When you think about considering offshore investments, one of the well-known companies is RL360°. Many people have signed up with RL360° to make accumulation investments. This is a great way to manage your assets because you will be investing in tax havens (offshore regions) where there are no taxes.

However, there are many unknowns when investing offshore with RL360°, such as what kind of products you should use to manage your assets. In addition, there are many things that you don’t know, including the advantages and disadvantages.

When you are invited to invest offshore, it is important to understand RL360° and its products in advance.

RL360° is an excellent company, and there are no scams. However, it is common for people to fall victim to scams due to bad referrals. So let’s discuss what you need to learn before you consider investing in RL360°.

Table of Contents

Isle of Man Insurance Company in a Highly Rated Tax Haven

One of the ways to find out whether an investment product is safe or not is to check whether it has a high rating from an external agency. No matter how much the introducer convinces you that the product is safe, it is doubtful that it is really safe. However, if it has a high rating from a global rating agency, you can know for sure that it is safe.

RL360° has been highly evaluated by global rating agencies. Specifically, they are as follows.

- Standard & Poor’s: A-

- Moody’s: A2

This is the same rating as the very large megabanks in developed countries. Therefore, it is safe to assume that the possibility of bankruptcy is close to zero.

RL360° is located in the Isle of Man, a tax haven where there are no taxes. Although there are 19 insurance companies registered in the Isle of Man, including RL360°, not one has ever gone bankrupt.

Such a very safe company is RL360°, and it is an insurance company with a worldwide reputation.

With a Long History and Large Total Assets, Safety is High

As you can see from the map, the Isle of Man is located right next to the United Kingdom. Also, the Isle of Man is positioned as a British Crown Dependency and is owned by the British Royal Family. Therefore, although the Isle of Man is a different country from the United Kingdom, it is treated almost as if it belongs to the United Kingdom.

The RL360° in the Isle of Man has a long history. RL360° was a part of the Royal London Group. Royal London was established in 1861 and had a long history.

The group’s total assets exceed USD 10 billion. In addition, the group has more than 6 million insurance policy customers around the world. Currently, RL360° is not part of the Royal London Group, but it is still a large group.

When you invest in offshore funds, you may ask yourself, “Is the investment safe?” However, you don’t need to worry about this because it is a huge major company.

If you want to invest in RL360°, you need to apply through an IFA (Independent Financial Advisor) registered in a tax haven. You must apply through an agent in an offshore area, not an agent in your country.

Is RL360° Illegal? Bad Reviews and Reputations are Caused by Referrals

If you are interested in investing in offshore, you may be concerned about the following two things: (1) the product is not licensed by the Financial Services Agency of your country, and (2) there are bad reviews on the Internet.

When considering offshore investments, it is true that the financial products you sign up for are not approved by the Financial Services Agency of your home country. They are regulated because they are so good that if they are sold in your country, most of the poor products offered by life insurance companies and investment companies in your country will not be able to sell well.

Nevertheless, why does RL360° have so many bad reviews?

The reason for this is that the referrals are not good and are frequently fraudulent. It’s true that RL360° has been introduced through multi-level marketing, or you may lose contact with your referrer during your investment, and as a result, many victims continue to appear.

However, RL360° itself is not a scam, and if you invest correctly, you can increase your assets significantly. In fact, it is true that you can aim for an annual interest rate of over 10% through regular investments. However, if you subscribe from a bad referrer, you will be a victim of fraud.

People Who Suggest Stopping or Withdrawing Midway Are Scams

How do you know if it is a scam or not? The method is very simple: just ask them if they recommend stopping or withdrawing.

There is the main principle to regular investment. You need to keep paying the amount you have decided at the beginning until maturity comes. If you don’t do this, you will lose your principal with a high probability.

The fees for investing in RL360° are reasonably high. The annual fee is about 3%. RL360° fees also include a 6% annual fee on the initial account (the amount you accumulate in the first two years).

For example, if you accumulate US$30,000 in the first two years, the annual fee will be $1,800.

- $30,000 × 6% = $1,800

Therefore, in the initial stage when the accumulated amount is small, it is difficult for RL360° to increase your money in asset management due to the high fees. Nevertheless, if you let the funded amount decrease through withdrawals, the fee percentage will increase, and as a result, it will be harder to increase your money. In the case of offshore investments, reducing the amount of money in the middle of the year is a negative factor.

Anyone who tells you that you can accumulate for the first two years and then stop, or that you can withdraw at any time, is trying to reduce your money.

You have to understand that the main principle is to keep investing the amount of money you have initially decided on without any reduction during the process, and you have to choose an investment product after learning the risks involved.

The Product for Regular Investment is the Regular Savings Plan (RSP)

What kind of investment product will you actually choose and sign up for at RL360°?

You must choose to invest in the Regular Savings Plan (RSP) because there is no other product worth signing up for at RL360°.

Offshore investments aim for an annual interest rate of over 10%, and the Regular Savings Plan is an investment product that can achieve such a high yield. By investing in offshore funds, you can aim for high asset management results.

The following is a brief description of the details.

-Contractor and age

You can sign up as an individual or a corporation. Individuals between the ages of 18 and 65 can sign up.

-Contract age and accumulation period

You can accumulate until you reach 71 years old. For example, if you are 61 years old, you can only accumulate for ten years. In asset management, the longer the period, the more powerful the investment, so the younger the contract age, the more advantageous it is.

-Fees

There are many complicated fees that are difficult to understand, but let’s think that the annual fee is 3% of the total amount of assets. The fees are very high, so if you do not sign up through a proper introducer, you are sure to end up with a negative investment result.

Basically, you will pay by credit card, but if you use Amex, you will be charged a 1% commission. If you don’t use Amex, the fee is zero, so never choose Amex for credit card payment.

-Loyalty Bonus

A loyalty bonus will be paid according to the number of years of participation when you reach the maturity date. A loyalty bonus is as follows.

- Years of contract × 0.25%

For the total amount of money paid up to that date, the following amounts will be refunded at maturity.

- 10-year contract: 2.50%

- 15-year contract: 3.75%

- 20-year contract: 5.00%

- 25-year contract: 6.25%

The IFA You Apply to Is Very Important

It is often misunderstood by beginners that investing in RL360° does not necessarily mean an annual interest rate of over 10%. When you invest offshore, you must apply through an agent called an IFA, and it is very important to choose the appropriate IFA.

RL360° has more than 200 funds to choose from. This means that you can choose from a wide range of investment products, including global stocks, developed country stocks, real estate, etc., and the IFA will manage the actual investment.

In other words, which funds to invest in depends on the agency you apply to, and the investment performance will be completely different.

As a beginner, you may think that if you apply to RL360°, your money will grow on its own as time goes by. However, if you apply to a bad IFA, your assets will not be managed at all, or your assets will decrease due to poor management.

After understanding this fact, you should apply for an IFA by focusing on whether the IFA’s past investment performance is acceptable and whether the introducer is a trustworthy person.

Risks and Disadvantages of Mutual Fund Insurance Products Are Early Terminations

If you want to invest with RL360°, you must also understand the risks of the Regular Savings Plan (RSP).

The Regular Savings Plan (RSP) is a mutual fund insurance product. It is an insurance policy, but it does not provide a high death benefit like an ordinary life insurance policy. The purpose of this product is to manage assets by mutual funds.

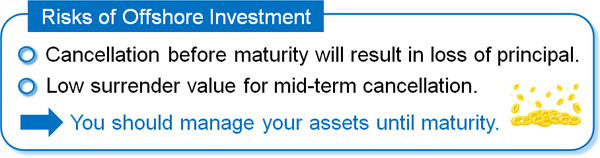

However, since it is an insurance product, there is a high probability that the principal will be lost if the policy is canceled before the maturity date. If you surrender early, you will surely lose money. The same is true for all life insurance policies sold in your country; if you surrender early, you will lose your principal.

Also, as mentioned earlier, the basic rule is to accumulate the amount of money you initially decide until maturity. It is important to understand that even if you choose a good IFA and are able to manage your assets at an annual interest rate of about 10%, you are likely to lose your principal if you make withdrawals or cancelations during the process.

You have to understand these risks and disadvantages before making investment decisions.

What Is the Actual Reputation of RL360°?

What are the actual reviews and reputation of RL360°? In this regard, it is not necessarily excellent.

As I have already explained, RL360° is not a scam, and you can manage your assets if you choose the proper IFA. However, RL360° is known for its extremely high fees. Although it is a huge company, the speed of asset growth is slow because of the expensive fees.

Even though it is slow, it is still far superior to the investment products sold in your country. However, when you compare it to other offshore investment products, it is inevitably inferior.

However, there are some people who focus on the size and history of the company. For those people, investing with RL360° is an excellent choice.

Investing Offshore with RL360°

When investing offshore, RL360° is known for its high commission. Therefore, you need to create a return on investment that is greater than the fees.

In such a case, the referrer (IFA you sign up with) is the most important. It must be a good agency because the investment yield will be completely different depending on the IFA. If the agent is not good, the high RL360° fees will add up, and the yield will be negative.

In addition, there is a risk of loss of principal if the account is canceled or withdrawn before maturity. In order to avoid such a situation, you need to invest the amount of money you initially decided until maturity.

It is not illegal, and RL360° is a safe and reliable company. However, you should consider not only the advantages but also the risks and disadvantages before making an investment decision.