Many institutional investors are investing in alternatives. There are different types of alternative investments, and one of them is derivatives trading.

Derivative trading is one of the most difficult investment methods. Commodity futures trading and options trading are included in derivatives trading. Also, when it comes to trading commodities such as precious metals, grains, energy, etc., you have to predict the changes in commodity prices.

For this reason, alternative investments in derivatives trading are not recommended for retail investors. However, if you invest in a hedge fund that trades derivatives, you can increase your assets at an annual interest rate of 20-30%.

If you want to increase your assets by investing in commodities, there is a right way to do it. I will explain how to think about it and how to manage your assets.

Table of Contents

Derivatives Are a Type of Alternative Investment

The method of not investing in traditional assets such as stocks and bonds is called alternative investments. In this case, investing in commodities is known as an alternative investment. Some famous commodities are as follows.

- Precious metals: gold, silver, etc.

- Grains: corn, soybeans, etc.

- Energy: crude oil, natural gas, etc.

When investing in these commodities, it is common to use derivatives trading.

When you invest in stocks, you usually take a long position (buying) to increase your assets. Therefore, in times of recession, the asset value declines, resulting in a negative return.

Alternative investments, on the other hand, use derivatives such as futures, options, and swaps. This allows you to generate profits not only during economic booms but also during recessions.

If you are investing in commodities, you can trade commodity futures and options. You can make a profit by using both long positions (buying) and short positions (selling).

Gold Is the Most Famous Commodity

Gold is one of the most famous commodities to invest in. Many individual investors, even amateurs, invest in gold. Unlike companies, gold has no risk of bankruptcy and will never lose its value to zero.

Gold is one of the most valuable metals. Therefore, the value of gold tends to increase during recessions. Because of these properties, gold is one of the most well-known commodity investments. For example, the following is the price movement of gold.

- SPDR Gold Trust (GLD)

However, since it is an investment in commodities, you will not receive dividends like stocks and bonds. In addition, since the gold price tends to fall during economic booms, many people invest in gold only for a temporary period, such as three or six months.

As you can see from the price movements of gold, it is difficult to increase your assets by investing in gold alone. It is impossible to significantly increase your assets by investing in gold for a long period of time.

Commodity Futures and Options Trading Are Not Recommended

Investing in commodities like gold may increase the value of your assets even in a recession. Also, by using commodity futures and options trading, you can increase your assets by both buying and selling.

However, unless you are a professional investor, it is not recommended for retail investors to trade in commodity futures and options. This is because derivatives trading is a very difficult investment method.

Even predicting the future price of stocks is difficult, and predicting the future price of corn or oil is much more difficult. For example, when the coronavirus pandemic occurred, the price of crude oil was temporarily negative.

In other words, we fell into an unusual situation where we had to pay money to sell crude oil. As a result, those who had bought crude oil through commodity futures trading or options trading lost a lot of money. Derivatives are more difficult to trade than investing in stocks.

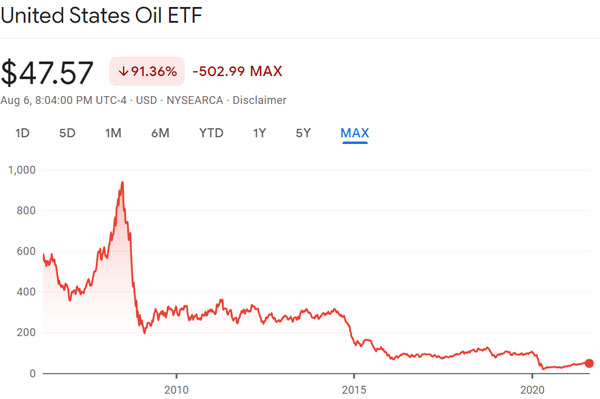

For your reference, the following is the trend of crude oil prices.

- United States Oil ETF (USO)

We can see that the price movements are different from those of stocks and bonds. However, prices continue to fall, and it is difficult to predict the future prices of commodities. This is the reason why I do not recommend derivatives trading for retail investors.

Also, the following is the price history linked to several grain prices, such as corn, soybeans, and sugar.

- Invesco DB Agriculture Fund (DBA)

There are periods when grain prices are rising, and there are periods when they are falling. Even when the economy is good, grain prices are falling, and we have to make a profit by predicting these price trends.

High-Risk, High-Return Hedge Funds Are Recommended

So, in any case, should individual investors not use derivative trading to invest in alternatives? If you have your assets managed by a professional, you can increase your assets significantly by using commodity futures and options trading in exceptional cases.

Having a professional investor increase your assets means, in essence, investing in a hedge fund.

Even retail investors can invest in hedge funds, although they need to use offshore tax havens where taxes are almost zero. A minimum of US$30,000 is required to open an offshore investment account, and you can invest in good hedge funds.

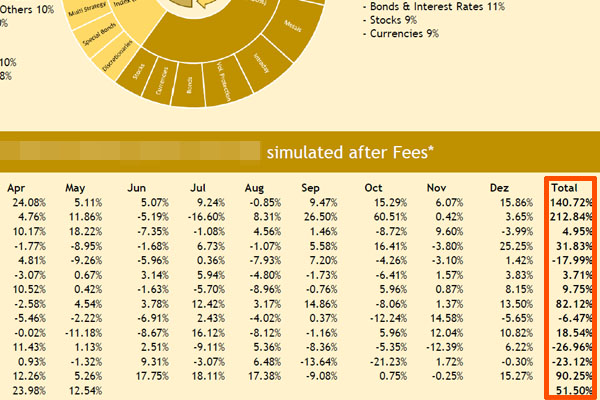

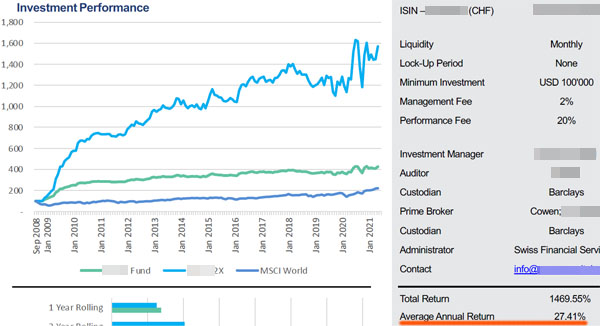

Hedge funds that trade in derivatives are classified as high-risk, high-return hedge funds. They invest not only in commodity futures but also in stocks, bonds, forex, and many others. For example, the following is a hedge fund with an average annual interest rate of 29.20%.

The returns vary greatly from year to year. If you invest in this hedge fund, you may see your assets triple in value in one year (212.84%), or you may see negative returns of about -25% for two consecutive years.

However, on average, investing in this hedge fund will increase your assets at a higher annual interest rate.

A Wide Range of Investments in Stocks, Bonds, and Commodities

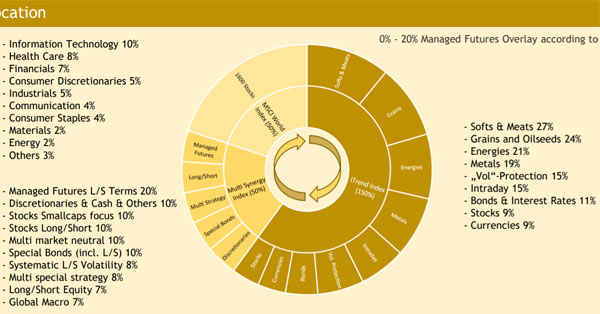

As explained earlier, high-risk, high-return hedge funds do not limit their investments to commodities. They invest in stocks, bonds, forex, and a variety of other investments.

For example, in the case of the hedge fund mentioned above, there are many investments, as shown below.

For commodities, they invest in metals, grains, and energy.

This hedge fund also uses a multi-strategy, which means that they increase their clients’ assets in various ways, including global macro strategies, long-short strategies, and managed futures strategies. Naturally, they trade in commodity futures and options.

While it is difficult for amateur retail investors to increase their assets through derivatives trading, they can increase their assets when investing in hedge funds.

Earning Higher Returns Through Long and Short Positions

As mentioned earlier, when investing in commodities, you can earn returns not only through long positions (buying) but also through short positions (selling). However, it is impossible for an amateur investor to make a profit through these methods.

Hedge funds, on the other hand, can make profits from derivatives trading by using both long and short positions. However, even professional investors can have negative returns from commodity futures trading and options trading.

For example, the following is a high-risk, high-return hedge fund that invests in stocks, bonds, forex, and commodities.

This hedge fund has an average annual interest rate of 27.41%. However, if you check the chart in the fact sheet, you will see that the returns have fluctuated greatly. Although there are some years with negative returns, the average annual interest rate is still high, and long-term investment allows us to grow our assets significantly.

When trading derivatives on your own, you have to make a profit through buying or selling by predicting the future price of precious metals or grains. Therefore, commodity futures and options trading are not recommended for retail investors.

Investing in hedge funds, on the other hand, allows you to increase your money by having professionals trade derivatives for you.

Also, when you invest in hedge funds, you can increase your assets even in a recession because they take short positions as well as long positions. Therefore, when considering alternative investments using derivatives trading, individual investors should not invest in commodities but rather in hedge funds.

Alternative Investments Through Commodity Futures Trading and Options Trading

Some investment methods are riskier than others. Derivative trading is known to be risky for amateur investors.

Commodity futures trading and options trading are included in derivatives trading and are known as alternative investments. However, it is not recommended for amateur investors to trade in commodity futures and options.

On the other hand, it is recommended to trade derivatives indirectly by using hedge funds. If you invest in a hedge fund, a professional will manage your assets by trading derivatives on your behalf.

If you want to use commodities as an alternative investment, there is a right way to invest. Instead of trading derivatives yourself, use hedge funds.