When investing, many people want to increase their assets as quickly as possible. Many of those people focus on leveraged ETFs. By leveraging, they can increase their assets efficiently.

A particularly famous mutual fund (ETF) is the leveraged Nasdaq. The Nasdaq is an index known for its excellent yield. So the idea is to leverage the Nasdaq and increase your assets quickly.

There is nothing wrong with using leveraged NASDAQ for short-term investments. However, leveraged investments should not be used for long-term investments such as savings investments. This is because most of your assets will disappear in a major recession.

There is a right way to invest using leveraged Nasdaq. I will explain how to use leveraged Nasdaq, including examples of past stock price simulations.

Table of Contents

TQQQ, a Popular Leveraged NASDAQ

When investing in US stocks, one of the most famous indexes is the S&P 500. The S&P 500 is an index that invests in the top 500 US companies.

The Nasdaq is known for its higher annual returns than the S&P 500. Most technology companies are listed on Nasdaq. The Nasdaq 100 (QQQ) is also known as a mutual fund that invests in the top 100 companies listed on Nasdaq.

Leveraged Nasdaq invests in the Nasdaq 100 (QQQ) by applying leverage to it. The following is a well-known leveraged NASDAQ.

- ProShares UltraPro QQQ (TQQQ)

By using TQQQ, the price movement is three times that of the Nasdaq 100. For example, a 1% price increase in the Nasdaq 100 (QQQ) will result in a 3% price increase in the TQQQ.

Leveraged Investments Are Good for Short-Term Investments

Leveraged Nasdaq is an excellent choice for short-term investments. Compared to the S&P 500, the Nasdaq 100 is more volatile. However, Nasdaq contains a lot of the top US companies and is known to increase its share price at a high annual rate. In other words, the stock price will increase in the long run.

So, when the Nasdaq 100 stock price declines temporarily, invest in TQQQ instead of QQQ. This way, you can get a return of about 30-40% just by returning to the original price. For example, the following.

As you can see, the asset value has increased by 44.27% in about two months.

Even with a superior annual interest rate index, stock prices do not always continue to rise. Even when the economy is booming, stock prices always fall by 5-10% several times a year.

So, we invest in TQQQ when the stock price is temporarily falling. This will allow you to earn a large return when the stock price returns to its original level in a month or two.

If you invest in QQQ, the return you can get is about 13-15% per year. If you invest in TQQQ, you can get a return of 30-45% in a month or two, which is a huge return.

TQQQ Is Not Suitable for Long-Term Regular Investment

When investing in leveraged Nasdaq, be sure to use it for short-term investments. As I explained earlier, TQQQ is an excellent ETF to use when stock prices are temporarily falling.

On the other hand, there are people who make long-term investments using leveraged Nasdaq. They use TQQQ for regular investments. However, you should not use leverage for long-term investments. It is an extremely risky way to invest, and there is a risk that the value of your assets will drop to almost nothing during a recession.

All people who understand investing use TQQQ only for short-term investments. There are no professional investors who use leveraged Nasdaq for long-term investments.

The reason why many people consider using the leveraged Nasdaq for long-term investment is that they are judging it based on the performance of investing for about 10 to 12 years since 2010. For example, the following is the result of investing in TQQQ from 2010 to 2021.

As you can see, the asset value has increased by about 195 times. For example, if you have invested $10,000, it will increase to about $1,950,000. As for the yield, this chart results in an annual interest rate of about 60%.

However, we should not forget that there was a long boom during this period. Also, this result does not take into account major recessions that have occurred in the past. Naturally, increasing asset values by three times means that assets will decrease three times during a recession. Therefore, we must also take into account recessions.

The following are some of the reasons why leveraged investments are not suitable for long-term investments.

- The value of leveraged products will be inferior due to price fluctuations.

- A major recession will reduce the value of assets by less than 10%.

- Prices are slow to return after a major crash

Once you understand these, you will understand why it is a high risk to make long-term leveraged investments.

Price Fluctuations Reduce the Value of Leveraged Products

By using leveraged ETFs, the daily fluctuation can be doubled or tripled; in the case of TQQQ, the price movement is tripled as mentioned above.

However, if you check over several days instead of one day, the price change will not be tripled. Understand that with leveraged products, the performance will become inferior as the days pass. As an example, let’s consider the following price movement of the Nasdaq 100 (QQQ).

| QQQ | TQQQ | |

| Day 1 | 100 | 100 |

| Day 2 | 110 (+10%) | 130 (+30%) |

| Day 3 | 90(-18.2%) | 59,1 (-54.5%) |

| Day 4 | 100(+11.1%) | 78.8 (+33.3%) |

As you can see, even though the price of QQQ has returned to its original value, the price of TQQQ is low. When compared over a single day, TQQQ has three times the price fluctuation. However, when we check over the long term, the price does not move three times. Rather, leveraged products are known to decrease in value as days pass.

The reason why long-term investment in leveraged products is considered disadvantageous is that the value of the product declines with the daily price fluctuation.

A Major Recession Will Reduce the Value of Assets by Less than 10%

If the economy is booming and the value continues to rise, the asset can increase more than 100 times by using leveraged Nasdaq, as shown in the chart I just described. However, this chart does not take into account a major recession. We need to understand what happens to the value of our assets in a long-term recession.

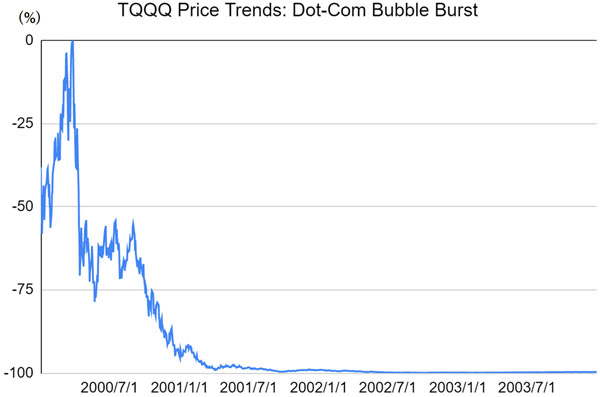

So let’s take a look at how much TQQQ’s asset value will fall due to the dot-com bubble burst and the collapse of Lehman Brothers. Below is a simulation of TQQQ at the time of the dot-com bubble burst.

During the dot-com bubble, using the highest stock price as a starting point, the value of assets was less than 1% after the bubble burst. By leveraging investments, assets rapidly disappear.

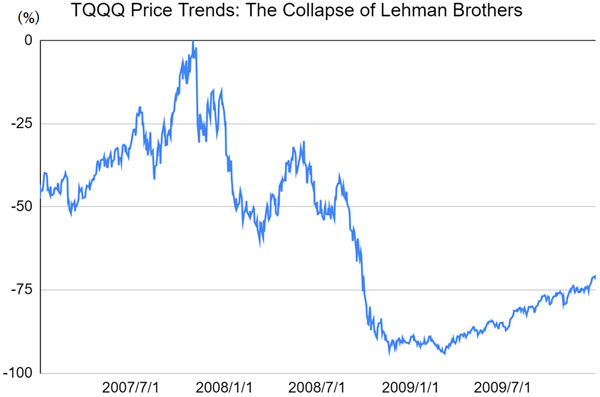

Also, the following is a simulation of investing in TQQQ at the time of the Lehman Brothers bankruptcy.

At the time of the Lehman Brothers bankruptcy, TQQQ caused asset values to fall by over 94%. While the decline in asset value is less than the dot-com bubble, the majority of assets disappear.

This is why you should not invest for the long term in TQQQ, including savings investments. There is always a major recession every few years. When this happens, if you are using leveraged investments, the majority of your assets will disappear. Even if your assets have increased 100-fold, every few years your assets will be reset to almost nothing.

Slow Return of Asset Value After a Major Crash: A Case Study in Chart Comparison

As mentioned above, in leveraged investments, the asset value will become inferior as days pass. Therefore, when stock prices plummet due to recession, the return of asset value will be slow. In other words, after the asset value becomes low due to a major crash, the speed of price increase is slow.

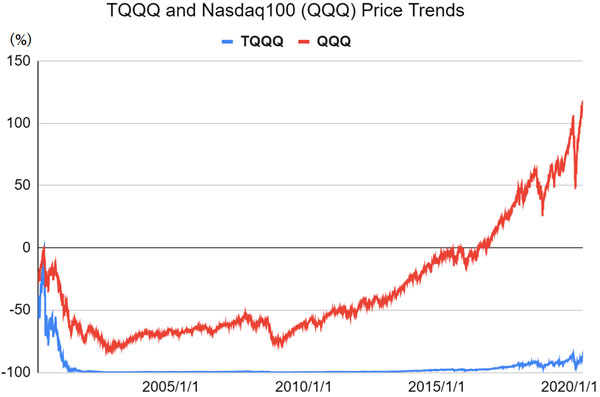

So, if we invest in TQQQ in 2000, let’s simulate what the stock price will look like in 2020. The results are as follows.

If you invest in TQQQ, the value of your assets stays low. In the case of investing in the Nasdaq 100 without leverage, the asset value has increased significantly due to the economic boom, even if the investment was made when the dot-com bubble burst. On the other hand, if you use a leveraged product for a long-term investment, your assets have decreased significantly.

It is true that by using TQQQ, your assets could increase more than 100-fold. However, you must understand that there is a risk that the value of your assets will be reduced to almost nothing due to a major recession that occurs every few years.

When making regular investments, you should not use leveraged products. This is because if you invest for a long period of time, there is a risk that a recession will reduce the value of your assets to almost zero.

If You Want to Achieve High Yield, Investing in Individual Stocks Is Better

For your reference, if you want to achieve a high yield by investing in stocks, invest in individual stocks without leverage, instead of using leveraged products. Investing in small-cap US stocks may increase the value of your assets by more than 100 times.

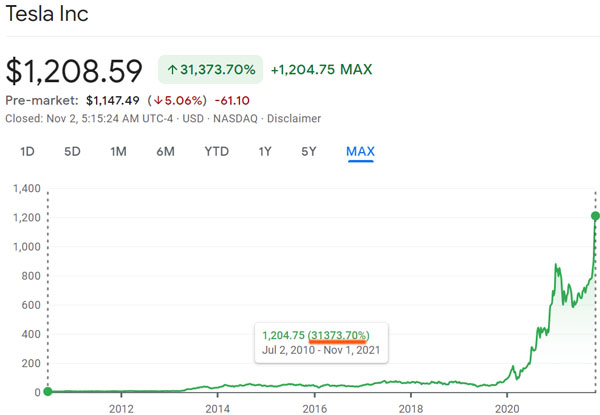

For example, if you invested in Tesla in 2010, the performance after 11 years is as follows.

As you can see, the stock price has increased more than 313 times. The annual yield is about 69%. In addition, even if a major recession occurs, Tesla’s stock price will never fall below 10%. Furthermore, since you do not use leveraged products, the stock price will rise again when the recession ends and the economy starts to boom.

When investing for the long term, it is less risky to invest in hyper-growth stocks than to use TQQQ. Also, if you choose the proper stocks, you can increase your assets at a higher yield than with TQQQ.

Do not invest in leveraged products for the long term, because there is a risk of losing almost all of your assets. TQQQ should only be used for short-term investments and not for long-term investments.

Understanding the Proper Way to Invest in Leveraged Nasdaq

Among ETFs, there are mutual funds whose price movements can be doubled or tripled through leverage. One of the most famous ETFs is TQQQ. Because of the superior yield of the Nasdaq 100 (QQQ), you can earn a large return by leveraging it.

For short-term investments, TQQQ can give you a return of 30-40% in a month or two. This is why it is recommended to use it temporarily.

On the other hand, you should not use leveraged investments for long-term investments. If you use leveraged Nasdaq for regular investments, there is a risk that the value of your assets will become almost zero during a major recession. Also, it takes a lot of time for the asset value to return to its original price after asset value becomes low. In some cases, the asset value may not return.

When investing in TQQQ, there is a right way to use it. Be sure to use leverages for short-term investments, not long-term investments.