There is an overwhelming advantage to increasing your money by investing in an offshore fund. The amount of money you can increase through asset management is much more effective when investing offshore than when investing in your country.

However, of course, there are advantages and disadvantages as well. Therefore, when you start investing in offshore investments, such as offshore insurance and mutual funds, you need to understand what risks are involved before you start.

As this is an offshore investment, you will invest in US dollars. Therefore, if you are not an American, the most obvious thing to keep in mind is currency risk. But of course, there are other things to be aware of, and if you don’t understand these, you will fail.

So, I will neutrally describe what you need to consider when investing in offshore, including the advantages and disadvantages.

Table of Contents

Offshore Investments Have the Advantage of Low Tax Rates and Easy Asset Growth

With offshore investments, you will be managing assets in tax havens (areas where there is little or no taxation). Especially in tax havens, there is no tax on the money you make from asset management.

Therefore, your money grows much faster than if you were to invest your assets in your home country.

Generally, if you make a profit on stocks and mutual funds, you will be subject to capital gains tax. However, in offshore areas, there is no capital gains tax (a tax imposed on money made from trading stocks and other securities), so you will receive all of your profits when they are made.

If you are going to invest your assets, it is far more profitable to invest them in a tax-free area. Even if you manage your assets in exactly the same way and achieve the same results, the final profit will be larger just by investing in an offshore area.

Tax Haven Investments Have a Hefty Bonus System

Due to the fact that there is no tax on asset management, there are some great bonus systems for regular investment in tax havens that are unthinkable in your home country.

For example, the principal is protected, and the annual yield is 4%. Even if there is a bonus promotion in your home country, it’s only about $50 USD cashback on opening an account, for example.

With offshore investments, you can receive benefits that you can only get from an overseas mutual fund. For example, below is the financial product, offered by one of the most contracted offshore insurance companies.

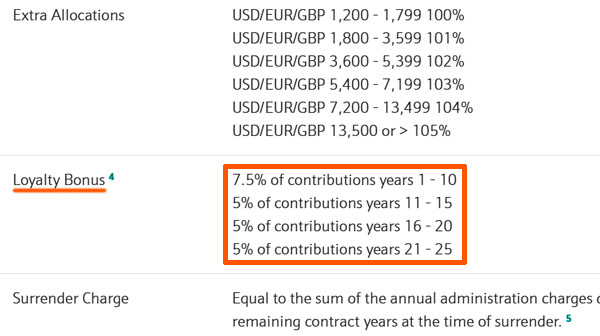

This is what is posted on the official website. Loyalty bonuses are awarded for continuing to save for years.

The bonus money is 7.5% or 5% of the contributions you have accumulated up to that point, so it promises to be highly rewarding. Not only do you get more money through asset management, but you also get these bonus programs.

The other option is to pay for 20 years in accumulation, which will return more than 160% of your principal. In short, your assets will certainly return more than 160%.

*It is important to note that there are conditions for campaigns and principal protection, such as no withdrawals or reductions in the middle of the policy.

The details of the campaign vary depending on the insurance company and financial product. However, when such special campaigns are available, you can increase your assets efficiently by actively utilizing them.

Compound Interest Management Increases Assets at an Accelerated Rate

In addition, your money will increase with compound interest in offshore investments. Compound interest means that interest is added to the amount of money you have increased by investing. When you invest with compound interest, your assets will grow at an accelerated rate.

In many cases, despite the fact that fixed deposits have a simple interest rate, debts are compounded. For example, assuming you invest $10,000 USD at an interest rate of 10%, simple and compound interest will look like this.

-In the Case of Simple Interest

| Year 1 | Year 3 | Year 10 | Year 20 |

| $11,000 | $13,000 | $20,000 | $30,000 |

With simple interest, only the original $10,000 USD is subject to the 10% interest rate.

With compound interest, on the other hand, the interest rate of 10% is calculated on the amount increased by the interest. The more years that pass, the larger the amount that will increase with interest.

-In the Case of Compound Interest

| Year 1 | Year 3 | Year 10 | Year 20 |

| $11,000 | $13,310 | $25,937 | $67,275 |

The same interest rate of 10% can make a big difference between simple and compound interest. Albert Einstein also said that the greatest invention of the 20th century is compound interest. Even Einstein, who discovered the theory of relativity, recognizes the greatness of compound interest.

If you compound interest, your assets will grow at an accelerated rate as the years go by. This is another advantage of offshore investing. Now, let’s compare the difference between investing in developed countries and offshore investments when accumulating $100 USD per month.

-In Developed Countries

If you save $100 USD each month from age 25 to age 65, you will save $48,000. In this case, the interest rate is almost zero, so the amount remains almost $48,000.

-In the Case of Offshore Investment

On the other hand, for offshore investment, if you accumulate $100 USD per month, and invest it at an interest rate of 10%, it will amount to about $638,000 USD between the ages of 25 and 65. In other words, there is a difference of more than 10 times. With such a difference, it is a loss to keep your money in your home country.

By the way, this example is not special, as offshore investments aim for over 10% in annual interest rates.

The Disadvantages of Offshore Investment Are the Exchange Rate Risk

We have discussed the advantages of offshore investment. Although offshore investment is attractive in terms of increasing your money, there are some disadvantages. One of the most obvious disadvantages is the currency risk.

Offshore investments are made in tax havens, so your money will be in US dollars. Therefore, when you eventually convert it to your country’s money, you are subject to currency exchange risk. If you’re an American, it doesn’t matter, but if you’re a citizen of any other nationality, you will be subject to currency exchange risk.

*In many cases, offshore investments can be made in Euros or British Pounds, and so on.

However, when you think about the speed at which your money grows, offshore investments are far superior, and even if there is a big exchange loss when you sell, you will still benefit in total.

As mentioned earlier, even if you save US$100 per month, if the interest rate is low, you will only have US$48,000 at the age of 25 to 65. If you invest offshore and the annual interest rate is 10%, it becomes US$67,275. There is some currency risk for some people, but since you will have more money than that, there is almost no currency risk.

Alternatively, you can continue to hold in U.S. dollars. Since the purpose is to manage your assets, there is nothing wrong with continuing to hold in U.S. dollars. That way, you won’t incur any currency risk.

In Some Cases, the Company You Are Investing in Is Not Well-Known

Offshore investments are made in tax haven financial institutions. In this regard, they are all large financial institutions, and you invest in such insurance companies (funds).

In some cases, however, you may use an investment company that you are not familiar with.

One of the most famous financial institutions in the offshore area is HSBC Bank, which has more than $2.5 trillion dollars in assets and is famous worldwide. However, in most cases, HSBC Bank is not used for offshore investment, and other financial institutions are used.

Even so, there is no question of safety.

When you want to find out whether these foreign companies are safe or not, check their ratings. Ratings can be found at the following companies that rate financial institutions around the world.

- Standard and Poor’s (S&P)

- Moody’s

The names of these rating agencies are very well known, and you’ve heard of them.

Most of the financial institutions that offer offshore investments are AA-rated companies. For reference, HSBC Bank, which I mentioned earlier, is rated AA by Standard and Poor’s (S&P), and just like HSBC Bank, you put your money in a reliable investment company.

The Possibility of Fraud Is the Biggest Risk of Failure

If you understand what I have explained so far, you will understand that the disadvantages that are considered in offshore investment are not actually major disadvantages.

However, it is often the case that people fail in offshore investment because they are caught in a scam due to a bad introducer.

For example, as mentioned above, there are financial products in offshore investments that will certainly return more than 160% of your money by investing in a 20-year. However, there is a condition that you have to continue to invest the initial amount of money that you have decided to invest without reducing or withdrawing during the process.

There are some introducers who make you sign an expensive contract without informing you of these conditions. This, of course, increases the risk of losing money. In order to avoid this risk, you need to make sure that the person who introduces you to the product is trustworthy, and explains to you the points to keep in mind.

When you invest abroad, your money will increase greatly, but it is very important to consider who you buy your financial products from.

Payment of Taxes to the Home Country Is Required

Furthermore, many people misunderstand that eventually you will have to pay taxes. In other words, you need to pay taxes (income tax or capital gains tax) to your home country when the profit is fixed from the investment.

The tax system varies from country to country. However, in many countries, you will be required to pay taxes on the money you earn abroad in your country of residence. For example, if you are American, you will have to pay taxes in your home country even if you make money from your offshore investments.

The tax system is different depending on your nationality and where you live, so it is best to check the tax system yourself.

-Offshore Investment Is Beneficial Even If You Pay Taxes

Some people may wonder if there is any point in investing in offshore, even though you have to pay taxes.

However, even if you invest in your country, you will hardly make any money. For example, I am Japanese, so I will talk about the case of Japan. If you buy life insurance in Japan, it will only increase 110-120% over 40 years.

On the other hand, with offshore insurance and mutual funds, you can invest freely in stocks and bonds, and there are financial products with annual interest rates of over 10%. Therefore, it is natural for your assets to increase 2-3 times or more, and there are even financial products that can increase your assets by over 10 times.

The speed at which your money grows is very fast. Even if you have to pay taxes, increasing your money in tax havens is overwhelmingly advantageous.

Tax havens are tax-free, so your assets will grow faster. However, if you want to return the money back to your home country for your increased assets, you will be taxed then. The big advantage is that your assets will grow faster, but the disadvantage is that you will have to pay taxes according to your home country’s tax system.

-If You Change Your Place of Residence, You Won’t Have to Pay Taxes

For your information, there are cases in which changing your country of residence will eliminate your tax obligation. For example, I am Japanese, and if I live in Japan, I am liable to pay taxes in Japan. However, I do not live in Japan. I live in Malaysia, and Malaysia has a tax haven system.

So even if I increase my assets through offshore investments, I don’t have to pay taxes in Japan. In Malaysia, there is no capital gains tax, and I won’t have to pay any taxes. There are some ways to avoid this kind of taxation.

Understanding the Risks and Taxation of Offshore Investments

We have discussed the advantages and disadvantages of offshore investment here. Offshore investment is a way to manage assets with high yields in a tax-free area.

In many countries, there are all kinds of restrictions by law. It’s hard to invest and grow your assets, and there is a capital gains tax. On the other hand, in the offshore area, there are no financial restrictions. This means that you can invest freely, and your money will grow at a high rate of return.

However, there are both advantages and disadvantages to investing in an offshore fund. Among them, you don’t have to worry about the foreign exchange risk and the low name recognition of financial institutions.

However, you need to be careful about the person who introduces you to the financial products of offshore investment. It is very important to make sure that the introducer is trustworthy. Although asset management using offshore accounts is excellent, it is a good idea to understand the cautions before investing.