Normally, if you deposit money in a bank or other financial institution, you will receive interest. However, in some countries, instead of receiving interest, your money may be reduced due to negative interest rates.

In reality, when you deposit money in a bank, your money will not decrease due to negative interest rates. However, with negative interest rates, your money will not increase at all because you will hardly earn any interest.

So how should you invest when the interest rate is negative or zero? The best way to invest with as little risk as possible is to invest in bonds or hedge funds.

Why should you invest in these when interest rates are negative or zero? In this article, I will explain how to invest and manage your assets with low risk.

Table of Contents

Japan and Germany Are Famous for Negative Interest Rates

Fixed deposit at a bank is known as the safest investment method. Even if you set up a fixed deposit at a bank, it is not an efficient way to invest your money compared to other investment methods. However, since there is no risk involved, many people use fixed deposits at banks.

However, some countries, like Japan and Germany, have negative interest rates. Theoretically, if you deposit money in the bank in these countries, your assets will decrease. Rather than receiving interest for depositing money in the bank, your money will be reduced.

As mentioned earlier, you will not actually lose any assets by depositing money in a bank. However, in the case of negative interest rates, the interest rate is very low. Also, in case of a recession, the interest rate will be zero in many countries, including not only Japan and Germany but also the US and European countries. In other words, there is almost no interest.

In this case, even if you deposit your money in a bank and make a fixed deposit, your money will hardly increase. Therefore, you should consider other asset management.

Yields on Government Bonds Are on the Decline Worldwide

Government bonds are known as an investment option that offers higher interest rates than fixed deposits at banks. As with fixed deposits at banks, investments in government bonds are known to be almost risk-free.

However, if you purchase government bonds with negative interest rates, such as those in Japan and Germany, you will receive less money than you paid. In other words, you are assured that your money will decrease, not increase. There is no value in investing in government bonds of countries with negative interest rates.

Also, interest rates are becoming low worldwide, so investing in government bonds is hardly profitable. For your reference, the following is the yield trend of 10-year US government bonds.

As you can see, the interest rate on government bonds has been declining year by year, and the annual interest rate is low even if you invest in government bonds. It is normal for the annual interest rate to be over 4% if you invest correctly, so you can understand that investing in government bonds will hardly increase your money.

Bond Investments and Hedge Funds for Low-Risk Asset Management

In the past, it was possible to earn an annual interest rate of 10% or more by investing in government bonds. Today, however, it is not possible to increase your money by investing in government bonds.

So, instead of government bonds, let’s try other investment methods. If you are a risk-taker, investing in stocks is an efficient way to increase your assets. However, investing in stocks is very risky, as your assets are often reduced to less than half.

Many people who want to increase their assets by investing even with negative interest rates are thinking of low-risk asset management. In this case, consider the following investments instead of investing in stocks.

- Investing in bond ETFs

- Investing in hedge funds

Even with negative interest rates, you can increase your assets by more than 5% per year by investing in these investments.

HYG Is the Most Famous Bond ETF (Exchange-Traded Fund)

There are two types of bonds: government bonds and corporate bonds. Of these, government bonds are low-risk but provide little interest income. If you invest in a country with negative interest rates, you will lose money, as mentioned above. Also, there are many countries with zero interest rates, and there are many government bonds that will hardly increase your money.

On the other hand, with corporate bonds, you can increase your assets by investing in them. Among these corporate bonds, try to buy corporate bond ETFs.

There are many types of corporate bond ETFs listed on the market. Among them, HYG is the most famous corporate bond that offers a high yield.

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

Even if a recession causes the value of corporate bonds to drop, corporate bond prices are known to return at an early stage. Therefore, investing in bonds is less risky than investing in stocks. It is suitable for those who want to increase their assets without fail, although they cannot make a large profit.

For your reference, below is a comparison of the past price movements of HYG and S&P 500.

The S&P 500 represents the price movements of 500 leading American companies. The yellow line is the S&P 500, and the blue line is HYG.

You can see that although bond prices fluctuate, the price of HYG hardly moves compared to stocks (S&P 500). The dividend yield of HYG is about 5%. Although the bond price fluctuates, you can earn about 5% dividend income every year, which is a positive return if you invest for many years. Naturally, the return will be greater than investing in government bonds.

If you want to get a high yield from your bond investments, most investors will invest in HYG. If you want to achieve a 5% annual interest rate with low risk, invest in HYG, a well-known high dividend bond ETF.

Low-Risk Hedge Funds Earn About 10% Per Year

However, if you invest in bond ETFs, there will be movement in the price of bonds, although it will be small. Also, the annual interest rate is only 5%. On the other hand, investing in hedge funds is one of the low-risk investments that can provide higher yields without price volatility.

When investing in low-risk hedge funds, you can earn as much as 10% annual interest. The hedge funds you should use are those that invest in alternatives. Alternative investments are methods that do not invest in stocks or bonds.

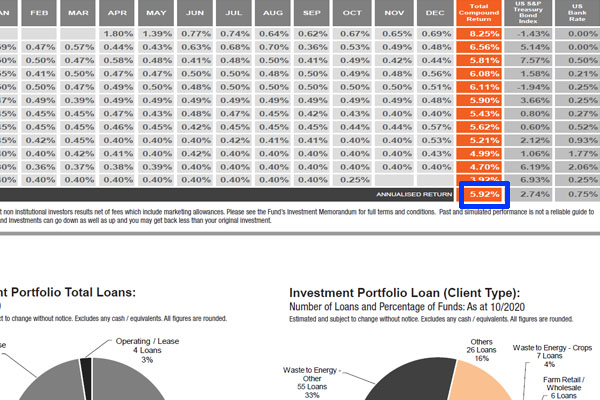

Some hedge funds deal in real estate, bridge loans, agricultural loans, etc., and earn interest income from them. By investing in these hedge funds, annual interest rates of 10% are possible. For example, the following is a fact sheet on the hedge fund that offers bridge loans in Europe.

When investing in this hedge fund, the investor’s yield after deducting fees is 8-10% per year. Although there is a risk of default by the lender, the risk is low because the fund does not invest in stocks or bonds, and there have been no negative return years in the past.

Investing in hedge funds that deal with alternatives will give you a higher yield than investing in bond ETFs. It is also less risky because of no price volatility.

The disadvantage is that you need to have US$30,000 in spare cash to invest in hedge funds. In the case of bond ETFs, you can invest as little as $100, so anyone can start investing. On the other hand, if you want to invest in a hedge fund, you need to have more than US$30,000.

It Is Possible to Invest in Hedge Funds with Low Annual Yield Fluctuations

You can also invest in hedge funds with lower risk. These hedge funds have annual volatility of less than 1%.

If you invest in these hedge funds, the yield will be as low as 6-8%. In this way, you can earn a stable 6-8% per year with almost no price fluctuation and no negative returns. For example, below is a fact sheet on the hedge fund that offers agricultural loans.

For this hedge fund, the past average annual interest rate is about 6%. The volatility is less than 1%, which means that even after deducting the fees to the hedge fund, you can still earn 6% interest annually.

As mentioned above, only those who have US$30,000 or more can invest in hedge funds. However, if you are able to invest, you can make a low-risk 6% annual interest income by investing in this hedge fund.

Many people think of hedge funds as trading stocks, bonds, forex, futures, and so on. All high-risk, high-return hedge funds trade with many times leverage against stocks and bonds. On the other hand, there are also low-risk hedge funds.

Even with Negative Interest Rates, You Can Increase Your Assets by Investing

If you do not understand how to invest properly, you may make a fixed deposit at a bank or buy government bonds. However, there are many countries with zero interest rates, and your money will hardly increase. Also, in countries with negative interest rates, buying government bonds will reduce your assets.

On the other hand, there are several low-risk ways to manage assets at an annual interest rate of over 4%. One of them is bond ETFs, which anyone can invest in, and if you invest in HYG, you can earn about 5% per year in dividends.

In contrast, if you can invest a lump sum of $30,000 or more, I recommend investing in hedge funds instead of bonds. By investing in low-risk hedge funds, you can earn a stable annual interest rate of about 10%.

Investing in ETFs (exchange-traded funds) and hedge funds is a low-risk way to grow your money, even if you live in a country with negative or zero interest rates. Understand that these investment methods are available, and use bond ETFs and hedge funds to manage your assets.