Amateur individual investors who are considering investing in stocks and bonds may not know what percentage of their savings they should invest.

If you have money to invest, you should invest as large a percentage as possible in stocks and bonds. The reason is that your money will increase significantly. On the other hand, if you are using bank deposits, there is a 100% chance that your money will decrease in value.

Saving in the bank is a risk, and if you don’t invest aggressively, your money will decrease. However, you should not put all your savings into investments. You need to invest in a balanced way.

So, I will explain how to think about the ratio of savings and investment.

Table of Contents

Inflation Reduces the Value of Money in Savings

When money is deposited in a bank, the deposit balance will not increase. On the contrary, the real value of your money will continue to decline.

Why does the value of money decline? The amount of money you have deposited in the bank is the same. You may think it strange that the value of your money is decreasing.

Inflation is the most common reason for the decrease in the value of money in bank deposits. Prices continue to rise due to inflation worldwide. For example, the Fed (central bank) in the US adjusts its inflation rate to be 2% per year. When prices rise due to inflation, it means that the value of money is decreasing.

If inflation occurs at 2% per year, prices will have approximately doubled in 30 years. In other words, if you keep your money in the bank, the value of your money will be reduced by half.

Some countries, like Japan, do not have inflation. But even in those countries, inflation continues worldwide. Therefore, from a global perspective, if you deposit money, its value will decrease.

Investing in Stocks and Bonds Will Make Your Money Grow

The reason why you should invest as much money as possible is that the annual inflation rate is about 2%, even in developed countries. If you do not invest, the real value of your money will decline over time. Having a bank deposit is the same as reducing your money, which is a big risk.

So, let’s invest in stocks. There is a famous study that shows what the value of money would have been if one dollar had been invested in the US in 1802, reported by Jeremy Siegel.

| Value in 1802 | Value in 2013 | |

| Stocks | $1 | $930,550 |

| Bonds | $1 | $1,505 |

| Bills | $1 | $278 |

| Gold | $1 | $3.21 |

| Cash | $1 | $0.052 |

As you can see, the value of cash has decreased significantly. On the other hand, if you invest in stocks, your assets have increased significantly. Also, when you invest in bonds, your money increases.

Assets Grow at a Faster Rate Than Economic Growth, Making Investors Rich

Why do the wealthy stay rich forever? The reason is simple: they invest in stocks. All wealthy people invest because they understand that if they invest, their assets will multiply hundreds of times.

To be more precise, if we invest, as a result, we will become wealthy. For example, if you inherit a large sum of money, it will disappear if you spend it. On the other hand, if you invest your money, your assets will continue to grow. In other words, even if you spend money, your money will not decrease because your assets will increase at a faster rate than that.

As mentioned above, the inflation rate is about 2%. However, if you invest in stocks and bonds, your assets will increase at a faster rate than the economic growth. This is because companies do not grow at 2% per year, and even large companies usually grow at 20% per year. Also, in the case of newly listed companies, it is common that the annual growth rate is 100%.

Since the company is growing fast, the stock price is also rising fast. If you invest in good companies, you can easily earn more than 10% per year by investing in stocks. For example, if you use the S&P 500, which invests in the top 500 companies in the US, it is widely known that you can earn more than 10% per year including dividends.

Not investing is a risk. This is because your money is decreasing year by year. You should actively invest your savings because investments can stop your money from decreasing due to inflation and increase your assets.

Determine Your Investment Rate Based on Your Monthly Expenses

How should you decide what percentage to invest? Naturally, you should not invest the entire amount. You need to use your surplus funds to invest.

As for how much money should be invested, the percentage varies greatly depending on each person’s situation. For example, in my case, I have already built up a large asset by investing, and cash accounts for less than 5% of my assets. In other words, I hold most of my assets in stocks and bonds.

On the other hand, if you have little cash, you will inevitably have limited money to invest.

How do you decide what percentage to invest? Decide how much to invest based on your monthly expenses. Specifically, leave six times the amount of money you spend per month as savings. For example, if you spend $1,500 a month, the cash you should leave in the bank is $9,000.

- $1,500 × 6 months = $9,000

The reason for this is that even if you become unemployed and lose your income, you will be able to live for 6 months without problems. 6 months is enough time to find a new job. Leave six months of expenses as cash because it is the money you need in case of trouble.

On the other hand, invest the rest of your money. Invest in stocks and bonds to increase your money.

You can also sell stocks and bonds at any time. If you need a large sum of money, you can sell your stocks. For example, if you need a lot of money to buy real estate, sell your stocks. After you have increased your money, there is nothing wrong with converting some of it into cash to spend.

Decide How Much to Invest with Consideration for Balance

Also, when investing, think about balance. For example, if your lifestyle has changed after marriage, the percentage you should invest will change. For example, if you are married and your living expenses are now 50% of what you used to pay (50-50 with your partner), the amount of money you can invest will increase.

However, if you have children, you will need to leave enough cash to pay for childcare expenses.

-Include Long-Term Investments in Your Portfolio

It is also recommended to include long-term investments in your portfolio. In other words, by investing money that you will never use for 10 to 20 years, you can compound your money over the long term.

For example, when investing in hedge funds, an annual interest rate of 8-13% is possible even for low-risk investments. Although you will be charged a hefty surrender fee for short-term investments, you can increase your assets significantly for long-term investments of five years or more.

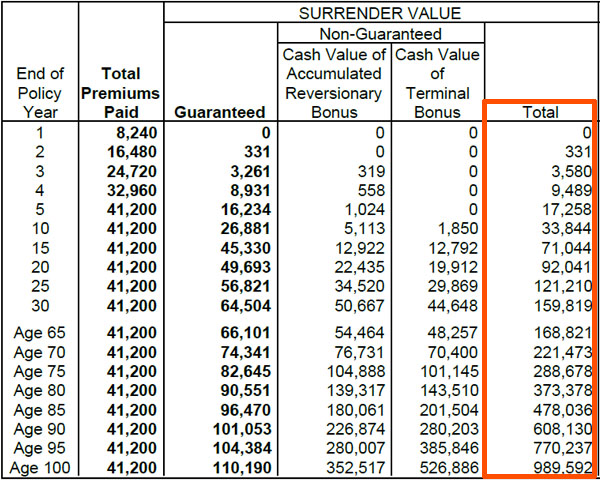

In my case, I also buy life insurance in offshore tax havens where there are almost no taxes. The surrender value will double in 20 years and quadruple in 30 years. The following is the actual insurance policy.

Since it is also a life insurance policy, if I die, the death benefit will be paid to my family. If you have money that you will not use for more than 10 years, consider investing for the long term by using hedge funds or offshore life insurance.

Anyone Can Make $200,000 in Assets

Anyone can make US$200,000 in assets by investing. As mentioned above, if you invest in the US index (S&P 500), the annual interest rate is about 10%.

For example, if you invest $100 per month, the annual interest rate of 10% will increase your money as follows.

| After 10 years | After 20 years | After 30 years | |

| Principal | $12,000 | $24,000 | $36,000 |

| Amount of assets | About $20,700 | About $76,600 | About $227,900 |

In this way, you can create an asset of over US$200,000. For reference, if you invest $300 per month, it will result in the following.

| After 10 years | After 20 years | After 30 years | |

| Principal | $36,000 | $72,000 | $108,000 |

| Amount of assets | About $62,000 | About $229,700 | About $683,800 |

On the other hand, what if you are depositing money in a bank? In this case, as mentioned earlier, the value of your money will be reduced by about half after 30 years due to inflation.

The reason why you should reduce the percentage of cash and invest aggressively is because bank deposits are very risky. To protect your money, you need to invest it. Even with a small amount of money, long-term investment can greatly increase your money.

Not Investing Is a Big Risk

If you have not invested in stocks or bonds, you may think that investing is risky. However, not investing is riskier. In the world, the average inflation rate is 2% every year. As prices continue to rise, the value of money decreases.

On the other hand, if you invest in stocks and bonds, your assets will grow faster than the economy grows. Especially if you invest in stocks, the value of your money is likely to grow.

For example, if you invest in US stocks, even if you invest in an index, you can earn more than 10% per year. You can also increase your assets by investing for a long time in hedge funds or offshore life insurance.

In any case, if you want to protect your money, invest it. With savings in the bank, the value of your money will keep decreasing. So invest and try to increase your money.