Sun Life is one of the largest life insurance companies in the world. Sun Life’s offshore life insurance products are available to non-resident aliens, and they offer excellent investment opportunities.

Among the insurance products offered by Sun Life, the main product is Life Brilliance. It is a savings-type life insurance policy that allows you to accumulate and invest your money, resulting in a large increase in assets.

So what are the details of Life Brilliance? If you do not understand the contents of the insurance, you will not know how to use offshore life insurance.

I will explain the details of Sun Life’s Life Brilliance.

Table of Contents

Life Brilliance Is Savings Life Insurance

Sun Life is one of the most famous life insurance companies in the world. It is multiple times larger than the top life insurance companies in developed countries like Japan and Germany, and is a highly reliable global company.

One of the insurance products offered by Sun Life is Life Brilliance. I have also purchased Life Brilliance, and below is the actual insurance policy.

There are two types of life insurance: savings and non-refundable. In the case of offshore insurance, you can purchase a non-refundable policy, but a savings-type policy will increase your money many times over for the amount you paid. It is common knowledge that with offshore life insurance, your assets will increase significantly.

Sun Life has branches in many countries, one of which is Hong Kong. Normally, you have to be a resident of the country to be able to purchase a life insurance policy. However, in the case of Hong Kong, even if you do not live in Hong Kong, Sun Life will accept your insurance policy. Therefore, it is common to purchase offshore insurance from Sun Life Hong Kong.

For example, for Sun Life in the US or the Philippines, you need to be a local resident to purchase an insurance policy. On the other hand, with Sun Life in Hong Kong, even non-resident foreigners can purchase insurance if they travel to the area.

Your Assets Will Double in 20 Years and Quadruple in 30 Years

How much exactly will your money grow? Hong Kong is an offshore tax haven with almost no taxes, and the insurance coverage is superior to life insurance in other countries. In other words, it is easy to increase your money through asset management.

It is invested in US dollars; it can roughly double your assets in 20 years and quadruple them in 30 years. If you are older or a smoker, the speed of asset growth will be slower. In any case, consider that your assets will increase.

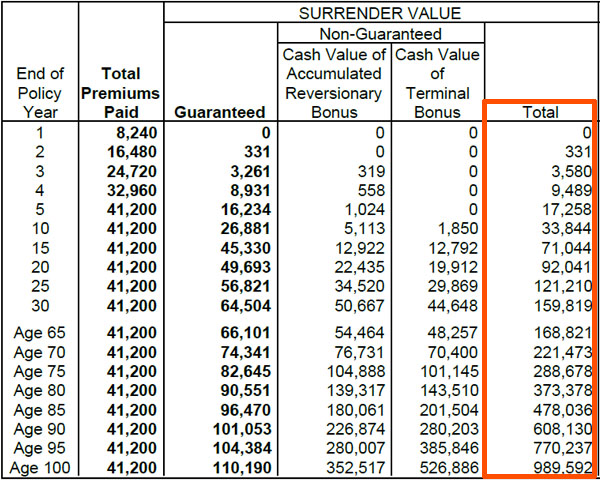

For your reference, the following is the insurance policy when I was 34 years old, a non-smoker, and paid a lump sum of US$41,200.

Checking the “Total,” you can see that my money will increase to $92,041 in 20 years and $159,819 in 30 years. In other words, my assets will increase about double in 20 years and about quadruple in 30 years.

For your reference, Sun Life’s Life Brilliance has an annual interest rate of about 4%. If the annual interest rate is 4%, it will double in 20 years and quadruple in 30 years.

-The Minimum Insurance Payment is US$15,000

In my case, I paid a lump sum of US$41,200, but a lower payment is available.

Specifically, Life Brilliance has a minimum insurance payment of US$15,000. If you can pay this amount of money, you can buy Life Brilliance. Note that if you pay in installments, the minimum payment is $3,000 per year for five years.

The age of the insured can range from 0 to 65 years old.

It Is a Whole Life Insurance Policy, and Your Family Will Definitely Receive a Death Benefit

What is important is that it is a life insurance policy. It has a death benefit, and if you die from illness or accident, your family will be paid a high death benefit.

Life Brilliance is classified as a whole life insurance policy. Whole life insurance refers to life insurance policies that provide you with coverage for a lifetime. Since people are bound to die someday, whole life insurance gives your family a 100% chance of getting a death benefit.

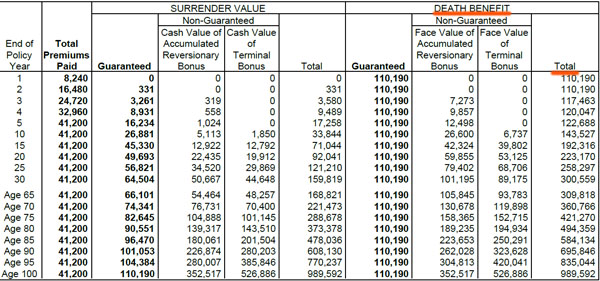

For the insurance policy I have purchased, there is also a death benefit. The amount of the death benefit is as follows.

You can see that just like the surrender value, the amount of the death benefit increases as the years go by. It is as follows.

| Years of Participation | Surrender Value | Death Benefit |

| 20 years | $92,041 | $223,170 |

| 30 years | $159,819 | $300,559 |

Since the death benefit increases with the passage of years, my family will receive more death benefits if I die after I have lived longer. Also, if my family receives the money as a death benefit, it will have a higher investment yield instead of 4% annual interest.

-In My Case, I Used It to Give My Wife the Death Benefit

For your reference, in my case, I am using offshore life insurance, not for my own asset management purposes, but leaving money to my family.

If I were to have an accident and die, my family would have a hard time making a living. However, since I have life insurance, my family will receive a high death benefit. The beneficiary of the death benefit is my wife, and I can leave enough money for my children to attend college.

On the other hand, if I die at the age of 80, my death benefit will be $494,359. With this amount of money, my wife will not have to worry about her retirement.

-The Money Can Be Received in Any Country and Any Currency

My wife will receive the money in the end, and even though it is invested in US dollars, she can receive it in any other currency. Of course, she can receive the money at any bank in the world.

When you invest in a tax haven, the insurance company will send the money to all the banks in the world. You don’t need to own a US dollar account, and you don’t need to worry about receiving your money.

You Can Insure Your Children and Use It as a Gift for the Future

Alternatively, you can buy life insurance for your children instead of buying life insurance for yourself. In other words, you can make the insured person your child.

In my case, I also have life insurance for my children. The following was a picture of my child when she was two years old; at this time, I purchased life insurance for her.

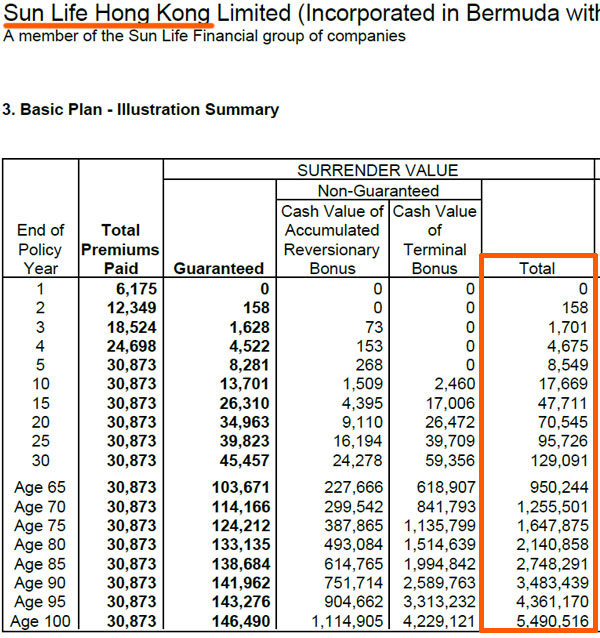

I paid a lump sum of $30,873. Thirty years later, when my daughter turns 32, the money will grow to $129,091.

So I am thinking of giving my daughter a life insurance policy as a gift when she turns 30; she can cancel the policy at 30 and receive the money, or she continues to grow the money without canceling it. It is up to my daughter’s choice, and in any case, I am able to give her a high-value asset as a gift.

The Younger the Age, the Greater the Effect of Compound Interest Management

Naturally, the younger you are, the more advantageous asset management is. This is because money increases through compound interest. This is also the case with life insurance; the younger you are, the more your money will increase through asset management.

For your reference, the following are the details of the insurance policy I signed under my daughter’s name.

As mentioned earlier, the total premium paid is $30,873. However, you can see that the surrender value of the policy when my daughter turns 70 years old is $1,255,501.

In other words, my daughter is guaranteed to build up more than $1 million in assets if she continues to hold on to her insurance policy without surrendering it.

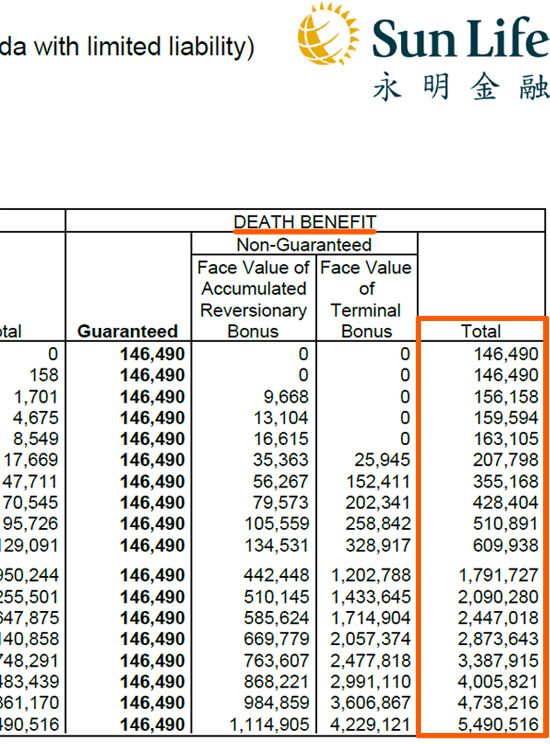

Also, as mentioned above, Life Brilliance is a whole life insurance policy. In the event of my daughter’s death, the death benefit will be paid out so that my family (probably my grandchildren) will receive a large sum of money. The death benefit is as follows.

- Age 65: $1,791,727

- Age 75: $2,447,018

- Age 85: $3,387,915

- Age 95: $4,738,216

- Age 100: $5,490,516

Even if the money paid is only $30,873, it can turn into such a large sum of money. This is possible with offshore life insurance.

The Most Recommended Payment Method is Lump-Sum or 5-Year Payment

You can choose to pay monthly, half-yearly, or yearly at Sun Life. You can also choose the payment period as follows.

- Lump-sum payment (payment in advance)

- 5-year payment

- 10-year payment

- 15-year payment

- 20-year payment

However, for offshore investments, if you are planning to invest for 15 or 20 years, it is better to use a financial product that allows you to aim for an annual interest rate of over 10%. Also, even if you use the least risky investment product with the principal protection, the annual interest rate will be 7-9% for 15 or 20 years of asset management.

As mentioned earlier, life insurance is a less efficient investment than other offshore investments, with an annual interest rate of 4%. Therefore, if you want to pay every month for a long period of time, there is no point in using Life Brilliance. Instead, make payments in a short period of time, such as a lump sum or five years, so that your assets will be invested without any subsequent premium payments.

With life insurance, paying a large amount at the beginning is excellent because it ensures that your assets will grow without any additional cost. In addition, it also adds a death benefit.

-You Can Pay by Credit Cards in Addition to International Money Transfer

By the way, not only can you send money to Sun Life Hong Kong by overseas remittance, but you can also pay by credit card; Visa and MasterCard are recommended because they allow you to send money without any credit card fees.

In my case, I sent money to Sun Life by credit card. Unless you have a specific reason, it is better to pay the premium by credit card.

The Biggest Disadvantage of Life Brilliance Is the Loss of Principal on Early Surrender

Although Life Brilliance has many advantages, it also has some disadvantages. The biggest disadvantage is the loss of principal due to early surrender.

As for the foreign exchange risk, there is no such risk because your assets will increase many times. Also, Sun Life is a super huge life insurance company, much bigger than your country’s insurance companies, so there is almost no bankruptcy risk. However, there is a risk of early cancellation.

Not only Sun Life, but all life insurance companies, including those in your country, have the same risk of losing principal if you cancel early. In the case of Life Brilliance, as you can see from the table above, the surrender value will not be greater than the total amount paid until 12 to 13 years have passed.

Of course, in the case of the death benefit, the payout from the insurance company will be many times larger than the total amount you paid. However, as for the money returned by surrender, the asset will not increase until a certain number of years have passed, such as 20 years.

Earlier, I explained that Life Brilliance is excellent for short-term payments such as lump-sum payments or five-year payments. The reason for this includes avoiding the risk of short-term cancellation due to difficulty in payment in the middle of the term.

Using Life Brilliance to Ensure Asset Growth

One of the most risk-free and reliable ways to increase your assets among offshore investments is through life insurance. You can purchase offshore insurance by taking advantage of offshore tax havens such as Hong Kong, where there are almost no taxes and which accept even non-resident aliens.

Sun Life is one of the most frequently used offshore life insurance companies. In Sun Life, many people use Life Brilliance, which allows them to increase their assets many times over and also add a death benefit.

Moreover, in general, offshore investments are made for a long period of time, such as 15, 20, or 25 years. On the other hand, with offshore life insurance, you can invest in a lump sum or pay for 5 years. Therefore, you can avoid the risk of not being able to pay your money in the middle of the term.

The annual interest rate on the surrender value of offshore life insurance is about 4%. Although the annual interest rate is lower than other offshore investments, life insurance is superior if you want to manage your assets without risk. If you want to use such a savings type of offshore life insurance, you can use Sun Life’s Life Brilliance.