment methods that are not influenced by the economy.

Although you invest in stocks indirectly through hedge funds, the long/short strategy allows you to make a profit even during a recession by short selling. For this reason, it is known as one of the alternative investments.

Some Hedge Funds Invest in Bonds with Leverage

There are hedge funds that invest in bonds as well as stocks in their long/short strategy. It is not only stocks that can be sold short.

Compared to stocks, bond prices are less volatile. Therefore, it is common for hedge funds with a long/short strategy to leverage their investments in bonds.

In general, when the economy is booming and stock prices are rising, bond prices are falling. This is because we can increase our assets more by investing in stocks than by investing in bonds. On the other hand, when stock prices fall, bond prices rise because people buy bonds, which are safe haven assets.

The reason why hedge funds that invest in stocks sometimes invest in bonds is that stocks and bonds have an inverse relationship. This means that future price movements can be predicted.

Hedge Funds May Go Long and Short on Specific Commodities

The long/short strategy also involves specializing in particular commodities. The most common long/short strategy, as mentioned above, is to invest in stocks. On the other hand, there are hedge funds that invest in commodities.

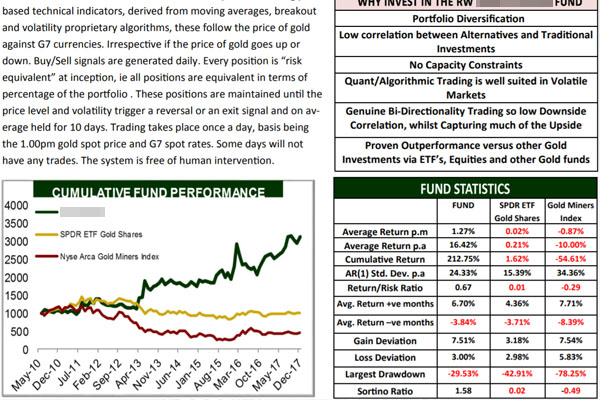

For example, here is a fact sheet on a hedge fund that invests in gold.

If you invest in this hedge fund, the average annual interest rate is 16.42%. The volatility is high, making it a high-risk, high-return hedge fund.

If you invest only in long positions in gold, you will not be able to increase your assets. Although gold is known as a safe haven asset, it does not increase in value as fast as stocks. Therefore, this hedge fund takes short positions in gold as well as long positions.

In any case, the long/short strategy is not only effective for stocks and bonds, but some hedge funds use it to invest in commodities.

Including Currency (Forex) and Commodity Futures Is a Global Macro Strategy

For reference, there are hedge funds that invest in stocks, bonds, currencies (forex), commodity futures, and all other investment targets, unlike the long/short equity strategy that focuses on a specific target. In this case, it is called a global macro strategy instead of a long/short strategy.

In the case of the long/short equity strategy, the fund invests only in stocks. A hedge fund with a long/short gold strategy invests only in gold. A global macro strategy, on the other hand, buys and sells short a wide range of investments.

Hedge funds that use the global macro strategy are often large hedge funds due to a large number of investment targets. Since hedge funds that can use global macro strategies are limited, long/short strategies that invest only in specific financial instruments are more common.

Incidentally, most hedge funds that make the news use the global macro strategy. The long/short strategy, on the other hand, is less newsworthy because it involves going long and short only in specific financial instruments.

It Is a High-Risk, High-Return Investment

Investing in a hedge fund with a long/short strategy is always a high-risk, high-return investment. Although hedge funds invest in stocks that will go up in price and short stocks that will go down in price, the price movements are often different from what is expected.

As a high-risk, high-return hedge fund, it is normal to have negative returns in some years. Therefore, you have to understand that the investment results may be poor for one or two years after the investment, and your assets may decrease.

However, since it is a high-risk, high-return investment, there is a possibility that you can increase your assets significantly.

When an individual investor invests in a hedge fund, there are several low-risk funds that can increase assets at an annual interest rate of about 8-13%. On the other hand, if you want to increase your assets at a higher yield, a hedge fund with a long/short strategy is one of the best options.

Disadvantages of Many Bad Funds: Checking Fact Sheets Is Essential

When investing in a hedge fund, always check the fact sheet to see how the fund has performed in the past.

Hedge funds registered in tax havens are disclosed on Bloomberg (a major financial and business news agency in the US) and are audited externally, so they cannot provide false information. Therefore, you can judge whether a hedge fund is worth investing in by looking at the fact sheet.

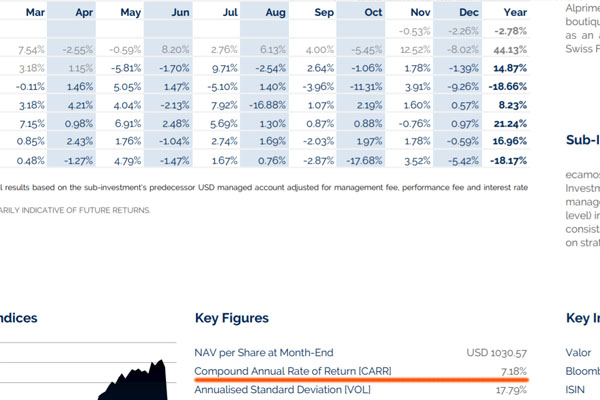

For example, the following is a fact sheet of a hedge fund that uses a long/short equity strategy.

The average annual interest rate is 7.18%. On the other hand, it has volatility of 17.79%, which can result in large negative returns in some years.

This is a low annual interest rate hedge fund with high risk and low return. Therefore, you should not invest in this hedge fund. Of course, investment returns are better than bank deposits, but the investment performance is poor despite the high risk.

In investing in hedge funds, even low-risk investments with almost no negative returns can earn more than 10% annual interest. Therefore, in the case of high-risk, high-return hedge funds, it is not worth investing unless the average annual interest rate is more than 15%.

There are many hedge funds that use a long/short strategy, and the disadvantage is that there are many funds with poor investment performance. So before a retail investor invests, checking the fact sheet is essential.

Retail Investors Invest in Funds with Long/Short Strategy

Individual investors can invest in hedge funds by using offshore tax havens. Many hedge funds use a long/short strategy, and they make profits by buying and selling specific financial instruments such as stocks, bonds, and commodity futures.

It is one of the alternative investments, and hedge funds with long/short strategies make profits regardless of the economy.

However, the long/short strategy is a high-risk, high-return method. In fact, if you check the fact sheets of hedge funds that use the long/short strategy, you will notice that all of them have high volatility.

Be sure to invest in hedge funds with an average annual interest rate of at least 15%. There are many hedge funds with long/short strategies, and there are also many funds with poor performance. So check the fact sheet and invest in hedge funds that have excellent performance.