There are many people who manage their assets by using foreign mutual funds and ETFs. They increase their money by investing not in their home country but other countries.

However, one thing that is sure to occur with overseas investments is currency risk. When you invest overseas, you are not investing in your home currency but in a foreign currency. Therefore, all investors are subject to currency risk.

Some mutual fund products may include currency hedging. If there is a currency hedge, you do not bear any currency risk. However, investment products with currency hedging are costly and not worth using.

I will explain the way of thinking about currency risk when investing overseas.

Table of Contents

Foreign Investments in Mutual Funds and ETFs Are Generally Made in US Dollars

When you are thinking about increasing your money through asset management, you should invest in the United States. If you invest outside the US, you will not be able to increase your money efficiently. Although there are other developed countries such as Germany, the UK, and Japan, you must invest in the US.

When investing in the US, stock prices have been rising for a long time, as shown below.

This is the stock price trend of Nasdaq. You can see that the stock price has been rising significantly.

Also, although some people consider investing in countries with high economic growth rates, such as China, Mexico, and the Philippines, their stock prices have not grown significantly. Do not invest in these countries because they are high-risk, low-return investments.

Also, since overseas investments are usually made in the US, you will naturally have to invest in US dollars. The US dollar is the most trusted currency in the world. The right way to invest overseas is to buy mutual funds or ETFs that invest in the US, a country with an excellent currency and strong stock market growth.

Currency Risk Exists in All Countries Except the US

When investing overseas, it is common to invest in US dollars, even when investing outside of the United States. There are many companies listed in the US, and you can invest in European, Chinese, Japanese, Mexican, and other companies in US dollars.

For example, the following is an ETF that allows you to invest in Japanese companies in US dollars.

In short, consider that the US dollar can be used to invest in various countries. Since companies from many countries are listed in the US, you can use US dollars to invest in countries other than the US.

Since investments are made in US dollars, there is a currency risk for those who do not live in the United States. Since you have to convert your money from US dollars to the local currency when you use the money, you cannot avoid the effects of exchange rate fluctuations.

You Should Grow Your Assets in US Dollars and Save in US Dollars

Even if you are not a US resident, you do not need to worry about the currency risk of investing in US dollars. This is because you should grow your assets in US dollars and save in US dollars.

As mentioned above, the US dollar is the most trusted currency in the world. Also, the value of a currency is proportional to the economic strength of a country. This means that in the long run, the value of the US dollar will increase, but it will not decrease.

There is a lot of risks when investing in emerging market currencies. This is because there is a risk that the value of the emerging country’s currency will continue to decline over time. For reference, below is the price history of the Turkish lira and the US dollar.

As you can see, the value of the Turkish lira continues to decline. When you invest using the currency of an emerging country, the impact of currency risk is significant.

In the case of the US dollar, on the other hand, as mentioned above, the value of the currency does not decline forever. It is also common to invest and save money in US dollars.

In addition, when converting from US dollars to the local currency, you only need to exchange as much as you need. Although the exchange rate will vary depending on the timing, in the long run, you will be converting from US dollars to the local currency at various times, resulting in zero currency risk.

If you understand what I have described so far, you will see that currency risk is practically non-existent in foreign investments.

Some Mutual Funds Offer Currency Risk Hedging

When investing overseas, some securities companies offer financial products with currency hedging. In other words, they offer investment products that reduce the foreign exchange risk to almost zero.

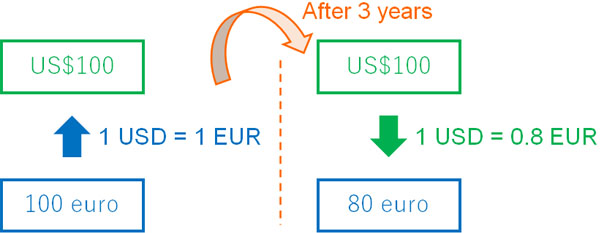

For example, if 1 US dollar is 1 euro and you invest by converting 100 euros into 100 US dollars, and three years later, if 1 US dollar becomes 0.8 euro due to the depreciation of the dollar, the exchange from US dollars to euros will be 80 euros.

In other words, people living outside the US will lose the benefits of asset management when the dollar weakens. This is why investment products that reduce the exchange rate risk to almost zero are sold.

In the case of currency-hedged mutual funds, even if the dollar depreciates, when you convert from US dollars to the local currency, it will be converted at the exchange rate at which you originally invested. Therefore, you can invest abroad without exchange rate risk.

Principles and Costs of Currency Hedging with Mutual Funds

The way to hedge foreign exchange using mutual funds is through forward contracts and futures trading. For example, you can make a contract that one dollar will be exchanged for one euro, no matter what the exchange rate will be one year from now. This way, you do not have to worry about the exchange rate even if there are exchange rate fluctuations.

Naturally, however, there is a cost associated with currency hedging. This is because, in order to hedge, you have to take a short position (selling).

For example, when you invest by converting euros to US dollars, if you want to use currency hedging, you make a short position by selling US dollars simultaneously. Since you are buying US dollars and selling US dollars at the same time, you can reduce your currency risk to zero.

However, selling US dollars means that you are borrowing money. Therefore, you have to pay interest, and the fees for currency hedging investment products are very high. The cost varies depending on the interest rate in the US and can range from 1-3% per year.

Currency Hedging Is Costly and Not Recommended

I do not recommend currency hedging products due to the high fees involved. When investing using mutual funds, it is common to invest for the long term. Therefore, the fees from currency hedging are higher than the exchange rate losses.

Many people worry about currency risk when investing overseas. However, even if you can avoid currency risk, do not buy investment products with currency hedging.

There is no point in hedging your investments, especially if you invest offshore in a regular savings plan. If you invest the same amount of money every month, you will have to convert from local currency to US dollars at different times.

In other words, with savings investment, you can diversify your risk by diversifying the timing of your US dollar purchases. Since you can diversify your risk, it is better to use investment products without currency hedging, which does not incur unnecessary costs.

-Investment Products Without Currency Hedges Are Superior

Also, as mentioned earlier, after you have increased your US dollar assets through offshore investments, you can save them in US dollars in your bank account. As long as you do not exchange US dollars into local currency, there is no exchange loss even if the US dollar depreciates.

The US dollar tends to appreciate in value over time, so even if the dollar is temporarily weak, you can wait for it to appreciate.

On the other hand, the dollar can also appreciate. If your mutual fund product does not have a currency hedge, you can earn a foreign exchange gain when the dollar appreciates. However, with currency hedging, there is no currency gain.

Considering these, there is no advantage to using investment products with currency hedging. Always use mutual funds without currency hedging.

No Need to Worry about Foreign Exchange Risk with Overseas Investments

The right way to invest is investing in the United States. Therefore, when you invest overseas, you will be investing in US dollars.

If you live in the US, you don’t need to worry about currency risk. On the other hand, if you live outside the US, there is always a currency risk. But since you can increase your assets in US dollars and save in US dollars, there is practically no exchange rate risk.

In addition, we usually use mutual funds for regular investments. In this case, the timing of the purchase of US dollars is different, so the risk is already diversified. Therefore, be sure to use investment products without currency hedging rather than products with currency hedging, which are more costly.

While there is currency risk in overseas savings and offshore investments, it is not a big problem. So don’t worry about it and invest in the United States in US dollars.