Investors Trust (ITA) is one of the insurance companies that many people sign up with when considering regular offshore investments.

Among the Investors Trust’s financial products, one of the most popular and low-risk products is the S&P 500 index. It is a financial product that invests in an index based on the US S&P 500, and although you cannot expect a large return, it is a method that can surely increase your assets.

The biggest feature of this product is that the principal is protected, and it is almost certain that the money will increase to more than 140% or 160% of the invested amount.

However, of course, there are some precautions. So, I will explain how you should think about investing in the Investors Trust S&P 500 Index.

Table of Contents

Investing in the US S&P 500 Index

Insurance companies in the world make money by taking money from customers and investing it. One of the investments they make is in the S&P 500.

The S&P 500 is the leading stock index in the US, and it is an index investment that is linked to 500 major stocks of companies listed in the US.

In the stock market, one of the most famous and wealthy people is Warren Buffett. He wrote in his will to his wife that he wanted her to invest 90% of her fortune in the S&P 500. The S&P 500 is so trusted that it has become one of the easiest indexes to grow your assets in the stock market.

For reference, the chart of the S&P 500 in the past is as follows.

Naturally, there have been several major global recessions during this period.

- 1987: Black Monday

- 2001: Dot-com Bubble Crash

- 2008: Bankruptcy of Lehman Brothers

- 2010: European Debt Crisis

- 2020: Coronavirus Shock

Even in such recessions, the S&P 500 has quickly rebounded and over the long term, its stock price has increased dozens of times. Investors Trust has a financial product that invests 100% in this S&P 500 index.

Investors Trust (ITA) Offers 15 or 20 Years of Principal Protection

One of the most important features of using S&P 500 financial products with Investors Trust (ITA) is that the profits are protected. It is principal protected, which means that you are promised a certain amount of asset growth.

In this regard, the principal is protected as follows.

- 10 years: 100%

- 15 years: 140%

- 20 years: 160%

In 10 years, the principal is 100% protected, so no one would subscribe for this investment period. Instead, we should choose 15 or 20 years. The principal protection is 140% for 15 years and 160% for 20 years. This is clearly stated on the official website as follows.

Of course, principal protection is the minimum value. If the investment return is good, you will receive more money at maturity, not just 140% in 15 years or 160% in 20 years.

Note That the Principal Is Not Guaranteed, It Is Conditional

The investment product of the S&P 500 Index is not principal guaranteed, but principal protected. It is important to note that the wording is slightly different and is not a principal guarantee.

The guaranteed principal means that at least 100% of the money you invest will be protected. A typical example is a fixed deposit. When you cancel your fixed deposit in the middle of the term, you are not promised interest on the fixed deposit, but you will receive 100% of the principal you initially invested.

On the other hand, with principal protection, your money is guaranteed only under certain conditions. In essence, it is as follows.

- Principal Guarantee: The principal is guaranteed under any conditions.

- Principal Protection: The principal is guaranteed under certain conditions.

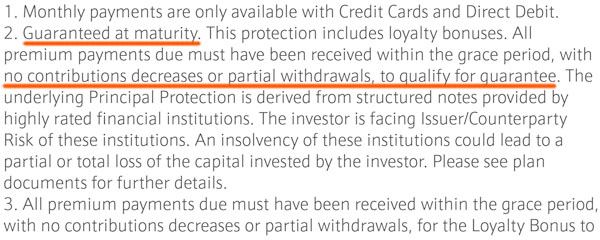

When you invest in Investors Trust, the principal is not guaranteed but protected. To be more specific, there are certain conditions that must be met in order to be assured that your assets will grow 140-160% or more in 15 or 20 years. This is clearly stated on the official website as follows.

This part is the most important sentence, stating that the principal is guaranteed only when there are no reductions or partial withdrawals.

It is true that investing in Investors Trust ensures that your assets will grow 140% in 15 years and 160% in 20 years. However, you should understand the condition that you have to accumulate the initial amount for a long time.

If the Bank Goes Bankrupt, There Is No Protection

There is also one more investment risk with Investors Trust. It is the risk of bank failure.

The reason why the principal is protected is that the funds are invested in structured bonds (bonds that combine futures and other instruments) of foreign banks. In short, they are managing assets using products offered by foreign financial institutions, so if the bank defaults on its obligations, the investor (you) bears the risk. Therefore, the principal will no longer be protected.

However, even though there is a possibility that foreign financial institutions may go bankrupt, offshore investments utilize banks that are overwhelmingly more reliable than your country’s megabanks and have been proven to be superior by global rating agencies.

Therefore, in regular investments, the risk of bankruptcy of financial institutions is almost zero. So, you don’t need to worry about this.

Why Investors Trust S&P 500 Is Superior?

What’s the point of investing with Investors Trust (ITA)? Since it is linked to the S&P 500 index, you may feel that you can invest in the index by opening your own account at a brokerage firm.

This is exactly true. However, since it is an index investment, there will always be ups and downs in stock prices. If you are investing and 15 or 20 years later, there is a risk of losing your principal if the stock price falls due to a recession.

With Investors Trust, on the other hand, you are promised that your assets will grow 140% or 160% even if the stock price falls. No matter how bad the investment profit is, your money will be returned to you with increased assets for sure.

Since profits are promised, this is the difference between Investors Trust and general index investing.

In reality, when you invest in indexes on your own, you often think about reducing the amount you invest because the stock prices are falling due to the recession. However, index investing allows you to buy a lot of stocks during a recession, so that your assets will increase significantly when the price rises in the future.

With Investors Trust, if you reduce the amount of money, you will lose your principal protection, so you will be forced to keep investing the same amount of money at all costs. As a result, it becomes easier to increase assets in regular investments.

The Commissions Can Be Offset by Loyalty Bonuses

Also, if you continue to invest with Investors Trust, you will receive a loyalty bonus. Although you will be charged fees for investing with Investors Trust, you can reduce the fees by taking into account the loyalty bonus.

The Loyalty Bonus is 5 to 7.5% of the amount you have accumulated and paid as follows.

If you continue to invest with Investors Trust until maturity, you will be able to offset your fees with high loyalty bonuses. So you don’t have to worry about paying commissions.

Monthly Accumulation Instead of Lump Sum Investment

With the Investors Trust S&P 500, it is a monthly accumulation investment.

In investment, there is a method called lump-sum investment. With the lump-sum investment, if the investment profit of the S&P500 is good, the asset will increase greatly. On the other hand, if there is a recession at maturity, the assets will be decreased. Therefore, by investing in a monthly accumulation, you can diversify your risk.

It is possible to choose lump-sum investment in the investment products of Investors Trust. However, because of the poor conditions, no one uses Investors Trust to make lump-sum investments. Be sure to choose a monthly savings investment.

In the case of monthly payments, the investment period will inevitably be longer, such as 15 or 20 years. However, by investing for a longer period of time, the money will start to increase with compound interest, which makes it possible to guarantee 140% or 160%.

Simulation of Asset Growth at 4% Annual Interest Rate

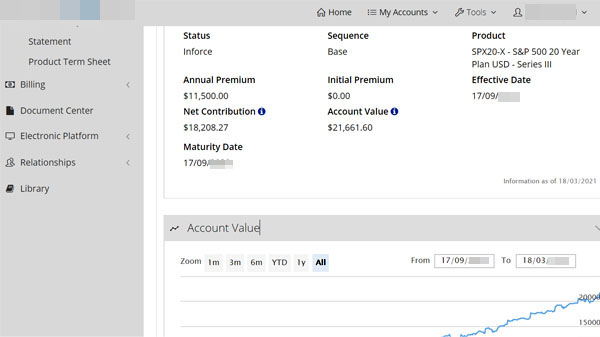

For reference, I have also invested in the S&P 500 of Investors Trust. The following are the numbers from the simulation presented by my agent (IFA) at maturity.

| Year | Investment Amount | Account Value |

| 1 | US$11,500.00 | US$11,627.63 |

| 5 | US$57,500.00 | US$61,500.79 |

| 10 | US$115,000.00 | US$140,140.26 |

| 15 | US$172,500.00 | US$224,692.21 |

| 20 | US$230,000.00 | US$367,998.72 |

I signed up for a 20-year plan, and the increase to 160% after 20 years means that my assets will grow at about 4% annual interest. Also, if there are more investment gains, the amount of assets will rise further.

Moreover, the simulations here are not uncertain whether asset management is really possible or not, but they are based on the worst investment performance. Therefore, you will be able to increase your assets with low risk as long as you follow the conditions you set at the beginning.

For your reference, the following is the management screen of my investment in the Investors Trust S&P 500 Index.

You will be investing in US dollars, and if your assets increase to 140% or 160%, you will have almost a 100% chance of winning, even taking into account the currency risk. Instead of keeping your assets in the country you live in, you can grow your assets by investing in the Investors Trust S&P 500 Index.

The Average Yield on the S&P 500 Is 7-9%

For reference, the average yield of the S&P 500 Index is 7-9% per year. In other words, the 4% annual yield is a very low estimate, and it is usually more than 140% in 15 years and more than 160% in 20 years.

Knowing that the average yield of the S&P 500 is 7-9% per year, it is not surprising that assets can grow to over 160% in 20 years. The S&P 500 is the most famous index in the world. This is because many people know that investing in the S&P 500 index will increase their assets by 7-9% per year.

Of course, in some years, the yield can be negative. However, if you think about it over a long period of time such as 15 or 20 years, the average yield will be 7-9% per year. For reference, if you invest US$500 every month at an annual interest rate of 7-9%, you will pay a total of $120,000 in 20 years. In this case, your assets would look like the following.

- The annual interest rate of 7%: About 253,860 USD

- The annual interest rate of 8%: About 284,640 USD

- The annual interest rate of 9%: About 319,620 USD

As you can see, investing in the S&P 500 Index will greatly increase your assets.

Increase Your Assets Over 140% or 160% with Principal Protection

Normally, regular investments aim for an annual interest rate of over 10%. However, these investment products naturally involve risks.

On the other hand, a safe method of investing without taking much risk is to invest in the S&P 500 Index of Investors Trust (ITA). Past data has shown that investing in the S&P 500 can lead to significant price growth.

Also, the most important feature is principal protection. If you reduce, stop, or partially withdraw your investment, the guarantee will be lost. However, if you do not do these things, S&P 500 Index is an excellent financial product that will surely increase your assets.

Since the profit is assured, there is no risk, and it is popular among many people. Since it is a principal-protected instrument, you need to understand in advance the conditions of achievement (no reduction, stop, or partial cancellation during the investment), but if you understand them and purchase the financial instrument, you can be sure to increase your assets with the S&P 500.

It is up to you whether you aim for more than 140% with a 15-year investment or more than 160% with a 20-year investment. In any case, make sure to manage your assets with mutual funds by accumulating the money you set at the beginning until maturity comes.