When increasing the money by investing in stocks, many retail investors hope to increase their money significantly by using mutual funds in emerging countries. Few people buy individual stocks of emerging countries, and they usually use index investment.

However, even with index investing, it is not recommended to invest in emerging market stocks except for professional investors. The reason is that they offer high risk and low returns. In other words, even if you take advantage of long-term investment, there is no increase in the price of stocks, and the risk of losing money is high.

People who understand stock investment think that investing in emerging market stocks is not worth. The reason for this is that it is difficult to make a profit from emerging market stocks.

If you check the past charts, you will be able to understand why you should not invest in emerging market stocks. So, I will explain with examples why index investments in emerging market stocks tend to offer lower yields.

Table of Contents

Emerging Economies Have High Economic Growth Rates But Low Stock Prices

As an amateur investor, you may think that emerging countries have high economic growth rates and growing populations, and therefore you can increase your assets by using mutual funds in emerging countries.

However, this idea is wrong. Even if you invest in an index of emerging countries, you will lose money at a high probability. In other words, emerging market stocks have high risk and low returns. It is true that the economic growth rate is high, and the population is increasing in emerging countries. However, their stock prices are not rising.

Emerging countries are countries that, for some reason, did not become developed countries. As a result, they have major political and economic problems.

China, for example, is easy to understand. China has a large GDP, many huge companies, and a higher economic growth rate than developed countries. Many amateur investors think that stock prices will rise significantly because of this situation. However, the average income of the Chinese citizens is low, and the political risk is high. In fact, the Chinese Communist Party is free to destroy domestic companies.

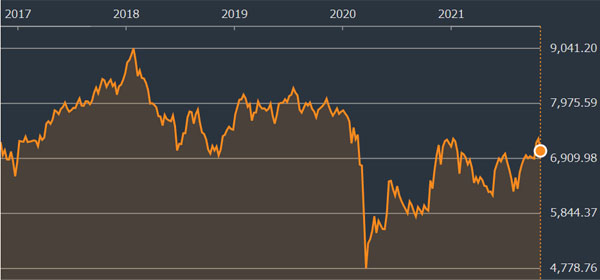

As a result, Chinese stocks have not risen in value. Below is a historical chart of the Shanghai Composite Index (SSE Composite Index).

As you can see, instead of going up in price, the stock price has gone down significantly. We can see that investing in Chinese stocks is a high-risk, low-return investment.

Check the Charts of Emerging Market Stocks and Find Out Why You Don’t Need Them

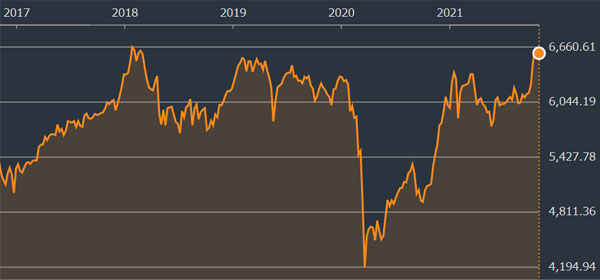

Chinese stocks aren’t the only ones that are unsuitable for stock investing. In most emerging countries, stock prices have not been rising. So, let’s check the stock price charts of some emerging countries for the past five years.

-Mexico (IPC Mexico)

-Philippines (PSEi Index)

-Indonesia (Jakarta Composite Index)

-Nigeria (NGSEINDX)

All countries have large populations and high economic growth rates. However, their stock prices are not increasing. This is why you don’t need to invest in emerging countries because their stock prices are not increasing.

The reason why you can make money by investing in stocks is that the stock prices increase. Although it is obvious, many amateur investors do not pay attention to past stock price charts. Therefore, they focus only on the economic growth rate and population growth rate to decide which country to invest in. As a result, they fail in their asset management.

Investing in Emerging Markets Provides Inferior Returns Compared to US Stocks

When investing in stocks, it is common sense to invest in US stocks. Even if you do not invest in US stocks, you should invest in stocks of developed countries.

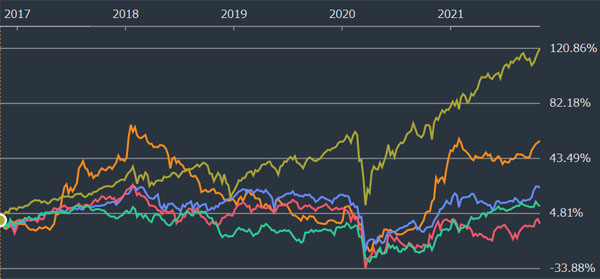

Although the US is a developed country, its population continues to grow, and its economy is strong. Therefore, its stock prices are known to be rising over the long term. As a reference, the following are the results of investing in the indexes for the past five years.

- Yellow line: America (S&P 500)

- Orange line: Nigeria (NGSEINDX)

- Blue line: Indonesia (Jakarta Composite Index)

- Green line: Mexico (IPC Mexico)

- Red line: Philippines (PSEi Index)

Compared to investing in the US, the yields are far worse when investing in emerging markets.

Naturally, you have to invest to increase your assets. You should not invest in countries that have a high probability of low yields or negative returns. In other words, you do not need emerging countries in your portfolio.

Even If the Economy Grows, Stock Prices Will Not Rise If the Company Does Not Generate Profits

Why do stock prices not rise despite high economic growth rates? The reason is that even if the GDP rises, it does not necessarily mean that domestic companies will be profitable.

In developed countries, including the US, the market capitalization of technology companies is high. Technology companies have high-profit margins, and as their sales increase, their profits also increase. If profits increase, the stock price will naturally rise.

Investing in US stocks can increase your assets because most of the top companies in the US are technology companies, which can increase sales and profits.

On the other hand, emerging countries have few good technology companies. This means that even if the GDP increases, foreign technology companies will make money, but domestic companies will not be able to increase their profits.

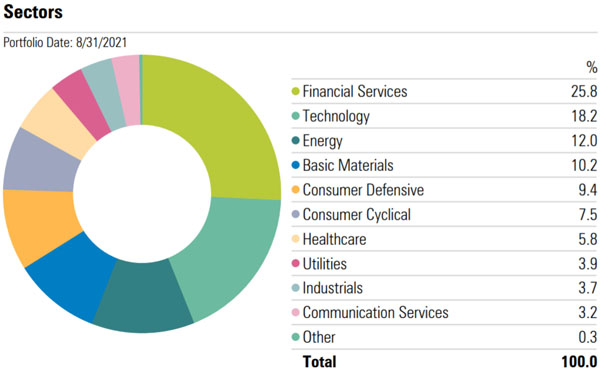

In fact, in most emerging countries, banks are the top companies. The industry with the largest market capitalization is finance, not technology companies. Naturally, banks’ profits do not increase rapidly, and even if economic growth rates are high, stock prices are unlikely to increase.

High Expense Ratio and Poor Return on Investment

There is another disadvantage to investing in emerging markets. It is the high expense ratio. When you invest in emerging markets through a mutual fund, you have to pay an annual fee. This annual fee is higher than that of investing in developed countries.

Many investors know that if you invest in US stocks such as the S&P 500 or the Nasdaq 100, you have a high probability of making a lot of money. Since many investors invest in the S&P 500 and Nasdaq 100, the expense ratio is low. For example, the expense ratio when investing in the S&P 500 (VOO) is about 0.03%.

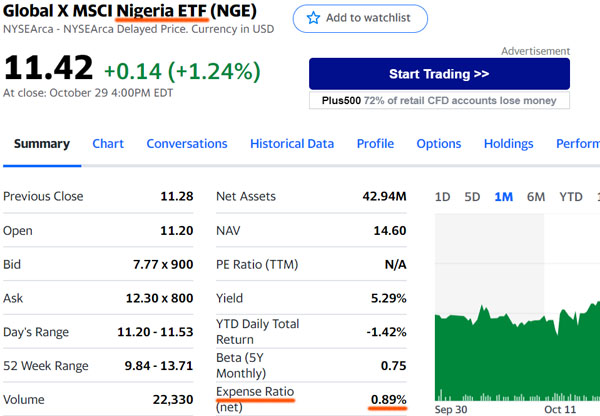

On the other hand, if you want to invest in Nigeria, for example, the expense ratio of the ETF is 0.89%.

When investing in emerging countries, the expense ratio is high, even though the yield is lower and the risk is higher than that of US stocks. Therefore, you should not invest for the long term.

If You Want to Invest in an Emerging Country, You Should Choose India

However, there may be people who still want to invest in emerging countries with high economic growth rates. In this case, you should invest in India. If you want to invest outside of the US, India is the only emerging country that I recommend.

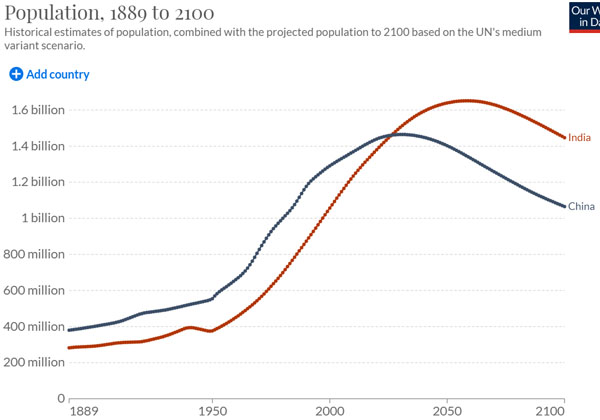

India has a large population and a large GDP. Many people predict that India will become a strong country in the future, just as China once developed rapidly due to its huge population. And unlike China, India’s population will continue to grow.

The economic situation in China and India is similar in terms of large population and GDP. However, India is a democratic country and has less political risk like China.

Also, China imposed fines and restrictions on domestic giant companies in 2021 without any reason. The targets are wide and include IT, education, real estate, gaming, and entertainment. As a result, many large companies have gone bankrupt, and their stock prices have plummeted. Investors also realized that investing in China is risky and started to invest in India instead of China.

Before 2021, like other emerging economies, Indian stocks were not attractive. However, since 2021, the self-destruction by the Chinese government has focused attention on Indian stocks, and Indian stocks have been rising. In fact, the yield on Indian stocks in 2021 is excellent.

If you want to invest in emerging markets, be sure to use an Indian equity index. Investing in emerging countries other than India is risky and not recommended.

The Optimal Investment Ratio Is at Most 10%

However, when investing, always focus on US stocks. If you want to invest in Indian stocks, the optimal percentage is 5-10%. The percentage invested in India should not exceed 10%.

While Indian stocks have the potential to provide excellent yields, they are emerging market stocks and therefore, as with any emerging market stock, they are risky.

If you invest in US stocks, you have a high probability of increasing your wealth. On the other hand, Indian stocks have the potential to perform better than US stocks, but there is also the risk that the stock price will be inferior.

For example, one of the most well-known ETFs (mutual funds) that can invest in Indian stocks is INDA. If you buy INDA, you will be investing in the following sectors.

As you can see, the financial industry is the main industry. The market capitalization of technology companies is not high, and as India develops, we can expect the percentage of technology companies will grow.

Since the market capitalization of technology companies is not as large as in developed countries, it is risky for Indian stocks to account for a large percentage of your portfolio. Therefore, when investing in emerging markets, it is best to limit your portfolio to 10% or less.

In addition, when investing in emerging markets, it is advisable to invest for the long term. In order for the stock prices of emerging countries to rise, domestic technology companies need to develop. So, invest for the long term and wait for the technology companies in India to grow.

No Need for High-Risk, Low-Yield Stocks in Your Portfolio

Most investors who think about investing in emerging markets are amateur individuals. The reason for this is that no one who understands how to invest in stocks actively invests in emerging countries. High-risk, low-return emerging market stocks are not necessary in a portfolio.

Most emerging market stocks have poor yields. Also, when you use mutual funds (ETFs), the expense ratio is high. If you check the historical charts, you will understand why you do not need emerging market stocks in your portfolio.

The only exception is India. When you invest in Indian stocks, you may get a higher return than investing in the US index (S&P 500). However, Indian stocks are also risky, so you should limit your investment to less than 5-10%.

When investing, you need to invest in stocks that have a high probability of making money. Therefore, it is important to understand that you do not need to invest in emerging market stocks.