When investing offshore, many people use Dominion Capital Strategies to invest in savings or lump sums. Dominion Capital Strategies is an offshore investment company with low fees, and they offer an annual interest rate of over 10%.

Dominion Capital Strategies offers not only low fees but also a system to protect your principal. This structure is called PIP (Protected Investment Portfolio).

If you use PIP correctly, you can increase your assets while minimizing the decline in asset value, even during a major recession. The PIP allows you to increase your money at a high rate of return while protecting your assets.

However, there is a right way to use PIP. You need to understand the characteristics of offshore financial institutions so that you can have good asset management. So I will explain how PIP works and what it is all about.

Table of Contents

Offshore Investment in Dominion Has a Principal Protected Structure

There are some cases where offshore investments allow for principal-protected investments. One of them is Dominion Capital Strategies, which offers PIP as a principal-protected structure.

The principal protection offered by each offshore financial institution is different. In the case of Dominion Capital Strategies, PIP allows you to protect up to 80% of your assets. It is important to understand that 100% of your assets are not protected as principal protection, but only up to 80%.

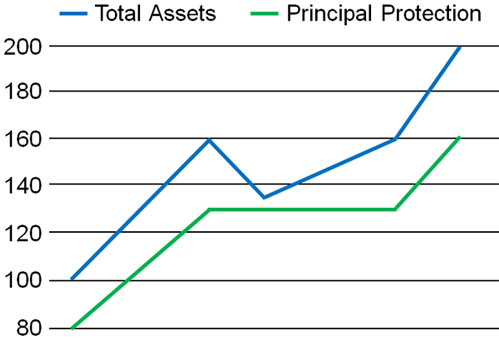

With PIP, your assets will be protected up to 80% based on the highest value of your assets. Therefore, as the amount of your assets increases through asset management, the amount of principal-protected will also increase. It is as follows.

For example, if the amount of assets is 100, the amount of principal-protected is 80. On the other hand, if the asset amount increases to 200, the principal-protected is 160. As your money increases through asset management, the amount of principal-protected will also increase, so if you invest for a long period of time, you will be able to increase your assets with a high probability.

The Fee Is 1% Per Year and Can Be Removed at Will

When you invest offshore with Dominion Capital Strategies, you usually do not use PIP, because if you use PIP, you will be charged 1% per year on your asset balance.

The fees at Dominion are 1.15-2.65% per year, which is low compared to other offshore financial institutions. However, if you use PIP, an additional 1% annual fee will be added. Since a 1% annual fee is a lot for an investment, we should not use PIP when the economy is booming and stock prices are rising. Instead, we use PIP when the economy is in recession.

Since economic conditions vary from time to time, there are times when PIP is necessary and times when not. The important thing to remember is that PIP can be removed at will on a daily basis.

If you think you need PIP, you can add PIP from the membership website. On the other hand, if you decide that you don’t need the PIP, you can remove it after logging in to the member website.

Automatically Invested in Six Funds

How does the PIP (Protected Investment Portfolio) work? Before you use a PIP, you need to understand its details.

Dominion Capital Strategies has multiple funds. Investors invest by choosing the funds they want to invest in from among the multiple funds. The reason why the annual interest rate varies from person to person is that the investment performance varies depending on which funds you invest in.

With PIP, on the other hand, we cannot choose which funds to invest in. Your assets will be automatically invested in the following six funds.

- New Technologies

- Managed Fund

- E-Commerce Fund

- Sustainable Growth

- Global Equities

- Luxury Fund

It is also automatically decided which funds to invest in and in what proportion. All decisions are made by AI.

Falling Stock Prices Automatically Increase the Cash Ratio

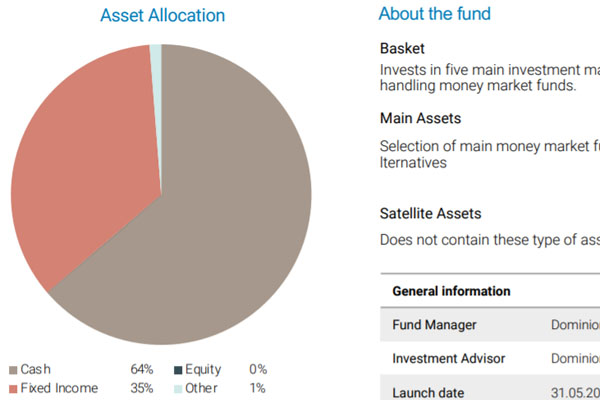

How can you protect your money when stock prices fall? The method is simple: increase the cash ratio. Even if the stock price plummets, the higher the cash ratio, the slower your assets will decline.

If the stock price is growing, all of your money will be invested in the funds I mentioned earlier. On the other hand, if the stock price falls sharply, the money is automatically converted to cash. The greater the decline in the stock price, the greater the percentage of cash.

Dominion Capital Strategies has a cash fund. The cash fund consists mostly of cash and fixed deposits, as shown below.

The AI decides how much to exchange into cash as the stock price falls. When using PIP, the result of asset management is the same for all Dominion users.

Simulation of Past Major Crashes

So, if a stock market crash actually occurs due to a major recession, what would be the outcome if we use PIP?

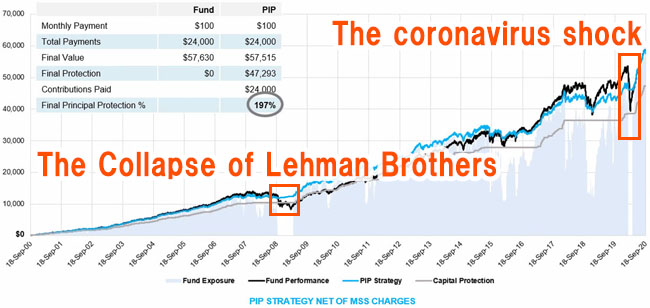

Dominion Capital Strategies has run simulations of what would happen with and without the use of PIP. The following is the result of the simulation for a regular investment from 2000 to 2020.

During this period, there were two major stock market crashes: the collapse of Lehman Brothers in 2008 and the Coronavirus Shock in 2020. if you do not use PIP, the stock price (black line) is below the gray line (the line where the principal is protected) after the collapse of Lehman Brothers.

On the other hand, when using PIP, the stock price (blue line) is higher than the gray line in both the collapse of Lehman Brothers and the Coronavirus Shock. In other words, the asset value has not dropped below 80%. Since the cash ratio will automatically be higher, when the asset value decreases due to a great recession, the decrease in value can be minimized.

If the Asset Value Falls Below 80%, the Bank Will Compensate You

When Lehman Brothers went bankrupt, the stock price dropped below 50%. For the S&P 500, which represents the stock prices of the top 500 companies in the US, the following chart shows the price movements from 2007 to 2008.

Even in the event of such a major recession, there will be a slight decline in asset values if you are using PIP. This is because most assets have been converted to cash.

However, this does not mean that the value of assets will never fall below 80%. In the Great Depression, the Dow Jones share price fell by up to 89%, which is a larger drop in share price than the collapse of Lehman Brothers. So what happens if you are using a PIP and the stock price falls below 80%?

In this case, the bank that has partnered with Dominion Capital Strategies will compensate you. Therefore, if you use PIP, the value of your assets will never fall below 80%.

-What to Do After the Bank Compensates You

After the asset value falls below 80% and the bank compensates you, you can choose one of the following four options.

- Re-set 80% as the highest value of the asset and manage the asset with PIP added

- Convert all assets into a cash fund

- Switch to regular fund investments

- Cancel the contract

If the value of assets falls below 80%, you can restart with the 80% line as the highest value of assets and add PIP. On the other hand, you can convert all your money into a cash fund or invest in regular funds. You can also cancel the investment.

In any case, you have four options to choose from.

It Should Be Used Before a Major Recession Strikes

In what situations should you use PIP? As mentioned above, there is no need to use PIP in a booming economy. When stock prices fall, the cash ratio will increase if we use PIP. In addition, since a fee of 1% per year is required, asset management becomes less efficient.

On the other hand, it is effective to use it before a major recession hits. This is because you can reduce the decrease in asset value significantly. And even if the value of your assets falls below 80%, the bank that has partnered with Dominion Capital Strategies will compensate you.

So when will a major recession hit? No one knows. But we can make a rough prediction. For example, a major recession is likely to occur when all of the following conditions are present.

- The Fed has raised its policy rate many times.

- An inverted yield curve appeared more than a year ago.

- Poor corporate earnings.

In the past, stock prices have plummeted as a result of the accumulation of these factors that lead to a recession. So, when signs of a coming recession start to appear, you should add PIP.

PIP Won’t Work Unless You Sign with a Good IFA

However, as an amateur investor, it is impossible to predict when a recession will hit. Therefore, when you invest offshore with Dominion Capital Strategies, you need to contract from a good IFA (Independent Financial Advisor).

It is the IFA who decides which of Dominion’s funds to invest in. In other words, the performance of the investment will vary depending on the IFA you sign up with.

In addition, although there is a PIP structure, most IFAs are amateurs in asset management. Therefore, not only are their annual returns low, but they also cannot predict when a major recession will hit. This means that they cannot advise their clients on the right time to add PIP.

While PIP is an excellent feature, it is worthless if you cannot predict when a major recession will hit. Therefore, it is important to understand that unless you contract with an IFA with excellent investment performance, you will not be able to use PIP properly.

Not Recommended to Change All Money into Cash When Stock Prices Are Rising

I have explained that PIP should be used before a recession hits. However, some people may think that it is better to convert all money into cash before a recession hits.

Certainly, it is better to convert all money into cash while the collapse of Lehman Brothers and the Coronavirus Shock are actually happening. However, you should not convert everything to cash before a major recession occurs. The reason is that your investment performance will suffer.

The situation before a major recession has one thing in common: stock prices are rising. Before a major recession hits, such as the Great Depression, the Dot-com bubble, the collapse of Lehman Brothers, or the Coronavirus Shock, stock prices always rise sharply. If you convert all money into cash, your assets will not increase when the stock prices are rising.

So instead of converting to cash, you should add PIP. By using PIP, you can increase the value of your assets when the stock price is rising. On the other hand, when a major recession hits, the asset will automatically convert to cash, preventing a decline in asset value.

As mentioned above, no one knows the exact date when a major recession will hit. Therefore, instead of converting money into cash, use PIP to prepare for a stock market crash while increasing the value of your assets.

Protecting Your Money by Using an Asset Protection Scheme

When investing, protecting your assets is as important as increasing your money. When the economy is good, stock prices rise and you can increase your assets. With Dominion Capital Strategies, you can manage your assets at an annual interest rate of 10% or more.

On the other hand, during a downturn, the value of your assets will decrease. During a major recession, it is common for stock prices to drop by half or more. Therefore, it is better to protect your assets by using PIP before a recession hits.

By using a principal-protected structure, you can greatly reduce the decline in your assets even during a major recession. While the IFA you choose to sign up with is important, using a PIP offered by Dominion Capital Strategies at the optimal time can minimize the decline in your assets during a recession.

One of the best features of Dominion Capital Strategies is the principal protected structure; use the PIP to protect your assets and manage them at an annual interest rate of over 10%.