There are many elderly people who want to increase their money through asset management. However, they should not manage their assets in the same way as younger people because they must not make mistakes and lose a lot of money when managing their assets in their 60s and 70s. In other words, you have to choose low-risk investments.

When building a retirement pension, there are optimal portfolios. They are all low-risk investments, and by combining some methods, you can create a private pension.

So what kind of asset management should the elderly use? And what are some of the low-risk asset management options?

It is important to understand in advance the right way to manage assets to build an annuity for retirement. I will explain what kind of portfolio is best for the elderly.

Table of Contents

Stock Investment by the Elderly Is at Risk of Failure

If you are young, you should choose riskier investment methods. In other words, investing in stocks is an excellent way to invest.

On the other hand, it is not advisable for elderly people to invest in stocks. This is because stock investment has the potential to increase your assets significantly, but it also has the potential to reduce your assets by less than half. For example, below is the stock price trend of the S&P 500 (an index that invests in the top 500 companies in the US) when Lehman Brothers went bankrupt in 2008.

As you can see, the stock price has been reduced by less than half. Investing in stocks can yield an annual interest rate of 30% or more in some years. However, in times of recession, the value of your assets can be reduced to less than half. Also, if you invest in individual stocks instead of indexes, the stock price can drop by less than 10%.

While investing in stocks has the potential to increase your assets significantly, it also has the risk of a major failure. This is why you should not invest in stocks when you are in your 60s or 70s.

A Low-Risk Portfolio Is Superior in Asset Management

So, try to create a low-risk portfolio. In other words, instead of aiming for an annual interest rate of 15-20% like investing in stocks, manage your assets with a lower annual interest rate. In short, manage your assets at an annual interest rate of 4-10%.

With investment methods that allow for high yields, there is a risk of losing a lot of assets. On the other hand, investment methods with low annual interest rates do not increase your assets significantly, but there is less risk of failure. Conservative investments are excellent for the elderly because they must not make mistakes in their investments.

For asset management in your 60s or 70s, investing in stocks is not recommended at all, except for professional investors. You should make your portfolio something other than stocks.

Even if you estimate a low annual interest rate of 4%, your assets will increase 1.48 times in 10 years. Also, in 15 years, it will increase 1.8 times. Even with almost no risk of failure, this kind of asset management is possible.

Investment That Can Be Withdrawn Is Best

Also, when investing at an older age, it is advisable to invest in investments that allow withdrawals through partial surrender. If you invest when you are young, it is possible to invest for more than 20 to 30 years without spending any money. However, if elderly people want to invest to build their retirement fund, they should choose an investment method that allows them to gradually withdraw their money after a few years.

When it comes to investing in stocks, the timing of the withdrawal is difficult. This is because with stock investments, the value of the asset fluctuates greatly from year to year.

On the other hand, if the value of your assets hardly changes and you can earn dividends every year, it is easy to make a plan to spend your money in retirement. For example, it is possible to purchase investment products with an annual interest rate of 8% and manage the assets while gradually withdrawing them.

For example, if you have US$200,000 in savings and you invest it at 8% annual interest, you will have US$16,000 per year.

- $200,000 × 8% = $16,000

If you withdraw US$10,000 every year by partial surrender, your money will not decrease. Rather, your money will increase through compound interest. With asset management, you can increase your money while receiving money through partial cancellation.

Types of Investment Methods That Are Excellent for Seniors to Build a Pension

What are the best types of investment methods for the elderly to start investing in order to build a private pension? There are three main types of investment methods that are excellent for people in their 60s and 70s.

- Bond ETFs in the US

- Offshore life insurance

- Low-risk hedge funds

Include these in your portfolio. Although they are all low-risk investments, it is better to diversify your investments rather than focusing on just one.

Invest in US Bond ETFs and Earn Dividends

One of the most common low-risk investment methods is bonds. Particularly important are bond ETFs, and you can grow your money by investing in bond ETFs listed in the US.

A mutual fund that combines many bonds is a bond ETF. Among the bond ETFs, HYG is known for its high yield.

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

HYG’s annual dividend yield is about 5%. If you add the increase in the bond price to this, the annual interest rate is about 6%. Compared to investing in stocks, the bond price increase is less, but the price decrease is also less. Below is a chart comparing the prices of the S&P 500 and HYG.

You can see that compared to the S&P 500 (yellow line), the HYG (blue line) has hardly changed in price.

Also, this chart does not take dividends into account. Therefore, adding dividends can increase your assets with compound interest. HYG is a high-yield bond ETF that many people use when they want to earn dividend income.

Use Offshore Life Insurance That Offers Private Annuities

Although bond ETFs are excellent investments, you have to diversify your investments by adding other investments. One important investment option for the elderly is offshore life insurance.

Offshore life insurance is life insurance sold in offshore tax havens where there are almost no taxes. There are some insurance products that offer private annuities as offshore insurance.

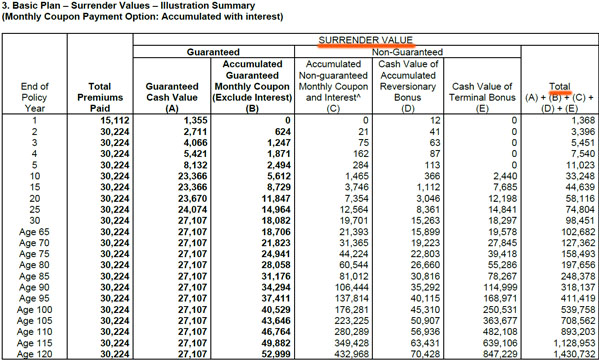

For example, the following is an insurance product sold in Hong Kong that specializes in private annuities.

Since this life insurance is designed to create a private annuity, the money will be transferred to you every year. While receiving money as a private pension, you can increase your money through asset management. In addition, if you surrender your policy, you can receive a high surrender value.

Offshore life insurance is known to provide an annual interest rate of about 4%. Although the annual interest rate is lower than the HYG I mentioned earlier, it is an investment product that almost certainly promises to increase your money by protecting your principal.

If you sign up before the age of 80, you can buy this offshore life insurance policy; even if you are in your 60s or 70s, you can create a private annuity using offshore life insurance.

Increase Your Money by Investing in Low-Risk Hedge Funds

On the other hand, you can also make low-risk investments. With low-risk hedge funds, an annual interest rate of about 10% is possible.

Hedge funds, which trade with leverage against stocks, bonds, commodity futures, etc., are high-risk and high-return. On the other hand, there are hedge funds that do not invest in stocks, such as bridge loans, mortgages, and microfinance. When using hedge funds that do not invest in stocks, it is possible to manage assets with low risk.

For example, below is a fact sheet on a hedge fund that offers bridge loans in Europe.

The annual interest rate of this fund is 8-10%, and it has never had a negative return year in the past. In addition, if you check the past performance, you will see that even in the month when the stock market crashed, the return was positive. Although it is impossible to earn more than 20% per year, it is an excellent investment if you want to manage your assets at about 10% per year.

The most recommended method of low-risk investment is investing in hedge funds. Investing in hedge funds requires you to use financial institutions in tax havens. Also, you need to invest a lump sum of money of at least US$30,000.

The disadvantage of investing in hedge funds is that you have to invest a large amount of money in a lump sum. However, if you have enough money, the most recommended way to manage your assets in retirement is to use low-risk hedge funds.

There are many types of low-risk hedge funds. So, it is a good idea to diversify your investments into several hedge funds to create an excellent portfolio.

Low-Risk Investments Are Recommended for the Elderly

When thinking about building a private pension for retirement, there are some investment methods that are the best for the elderly; for those in their 60s and 70s, they should choose investment methods with as little risk as possible. For this reason, try to avoid investing in stocks.

Instead, invest in bonds, offshore life insurance, and low-risk hedge funds. Also, since there are many types of hedge funds, you can diversify your investments by investing in several hedge funds.

Investment by the elderly requires low risk in the portfolio. After investing, you will withdraw your money by partial surrender while managing your assets. Therefore, an investment method that does not fail is superior. In other words, although your assets will not increase significantly, you should choose an investment method that will not fail.

High-risk portfolios are not suitable for the elderly. It is important to understand that low-risk investments are the best way to manage your assets in retirement.