When considering asset management through offshore investment, many people sign up with RL360°.

However, there are some people who want to reduce, stop, or withdraw their investments in the middle of their regular investments with RL360°. Especially if the introducer is not good, it is common for people to think about reducing or stopping their investment amount midway.

However, if you reduce or withdraw your investment, you will lose your principal with a high probability. You also have the option of transferring your account, but basically, you should expect that no one will accept it.

It is possible to reduce or withdraw the amount, although it is basically not recommended. So, I will explain how you can reduce, withdraw, stop, or transfer in RL360°.

Table of Contents

Reduction or Partial Cancellation at RL360° Causes Losses

First of all, as mentioned earlier, you should not reduce, stop, or withdraw money from RL360°.

At RL360° seminars, people are often told that they can make partial withdrawals during the course of their investment. However, an IFA (Independent Financial Advisor) who solicit this way is a scam.

When they solicit you, they may also show you a simulation of asset management at 10% annual interest.

However, there is no guarantee that the annual interest rate will be 10%, as their simulation shows. Also, RL360° is a financial institution with very high fees, so there is a high risk of losing your principal if you make a withdrawal.

In RL360°, Fees Reduce Principal

RL360° is a legitimate company, and there is nothing wrong with it as a place to invest. However, in offshore investment, it only makes sense to keep accumulating a certain amount of money until the maturity of the contract.

If you reduce, stop, or cancel your investment, you will lose a lot of profit.

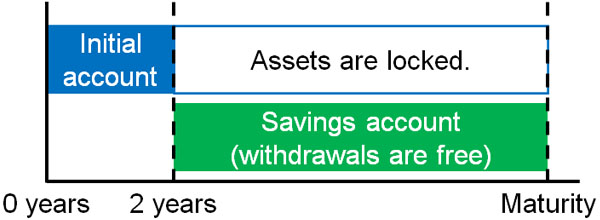

Why does it cause problems if you stop accumulating with RL360°? For RL360°, there is a 6% annual fee on the initial account.

The duration of the initial account will vary depending on the length of the contract. Roughly speaking, the money that accumulates in the first two years should be considered the initial account.

The longer you invest and the more money you accumulate, the smaller the fee rate will be for your initial account, resulting in a lower fee rate as the years go by.

On the other hand, what if you reduce or stop the amount? In this case, since there is no increase in the amount of money accumulated, the fee rate will not decrease, and you will pay a higher annual fee. Also, if you make a withdrawal due to a partial surrender, the commission rate goes up dramatically because you are withdrawing the money you have accumulated.

RL360° is designed so that for the first few years, your money will not grow at all. This is because of the high fee of 6% of the initial account. Therefore, if you reduce, stop or partially cancel your account, only bad effects will happen.

Transferring an Account is Basically Impossible

Some people may think, “Can’t I transfer my RL360° account to someone else?” RL360° has a system that allows you to transfer your offshore accounts, so theoretically, it is possible.

However, the fact that there is a system for transferring the account and actually being able to transfer the account to someone else are completely different things. In reality, it is impossible to transfer an RL360° account.

-Transfer Is the Same as Cancellation

Many people make the mistake of thinking that if they transfer their account, they can pass it on to someone else under the current conditions. However, the meaning of transfer is the same as a cancellation. The money in your initial account will not be returned to you.

Also, if you sign a contract with unfavorable terms, those conditions will be passed on to others.

The money in the initial account will not be returned, and no one wants to take over an offshore account with unfavorable conditions. Therefore, in practice, transfers are almost never made.

If you have already accumulated more than 10 years, you may be able to transfer your account. However, in cases with short accumulation years, there is no one to accept the transfer, and it is better to think that it is impossible.

Ask an IFA to Reduce, Withdraw, or Transfer

Some people still want to reduce, stop, or withdraw their money. If you stop, at least you will avoid further damage.

In such cases, you should ask your IFA (Independent Financial Advisor) that you want to stop or withdraw. The IFA will then provide you with the documents. For example, here are the documents to make a withdrawal

After you get these forms, ask the IFA staff what you need to fill out. These procedures will allow you to reduce, stop, withdraw, or transfer the funds.

You Should Consider Canceling Your Contract

If you have been paying for a short period of time, you should also consider canceling your account. Even if you stop making payments, you will not get your initial account back. In addition, if you leave your RL360° policy alone, you will be charged a hefty fee every year.

If so, you should cancel your contract so that you can get a full refund of the money you can withdraw.

To cancel the contract, you need to ask the IFA for the documents. The documents are as follows.

In the case of a bad contract, it is better to cancel the account than to freeze the account for a long time, so that you can get some money back.

-If You Can’t Contact Your Referrer, Contact RL360°

In some cases, you may not be able to contact your referrer, or you may not know which IFA you applied from. In this case, you need to contact RL360° directly.

No Problem to Switch to Other Offshore Investment

Alternatively, you can close your account and switch to another offshore investment.

As a matter of fact, RL360° is one of the most expensive offshore investments, so it is difficult to increase your money even if you want to manage your assets. So, there is a way to switch to another excellent offshore investment with the money you have saved up until then.

In this case, no matter how hard you try, you will not be able to get back your initial account. However, you can use the savings account (withdrawable account).

If you transfer your savings account to another offshore financial institution, you will be able to restart your offshore investment at a more favorable condition than transferring your savings account to another person.

Of course, make sure that you set the amount that you can invest until maturity, not the unreasonable amount that you signed up for with RL360°. Then you can consider reinvesting from RL360° into other good funds with lower fees and an annual interest rate of over 10%.

Understanding What You Should Consider in RL360°

It is important to note that investing offshore with RL360° will never be beneficial if you reduce, stop, or withdraw in the middle of your investment. For this reason, I recommend continuous accumulation investment.

However, you may not be able to continue your contract because your referrals are not good. Or, you may have negative investments due to high RL360° fees and lack of optimal asset management.

In that case, you may start thinking about reducing, stopping, or withdrawing. But in order to prevent the damage from spreading, you need to consider canceling the account or switching to another offshore financial institution.

If you invest in offshore accumulation properly, you can increase your money greatly. However, if the introducer is not good, you may fall victim to fraud, so consider it as a learning expense. Then, take procedures to move on to the next step, including cancellation or switching.