Excellent yields can be achieved when investing in offshore tax havens where there is little or no taxation. Among these offshore investments, many people invest in hedge funds.

There are different types of hedge funds, and one of the most popular investments for many people is the principal-protected hedge fund. In other words, after investing in a hedge fund, the possibility of losing money is low.

It is important to note that it does not mean that you will not lose your principal in any case. If you make a mistake in your investment method, you may lose your principal. However, many people have used principal-protected hedge funds to increase their assets significantly.

What are the characteristics of principal-protected hedge funds? And what are the cautions? In this article, I will explain the principal-protected funds that can achieve high returns with low risk among offshore investments.

Table of Contents

There Are Two Types of Principal Protection Offshore Investments

When you invest in a tax haven overseas, there is a low-risk way to invest. This is the principal protection type of offshore investment. When you want to invest in a tax haven, there are two main ways to do so. These are as follows.

- Investing in mutual funds: Regular investment

- Investing in hedge funds: Lump-sum investment

When you invest offshore as a regular investment, there is an investment product that protects your principal. Specifically, it promises to increase your assets to more than 140% in 15 years and more than 160% in 20 years. It is an investment product that invests 100% in the S&P 500, and if you invest your assets at 4% annual interest, you can achieve 160% in 20 years.

It is also widely known that the S&P 500 has an average annual interest rate of 7-9%. Therefore, a higher yield is possible.

On the other hand, when you invest in hedge funds, you invest in a lump sum instead of an accumulation. The S&P 500 is a famous American index, not a hedge fund. When investing in hedge funds, on the other hand, you can protect your principal by investing in a lump sum.

Investing in a Principal-Protected Hedge Fund

There are countless hedge funds, and their investment strategies vary greatly from fund to fund. Among them, there are a few hedge funds that offer principal protection.

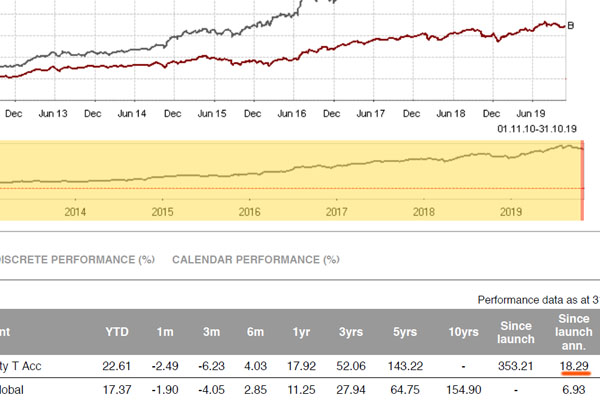

For example, the following is a principal-protected hedge fund with more than 40 billion dollars in assets.

In the case of this hedge fund, the average annual interest rate in the past is 18.29% after 10 years of asset management. Therefore, investing in this hedge fund is by far the best way to increase your money than investing in an index. After deducting fees, the annual interest rate is 18.29%, which is a very high yield.

Also, the guarantor is Morgan Stanley, and the global rating is very high. Because of its good investment performance and high rating, investment money from all over the world is attracted to the fund, and the asset balance is quite high.

However, even if a hedge fund has excellent investment performance, in some cases, it may fail to manage the assets and result in negative returns. This is why the hedge fund is designed to protect the principal. Specifically, 95% of the invested amount is guaranteed at maturity, even if the return is negative.

In the past, when the dot-com bubble and Lehman Brothers bankruptcy occurred, stock prices fell by more than 50%. Even if a major recession occurs, 95% of the principal is guaranteed at maturity.

In fact, the average annual interest rate is 18.29%, so there is no need to worry about negative returns. However, even if the return is negative, most of the principal is protected.

It Doesn’t Mean That You Will Never Lose Your Principal

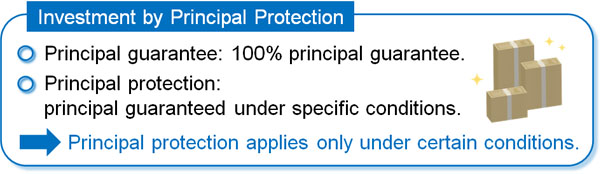

Note that this does not mean that you will never lose your principal. In other words, it is not a guarantee of principal but an investment that protects the principal. There is a difference between a principal guarantee and principal protection.

Principal protection means that the money is guaranteed under certain conditions. In the case of the hedge fund I mentioned earlier, you invest a lump sum, and it matures after six years. Specifically, if the money is withdrawn or canceled before the maturity date, the principal protection does not apply.

It is important to understand that the principal protection is only applied to those who meet the predetermined conditions and invest until maturity.

Also, in the hedge fund I mentioned earlier, the principal is protected at 95%. This means that even if you get a significant negative return, you will only lose up to 5%, but you will get back less money than the principal amount invested. In other words, you may lose your principal at maturity.

Principal Guarantee Is Available Only for Bank Deposits: Investments Are Principal Protected

For your information, the only investment method that has a principal guarantee is bank deposits. In the case of the investment method of making a fixed deposit at a bank, the principal is guaranteed.

If you need a large amount of money and cancel your fixed deposit at the bank, you will still get 100% of your money back. Although the high-interest rates of fixed deposits do not apply, you will not lose your money even if you cancel the deposit midway.

On the other hand, other than fixed deposits at banks, there is no principal guarantee. It is a principal protection investment; the principal amount is guaranteed only if you continue to invest until maturity under the conditions you set at the beginning.

It is true that the risk of principal-protected offshore investments is very low, and you can almost certainly increase your money. However, it does not mean that you will never lose your principal. So, it is important to understand the difference between principal guarantees and principal protection beforehand.

The Reason Why You Can Protect Your Principal by Investing in Hedge Funds

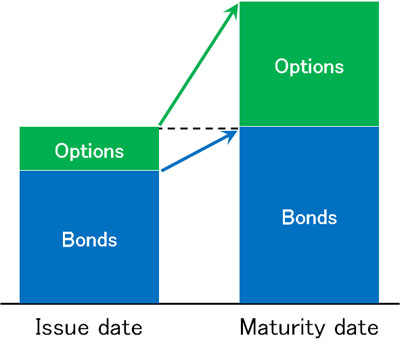

Why is it possible to protect your principal with a lump sum investment in a hedge fund? All hedge funds that can generate annual interest rates of 15% or more invest in stocks and bonds. This is because they cannot generate high yields unless they invest in high-risk assets.

The hedge fund I mentioned earlier also invests in stocks and bonds. In the case of this hedge fund, it invests in bonds and also buys and sells stocks through options trading.

If they invest in bonds, they can earn a fixed interest rate. Therefore, the fixed interest rate on bonds can be used to increase assets and protect their client’s investment principal. However, investing in bonds alone does not provide enough yield. Therefore, they try to increase their clients’ assets by trading options (buying and selling stocks).

In this way, while protecting the principal through fixed interest rates on bonds, the fund aims for a high yield by using options trading. This is the basic structure of a principal-protected hedge fund.

A detailed explanation of the mechanism of principal-protected hedge funds would be very complicated. Also, the concept of options trading is difficult. In any case, hedge funds invest in stocks and bonds to increase assets with principal protection.

Principal Protection Funds Are Available for a Limited Time

When you invest in principal-protected hedge funds, you can achieve low risk and high returns.

Normally, it is impossible to achieve a high return on a low-risk investment. However, in the case of principal-protected hedge funds, it is possible to achieve high returns with exceptionally low risk. As mentioned above, even if the investment fails, 95% of the principal is protected. Also, as you can see from the fact sheet, the actual average annual interest rate is 18.29%.

However, there is also a disadvantage. The only disadvantage is that there is a limited offering period.

As mentioned above, principal-protected hedge funds invest in bonds. Therefore, if the annual interest rate of the bond is low, it is not possible to create a principal-protected product. Therefore, there will be no offer.

To be more specific, if the US dollar interest rate is low, we cannot invest in principal-protected products. Offshore investments are generally made in US dollars. Therefore, if the US dollar interest rate is low and we cannot get a high fixed interest rate by investing in bonds, the hedge fund cannot create a principal protection product.

For example, in 2020, when the world was in chaos due to the coronavirus pandemic, the short-term interest rate of the US dollar was set to zero by the Fed (US central bank). As a result, there were no new offerings for more than a year and a half because it was impossible to create a principal-protected product due to the inability to earn a high yield by investing in bonds.

For your information, when the US dollar interest rate is high, we can earn dividends at high-interest rates by investing in bonds. Therefore, when interest rates are high, the conditions for investing in principal-protected hedge funds are better.

Due to the characteristics of principal protection products, it is important to understand that there is an offering period, and the conditions may change depending on the US dollar interest rate.

Investing in a Principal-Protected Hedge Fund

You don’t have to be wealthy to invest in a hedge fund. You can invest in hedge funds in tax havens through offshore investments, even if you are a retail investor. Some hedge funds offer principal protection.

Investing in hedge funds with principal protection allows for low risk and high returns. If you continue to invest until maturity, 95% of your principal is guaranteed, and you can also grow your assets at an average annual interest rate of 18.29%.

However, it is not possible to invest at any time. The application period is limited, and you cannot apply after the period has expired. Also, when the US dollar interest rate is low, it is impossible to create a product that protects the principal, so it may not be offered for many years.

Although there is this disadvantage, principal-protected hedge funds are a popular investment method for many investors because they offer high returns with low risk. In the case of the hedge fund mentioned in the example, it is guaranteed by Morgan Stanley and has a high rating. Those who want to achieve high returns with low risk should invest in principal-protected hedge funds.