When investing, an important way is to invest in hedge funds. Even retail investors can invest in hedge funds and increase their assets with high yields.

There are many different strategies used by hedge funds. One of the most famous strategies is the global macro strategy. Hedge funds that use the global macro strategy have many famous fund managers and are easily in the news.

So, what is the global macro strategy, and how does it work? And how much return can an individual investor get from investing in a hedge fund with a global macro strategy?

If you want to increase your assets with high-risk and high-return, investing in a global macro strategy hedge fund is the best choice. Let’s take a look at what a global macro strategy is.

Table of Contents

Determining Where to Invest from Macroeconomics

When considering where to invest, there are various methods. One of them is the global macro strategy, which is a method of deciding where to invest from the perspective of macroeconomics.

Countries around the world are engaged in economic activities, and financial markets and economic conditions are changing. In global macro strategy, we decide where to invest by analyzing these large market economies.

An obvious example is China’s previous harsh fines and restrictions on several IT giants in their country without any reason.

As a result of multiple fines and restrictions imposed by the Chinese government on several companies, China’s stock prices have plummeted. China is not a democracy, and the government is free to destroy its own industries. These policies of the Chinese government show that if you were shorting Chinese stocks at that time, you would have made a lot of money.

When we invest in individual stocks, we check the performance and financial statements of a single company before we invest. On the other hand, in macroeconomics, we decide where to invest based on the government, financial markets, and economic conditions.

No matter how good a company’s performance is, if the economic situation is bad, the stock price will fall. In fact, as I mentioned earlier, the Chinese Communist Party imposed restrictions on giant IT companies, and as a result, stock prices plummeted. In any case, the political and economic situation is important in global macro strategy.

Investments Vary from Stocks, Bonds, Forex, and Commodities

The global macro strategy has a wide range of investments. For example, we invest in the following targets.

- Stocks

- Bonds

- Forex

- Commodities

There are many types of stocks to invest in, including global stocks, US stocks, emerging markets stocks, and stocks of specific countries (such as Chinese stocks). Commodities include gold, silver, corn, oil, and many other investments.

They have to decide what they want to invest in. Also, the main investment targets vary greatly depending on the time of year. In other words, it is important to understand that the global macro strategy is to invest in every possible way.

In order to adopt a global macro strategy, it is necessary to analyze many situations, such as the world situation, policy details, major events, and financial markets. For this reason, hedge funds with small assets cannot use the global macro strategy, and only major hedge funds can use this strategy.

Profit from Long and Short Positions

In the global macro strategy, they take not only long positions (buying) but also short positions (selling).

In a typical investment, we only take long positions. On the other hand, in investing, you can also make profits by short selling. Although short selling is a risky method, we can generate profits even when prices are falling by short selling.

I gave you an example of the regulations imposed by the Chinese government on giant IT companies. At that time, those who invested in Chinese stocks with long positions lost a lot of money. On the other hand, hedge funds that quickly analyzed the Chinese government’s policies and shorted Chinese stocks made a lot of money.

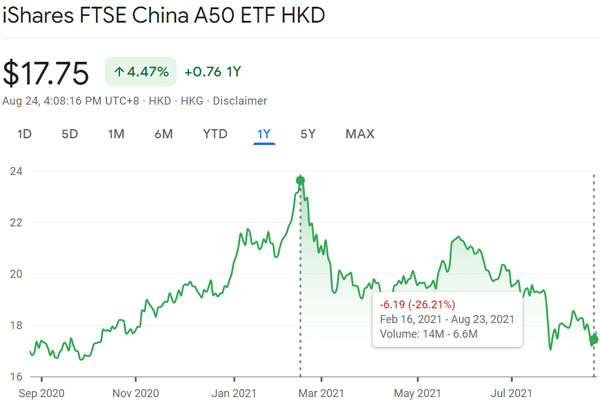

For your reference, the following is the price movement of Chinese stocks at that time.

Although stock prices had been rising, they plummeted after the Chinese government started issuing a series of regulations and fines.

Also, during a major recession, hedge funds with global macro strategies can increase their assets significantly. This is because it is easier to predict stock price fluctuations during recessions, and they can make money by short selling. In any case, the global macro strategy is to manage assets by both buying and selling.

George Soros Is Famous for His Global Macro Strategy

George Soros is one of the most famous hedge fund managers who use the global macro strategy.

In the past, the value of the British pound plummeted on September 16, 1992. This is called the British Pound Crisis.

He found the British pound to be overvalued. At the time, the UK had an economic growth rate of 0%, but the policy interest rate was very high at 10%. When the policy rate is high, many people want to invest in the currency, and the value of the currency rises.

From today’s perspective, even an amateur can understand that a 10% policy interest rate (i.e., the interest rate on bank deposits) is abnormal, even though the economy is not growing at all. However, at that time, there were many countries with high policy rates, and the Internet did not exist, so many people were unaware of this situation.

George Soros, on the other hand, realized that the British pound was overvalued and took a large short position in the British pound. Later, the value of the currency plummeted due to the British Pound Crisis, and he made a lot of money.

Global Macro Strategy Hedge Funds Tend to Be in the News for Short Selling

Among hedge funds, those that use global macro strategies tend to be in the news.

As mentioned above, the global macro strategy covers all investments. It is also known for its large amount of short selling.

If you want to profit from long positions, you must invest for the long term. Price increases in stocks, bonds, futures, etc., are gradual increases. On the other hand, when a major price crash occurs, it is often instantaneous. In investing in stocks and commodities, it is normal for prices to drop 20-30% in a month.

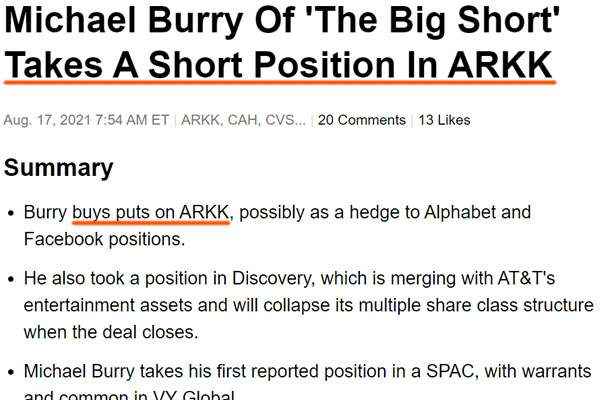

Therefore, by short selling with many times leverage, hedge funds can earn huge profits. This is why global macro strategies tend to make the news. For example, the following is newsworthy.

A put on an ETF means, in essence, that they are selling short. Michael Burry’s hedge fund, mentioned in this article, made a lot of money during the financial crisis caused by the collapse of Lehman Brothers, and hedge funds with such global macro strategies tend to attract attention.

You Cannot Invest in Global Macro with ETFs and Mutual Funds

If you want to invest in a hedge fund that adopts a global macro strategy, you must open an investment account in an offshore tax haven where there is almost no tax. Even if you open an account at a brokerage firm in your country, you will not be able to invest in hedge funds.

Although a lump-sum investment of US$30,000 or more is required, individual investors will be able to invest in hedge funds after opening an offshore investment account.

On the other hand, it is impossible to invest in hedge funds using ETFs (Exchange Traded Funds).

There are active funds in mutual funds. However, active funds can only take long positions. As a result, active funds are known for their poor investment performance and inability to generate higher yields than index funds.

Also, hedge funds that engage in short selling are not allowed by the FSA to be registered as ETFs in securities accounts. Investing in hedge funds is only available through direct investment in the fund or an offshore investment account.

Examples of Global Macro Strategy Hedge Funds

So, what kind of funds are available for retail investors to invest in global macro strategy hedge funds?

While there are a few well-known hedge funds, ordinary people cannot invest in the well-known funds that everyone knows. It is true that you can invest in almost any hedge fund by using an offshore investment account. However, there are a few hedge funds that require a minimum investment of US$1 million.

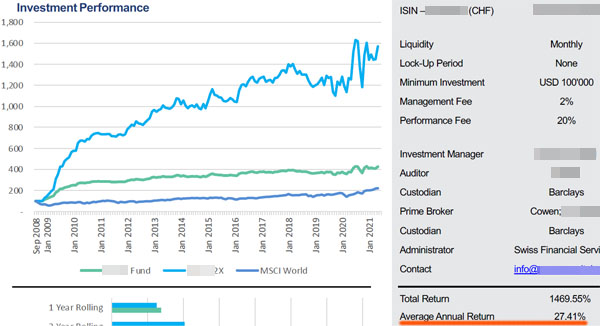

However, there are several global macro strategy funds that are not well known to the public but have excellent performance. For these hedge funds, even ordinary people can invest as little as US$10,000. For example, here is a fact sheet on a global macro strategy hedge fund.

This fund uses 2x leverage to achieve high returns. The fact sheet shows that if you invest in this hedge fund, your assets will increase 16 times in about 12 years. The average annual interest rate is 27.41%, which means that you can increase your assets at a high rate of return.

High-Risk, High-Return Fund Is a Global Macro Strategy

As you can see from the fact sheet, although the average annual returns are high, the returns fluctuate widely from year to year. Naturally, there are several years with negative returns. On the other hand, there was a year when assets increased 4.4 times in one year.

As is common with hedge funds with global macro strategies, they are high-risk and high-return. Therefore, there is a high possibility of a negative return after investing. However, if you invest for a long period of time, the average annual interest rate is 27.41% in the case of this hedge fund.

-Evaluate the Fund from the Fact Sheet

When investing in a hedge fund with a global macro strategy, be sure to check the fact sheet. AI does not make decisions when investing, but a human will always decide where to invest. Also, the main investments vary greatly from year to year.

In other words, the investment performance varies greatly depending on the fund manager. Because it is a risky investment method, there are many hedge funds with global macro strategies that have poor performance.

So check the fact sheet and see how the fund has performed over the past 5 to 10 years. After that, you can decide if it is a good hedge fund to invest in.

One of the Main Investment Approaches Is the Global Macro Strategy

Different hedge funds have different investment strategies. One of the main strategies is the global macro strategy, which invests in everything from stocks, bonds, currencies, and commodities. Since there is no fixed investment method, hedge funds have a high degree of flexibility.

This means that investment performance can vary greatly depending on the fund manager. Many famous hedge funds use the global macro strategy because it allows them to make huge profits through short selling, which attracts a lot of media attention.

The global macro strategy is a high-risk, high-return hedge fund. Therefore, if you are an investor who can take risks, try to use global macro strategy hedge funds to increase your assets.

Understanding the investment strategy is important for retail investors when investing in hedge funds. The global macro strategy is a highly flexible investment method, and if you want to increase your assets with high-risk and high-return, you should invest in hedge funds with this strategy.