RL360° is one of the most important insurance companies (financial institutions) when you start to invest offshore. Regular Savings Plan (RSP) is the only product you should choose when you sign up with RL360° unless you have a specific reason.

However, when using the Regular Savings Plan, if you are a beginner in regular investment, you may not know what kind of product specifications it has.

What you need to understand are the fees, bonuses, and how to choose an IFA (Independent Financial Advisor). By understanding these points in advance, you will be able to increase your money through asset management.

Therefore, I will explain the fees and loyalty bonuses of the Regular Savings Plan (RSP), an important RL360° product, as well as how to choose an IFA.

Table of Contents

Learn About RSP Contract Age, Limitations, and Savings Period

If you are interested in signing up for RL360°, the only product you need to choose is the Regular Savings Plan (RSP). The product used to be called Quantum, and Quantum has been discontinued, and the Regular Savings Plan (RSP) has been sold instead starting in 2019.

What are the product specifications when you sign up for a Regular Savings Plan? Although RL360° has a long history and is highly rated by rating agencies, you need to understand the specifications of the product.

Buying financial products without thinking can easily lead to losses, so understand the basic specifications first. This is as follows.

-Contract Age and Accumulation Age Limit

Not all people of any age are accepted. In asset management, the younger your age, the more advantageous it is; if you are older, the rate of increase in your assets during your lifetime will be lower. For this reason, RL360° has a contract age limit.

You can sign up for a contract between the ages of 18 and 65, and you must subscribe within that age range.

Also, the age limit for accumulating assets is 71 years old. For example, if you sign up at the age of 61, you will be able to invest in overseas savings for 10 years. Therefore, it is advisable to subscribe to RL360° early.

If you buy it after the age of 60, the period of time you can accumulate is too short to make sense. If you are older, other offshore investments are better.

-Accumulation Period

As for the accumulation period, it ranges from 5 to 25 years. You can decide the most appropriate number of years for you among the accumulation periods.

In the accumulation period, you can freely decide the maturity period. However, an offshore investment of 10 years is too short. You need to consider 15, 20, or 25 years as a long-term investment.

-The Main Investment Currency Is the US Dollar

You can choose to invest in the US dollar, Euro, or other currencies. However, in regular investments, assets are usually invested in US dollars. You can invest in other currencies, but unless you have a specific reason, you should invest in the US dollar, which is the key currency.

Understanding the Regular Savings Plan (RSP) Fees

When you purchase a financial product, there is one thing that you must understand: the fees. This is because just a 0.1% difference in annual fees can make a difference of tens of thousands of dollars in your investment income.

In the Regular Savings Plan (RSP), there are the following fees.

- Plan Fee

- Initial Account Management Fee

- Asset Management Fee

- Fund Fee

- Credit Card Fee

Among the offshore investments, RL360° has a reasonably high fee rate. This is because of these various fees. Here is a more detailed explanation of what exactly they are.

Plan Fee: $7 per Month

If you invest in RL360°, you will be charged a monthly plan fee of US$7. Therefore, the annual fee is $84.

As for the $7 fee, the percentage of the fee will be larger in the early years when the amount of the fund is small. On the other hand, the fee is negligible when the amount is large. As is common with any offshore investment, the larger the investment, the lower the commission rate of the plan fee.

Initial Account Management Fee: 6% of the Initial Account per Year

Under the Regular Savings Plan (RSP), you will be charged a fee of 6% annually on your initial account.

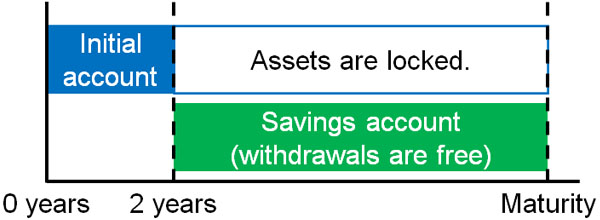

Think of the initial account as the money that is saved in the beginning. The term of the initial account varies depending on the contract length, and roughly speaking, the money you save and invest in the first two years will accumulate in the initial account.

To be more specific, the number of months in the initial account will vary depending on the contract period (accumulation years) as follows.

- 5 to 18 years: 18 months

- 19 years: 19 months

- 20 years: 20 months

- 21 years: 21 months

- 22 years: 22 months

- 23 years: 23 months

- More than 24 years: 24 months

The fee is 6% of the initial account each year.

For example, if you sign a 25-year contract and invest $30,000 in the initial account, the fee will be $1,800 per year.

- $30,000 × 6% = $1,800

Therefore, you should consider that the fees will be quite large. As for the commission for the initial account, the longer the accumulation period and the larger the amount of savings, the lower the final overall commission rate will be.

Asset Management Fee: 1.5% of Market Capitalization per Year

When you actually manage your assets through investment, the larger the investment income, the higher the market capitalization will be.

RL360° will charge 1.5% of the market capitalization per year as an asset management fee. A fee is charged each month on the total assets increased by asset management, resulting in an overall fee of 1.5% per year.

As for the fee on market capitalization, it is required by any financial institution for offshore accumulation investment.

Fund Fee: 1% per Year

RL360° is the place where the money is deposited, and the IFA is the one that actually manages your assets. The fee you pay to the IFA is 1% per year of the total assets under management.

Fund fees vary from IFA to IFA, and in some cases, the commission rate can be higher. Generally, you can expect to pay about 1% per year.

There are some insurance companies that offer no fund fees for offshore investment. However, RL360° has a fund fee, which is why its fees are higher than other financial institutions.

Basically, There Are No Credit Card Fees

When you actually use regular investment, there is a high probability that you will choose to pay by credit card. There are not many people who have bank accounts overseas, and there is no point in having an overseas account at an early stage when the maturity date has not yet arrived.

So, we use credit card payments to transfer money overseas. In this regard, RL360° basically does not charge credit card fees.

However, there is an exception for Amex, which charges a 1% fee on the amount paid. Therefore, if you pay with a credit card, do not use Amex.

RL360° has high fees. In addition to that, a 1% fee will make your future investment returns much worse. The only thing you need to remember is that you should never use Amex to pay RL360°.

The Commission Rate Is About 3% per Year

So far, I have explained what the commission rate is when you subscribe to Regular Savings Plan.

However, most people would like to know how much they will be charged roughly per year, rather than the exact rate. It depends on the number of years of the contract, but if we assume that the contract is for 25 years, the commission rate would be about 3%.

Since the fee rate is 3%, it can be said to be reasonably high. Also, as mentioned earlier, the fee is 6% of the funds saved in the initial account, so it is difficult to accumulate money at the beginning.

Since regular investments aim for an annual interest rate of over 10%, compared to this, 3% may seem low. However, it is important to understand that if the investment performance is poor, the principal will be lost.

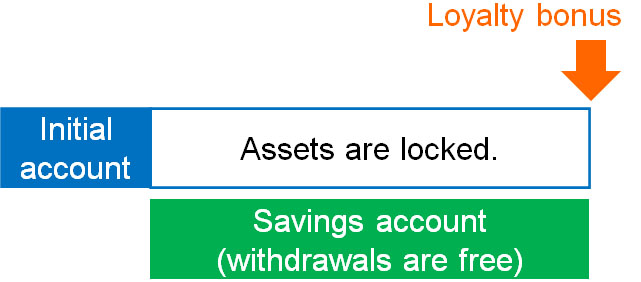

Offsetting the Fees Is the Loyalty Bonus

Although the commission rate is high, RL360° offers a loyalty bonus to those who continue to pay money until maturity. Consider that the loyalty bonus will be paid at the end of the maturity period, as shown below.

As for the Loyalty Bonus, it will be 0.25% multiplied by the number of contract years. This percentage will be paid as a bonus on the total amount of your contributions up to that point. Specifically, it will be as follows.

- 10-year contract: 2.50%

- 15-year contract: 3.75%

- 20-year contract: 5.00%

- 25-year contract: 6.25%

Even though there is this loyalty bonus, you should think of it as offsetting the high fees you pay each year. Rather than gaining from the bonus, you can mitigate your commission by being paid a loyalty bonus.

If you stop paying in the middle of a term, that term will not be included in the number of years, and the percentage of the loyalty bonus will be calculated.

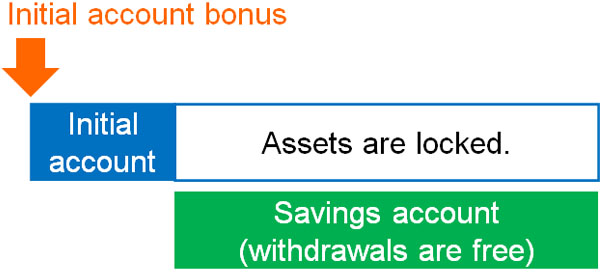

The Initial Account Bonus in RL360° Is Meaningless

RL360° will also pay you an initial account bonus if you invest more than a certain amount of money.

If your monthly investment is $420 or more, the following amount will be added to your initial account as an initial account bonus.

| Accumulation years | Incentives |

| 5 to 9 years | None |

| 10 to 14 years | 1.5 months |

| 15 to 19 years | 3 months |

| 20 to 24 years | 4.5 months |

| 25 years | 6 months |

For example, if you sign a 25-year contract at $500 per month, $3,000 will be added to your initial account.

- $500 × 6 months = $3,000

With such an initial bonus, you will feel like you are getting a great deal. However, the more initial account money you have, the more the 6% annual fee for the initial account will increase. In fact, the total fee for a 25-year investment, for example, is 150%, and your assets will decrease by the amount of the increased fee.

- 6% × 25 years = 150%

Therefore, even though there is a bonus for the initial account, it is just converted to a fee, so invest a reasonable amount.

Allocation Bonus for Larger Accumulation Amounts

There is also a bonus of 1% or 2% if the monthly accumulation amount is large. This is called an allocation bonus.

You need to invest a reasonably high accumulation amount, and in the following cases, the bonus will be added to your monthly contribution amount.

| Monthly Accumulation | Incentives |

| $770 | 1% |

| $1,330 | 2% |

However, the main principle of regular investment is to keep investing the amount of money that you have initially decided. Otherwise, the principal will be lost with a high probability.

It is impossible to keep paying out $770 or $1,330 every month unless you are wealthy. Therefore, if you are not a wealthy person, do not aim for the allocation bonus, and choose an amount that you can accumulate until maturity.

It Depends on the IFA Whether or Not the Principal Is Lost

Many people make a misunderstanding when it comes to investing in RL360°. Many of them think that if they invest in RL360°, their assets will be managed uniformly, and they can aim for an annual interest rate of 10% or more.

However, RL360° is just a place to deposit your money, and RL360° has a number of funds from which you can choose the investment products you want.

For example, in your home country, after depositing your assets with a brokerage firm, you can choose from all kinds of investments, including global stocks, developing country stocks, real estate, and gold. In the same way, RL360° offers a lot of investment options, and the IFA decides which investment products to purchase.

In RL360°, you can only sign up through an IFA, and depending on which agency you sign up with, your asset management performance will be completely different.

Of course, if you apply from an IFA that is not good at asset management, your investment will be negative, and you will lose your principal. It can be said that whether or not you can increase your money through asset management depends on the IFA. Recognizing this fact, the most important factor in applying for a Regular Savings Plan (RSP) is to choose the proper agent.

Understanding the Product Characteristics of RSP

The most important product for offshore investment with RL360° is the RSP, and you should not apply for anything other than the Regular Savings Plan.

However, if you want to start investing with RL360°, make sure you understand the fees beforehand. Many bad introducers will try to get you to invest a higher amount by emphasizing the benefits of the initial account bonus. But if you understand the nature of commissions, you will realize that bonuses are meaningless.

When investing overseas, RL360° charges higher fees. Make sure you understand this fact and set a reasonable amount for your investment.

Also, while it is possible to aim for an annual interest rate of over 10%, it all depends on an IFA. Therefore, even if you start with RL360° products, it is a good idea to sign up with a good agent that explains the risks involved, including the fees.