When investing in countries with high economic growth rates, India is the most recommended place to invest. In many emerging countries, stock prices have not been rising. However, India is known to be an exceptionally good investment destination.

When investing in India, many people use mutual funds (ETFs). It is rare for people to invest in individual Indian stocks, but by using ETFs, they invest in top Indian companies. ETFs also allow you to invest in US dollars instead of Indian rupees.

A good mutual fund to invest in Indian stocks is INDA. It is not recommended to invest in any other ETF. When investing in India, unless you have a specific reason, you should use INDA.

Why is INDA the superior choice for investing in India? Let’s take a look at INDA, the best India ETF.

Table of Contents

Mutual Funds and ETFs Are the Best Way to Invest in India

Many emerging countries do not have growing stock prices and are not suitable for investment. This is because most emerging countries are underdeveloped due to some political or economic problems.

For example, there are few professional investors who invest in China. The Chinese Communist Party is running the government, and the Chinese government is free to destroy the domestic industry. In fact, China has imposed regulations on many industries such as IT, education, real estate, and gaming since 2021, and many large companies have gone bankrupt.

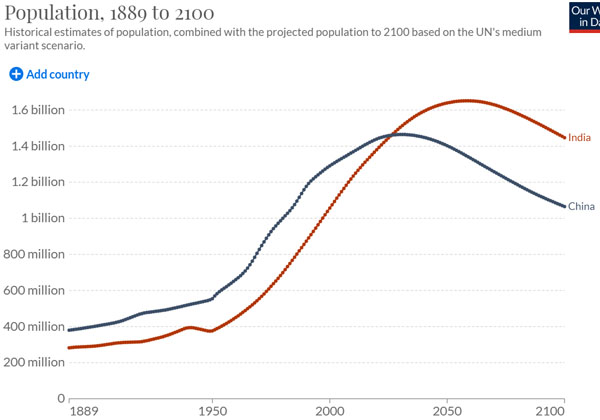

On the other hand, India is the only exception among the emerging countries. India has a large population, and although its economic situation is similar to that of China, it is a democratic country, so there is less political risk. Also, while China’s population will not increase in the future, India’s population will continue to grow, as shown below (India: red line, China: blue line).

Furthermore, the 2021 regulations mentioned above have made many investors realize that the risk of investing in China is high, and as a result, investment money has flowed into India.

As is common in all emerging countries, the market capitalization of listed companies is low. Therefore, if a little investment money goes into India, the stock price will rise many times. This is another reason why investing in India is likely to increase your assets significantly.

The Most Famous ETF Is INDA

It is not recommended to invest in individual Indian stocks. It is difficult to predict which Indian company’s stock price will rise. However, if you use mutual funds and invest in a number of top Indian companies, the stock price will rise as India’s economy develops.

There is a specific ETF that you should use when investing in India, and that is INDA. Here is a historical stock chart of INDA.

- iShares MSCI India ETF (INDA)

The performance of INDA is inferior to that of the S&P 500, which invests in the top 500 companies in the US. Therefore, many people think that it would be better to invest in the S&P 500 instead of INDA.

This idea is correct. However, as mentioned earlier, as a result of the series of regulations and fines imposed by China on domestic companies in 2021, a large amount of investment money has moved from Chinese stocks to Indian stocks. Before 2021, Indian stocks were not attractive. However, since 2021, Indian stocks have become more attractive.

Institutional investors do not invest in China unless they have a specific reason. They usually invest in India instead of China, where the political risks are greater. For example, in 2021, the performance of INDA (blue line) is better than that of the S&P 500 (yellow line).

One of the reasons for this is the massive investment money from China that has flowed into India. Naturally, investment money will continue to be attracted to India, not China.

INDA can be purchased through an online brokerage. Alternatively, you can invest in India through offshore investments.

Using INDA to Invest in Major Indian Companies

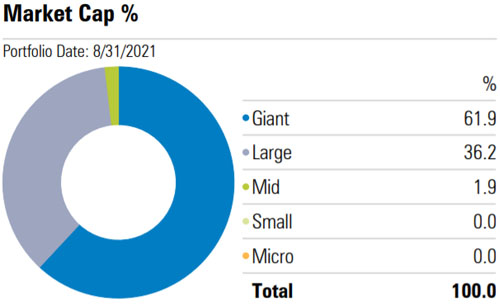

What kind of ETF is INDA? INDA invests in large companies that are listed in India. The MSCI India Index is a well-known index covering large-cap stocks in India, and INDA uses the MSCI India Index as its benchmark.

When using INDA, you will be investing in large companies listed in India as follows.

As mentioned earlier, the S&P 500 is an index that invests in the top 500 companies in the US. In essence, we should understand that INDA is the Indian version of the S&P 500.

Most Investments Are in Banks, Gradually Increasingly in High Tech Companies

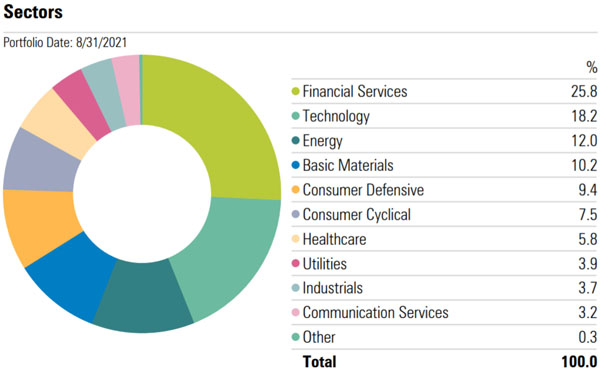

Unlike US stocks, investing in Indian stocks involves investing in emerging markets. Therefore, the market capitalization of banks is larger than that of Indian domestic tech companies. The sectors in which INDA invests are as follows.

As you can see, financial services are at the top of the list, followed by technology companies. When investing in emerging countries, the market capitalization of financial institutions inevitably becomes large.

As India’s economy develops, we can expect the number of giant technology companies to increase and their market capitalization to become huge, just like in China. Therefore, if you invest in INDA, the percentage of your investment in technology companies will increase over time.

However, it is difficult to predict which technology companies will grow in India and increase their market capitalization. So, we use mutual funds. With INDA, which invests in Indian giants, the companies and the percentage of investment will automatically change over time, and the stock price will increase as India grows.

Other ETFs Have Low Volume and Are Not Suitable for Investment

There are other ETFs that invest in India. For example, the following ETFs are known to invest in India.

- WisdomTree India Earnings Fund (EPI)

- iShares MSCI India Small-Cap ETF (SMIN)

- Invesco India ETF (PIN)

However, the daily trading volume of these ETFs is low. Naturally, the total asset value is low. Therefore, when you try to sell your shares, you may not be able to sell them at the right price due to low trading volume.

As for the expense ratio, INDA has an annual expense ratio of about 0.7%, which is the lowest among the ETFs that invest in large-cap Indian stocks. For this reason, most people invest in INDA.

INDA Listed in the US Is Important for Investing in Indian Stocks

A lot of people are thinking about investing in Indian stocks. The reason for this is that India is known to be a fast-growing country. Also, since Chinese stocks are not attractive and institutional investors do not buy Chinese stocks, investment money is more likely to be attracted to Indian stocks.

The basic investment strategy is to invest in US stocks. However, if you want to diversify your investment, consider investing in Indian stocks. There are several ETFs listed in the US, the most famous of which is INDA.

With INDA, you can invest in top Indian companies. Also, with the growth of India, we can expect the high-tech companies to gradually get bigger. This will further attract investment money to India, and the stock price will rise.

If you are considering investing in an emerging country, use the INDA. INDA is a great way to invest in India in US dollars instead of Indian rupees.