There are many prestigious universities in the United States. These universities collect large donations, and American universities are increasing their money by managing their assets. By increasing their assets, they are able to create research funds and provide scholarships to outstanding students.

Among US universities, Harvard University is known for its excellent asset management performance. What kind of portfolio does the Harvard University Endowment Fund use to generate such excellent returns?

The type of asset management that Harvard University and other US university foundations do is called endowment investment. By referring to the excellent portfolio of endowment investments, retail investors can earn excellent returns.

So, learn how the US prestigious universities are managing their assets and the detail of their portfolios. This way, you will know how to invest and grow your assets efficiently.

Table of Contents

US University Foundation Is Endowment

Endowment means a donation. However, in the case of US universities, an endowment means an endowment fund. The US has many outstanding entrepreneurs, and as a result, they donate a lot of money to the universities they graduate from. This is why the US university foundation is called an endowment.

If a large amount of money is raised and then all of it is spent, there is no money left. On the other hand, it is common for prestigious universities to invest their endowments instead of spending them all. This is the reason why university foundations are called endowments.

In the case of institutional investors such as life insurance companies and pension funds, they are entrusted with money from their clients and must return the money at some point in the future. For this reason, they tend to avoid negative returns and are not able to actively manage their assets.

For example, if you purchase life insurance in the US, your money will grow at an average annual interest rate of about 4%. Life insurance is a way to increase your money with almost no risk. However, compared to other investment methods, the speed of asset management is slower because there is almost no risk.

On the other hand, in the case of university endowments, they use endowments to manage assets. Since the money does not have to be repaid, it can be invested for a long period of time, and in this respect, it is similar to investment by individual investors. As for individual investors, they also use their own money, which does not need to be repaid, to manage their assets.

Retail investors should learn the investment methods of famous universities in the US because they can achieve excellent investment results by imitating endowment investments.

Harvard University Endowment Has Excellent Investment Yield Performance

Among the prestigious universities in the United States, Harvard University has one of the best endowment investments. For general endowment investments, the average annual interest rate for US university endowments is about 7%. On the other hand, in the case of Harvard University, the average annual return is about 10%.

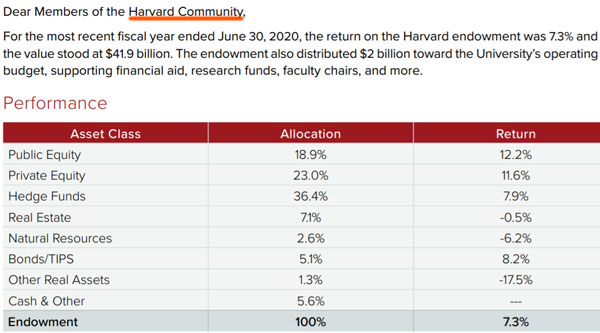

In other words, Harvard University has superior asset management performance compared to other university endowments. The Harvard University Foundation officially discloses its investment performance and portfolio as follows.

The investment performance varies from year to year. In any case, they manage their assets by this kind of portfolio.

For individual investors, there is a lot that can be learned from this portfolio. You can also find out how to get a return of about 10% annually.

They Invest in More Than Stocks and Bonds Through Diversification

Endowment investing, which Harvard University does, involves active diversification. It does not limit its investments to a single investment but rather lists multiple investments in its portfolio.

Many retail investors have unbalanced investment portfolios. Specifically, most of them invest only in stocks and bonds. This makes them highly risky.

There is an opportunity to increase a lot of assets by investing in stocks. On the other hand, during a major recession, it is normal for the money invested in stocks to be reduced to less than half.

However, when managing your assets, you need to increase your money even during a recession. However, if you invest only in stocks and bonds, there is almost a 100% probability of losing money during a recession. On the other hand, endowment investing allows university funds to diversify their investments by investing in other types of investments besides stocks and bonds to increase their assets even during recessions.

High Percentage of Alternative Investments

Stocks and bonds are referred to as traditional assets. On the other hand, investing in assets other than stocks and bonds is called alternative investments.

If you look at the portfolio of the Harvard University Foundation, you will notice that the percentage invested in stocks and bonds is low. If we add up the percentage of listed stocks and bonds in the previous figure, the total is 24%. In addition, the percentage of cash is 5.6%. In other words, more than 70% of their assets are invested in alternatives.

The alternative investments made by the Harvard University Foundation’s endowment investments include the following.

- Hedge funds

- Private Equity (PE)

- Real estate

- Natural resources and commodities

In particular, the Harvard University Endowment invests a large percentage of its funds in hedge funds. The reason for this is that hedge funds are the most efficient way to grow assets among alternative investments, and they are low risk.

Many people misunderstand that investing in hedge funds is a high risk, but investing in hedge funds can be a low-risk investment. It is true that there are high-risk, high-return hedge funds that leverage stocks many times and sell them short. However, there are also many low-risk hedge funds that deal with mortgages and bridge loans.

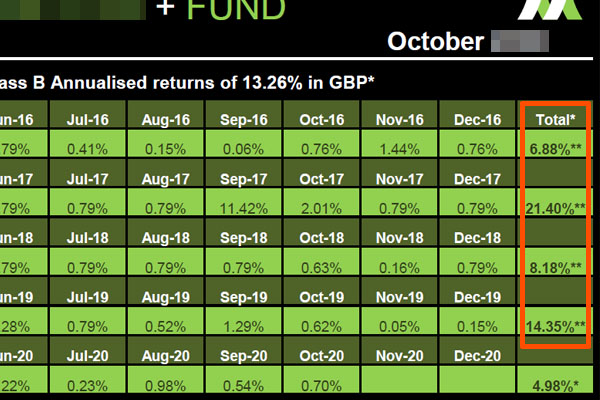

For example, below is a fact sheet on a hedge fund that provides mortgage loans to the elderly in the UK.

For this hedge fund, the average annual interest rate is 13.26%. Also, because of its low-risk asset management, it has never had a negative return year in the past.

It is impossible to more than double your assets in one year, like investing in stocks. But by using low-risk hedge funds, you can grow your money at an average annual interest rate of 8-13%.

Outsourcing Asset Management to Outside Experts

In addition to this portfolio, the Harvard Endowment is unique in terms of who manages its assets. The Harvard Endowment does not employ an asset manager. In other words, the assets are always managed by professionals.

Both institutional investors and family offices generally manage their assets by hiring professional investors or by outsourcing to outside investment institutions. Similarly, in Harvard Endowment investments, assets are always managed by professional investors.

Harvard University has been able to grow its assets at an average interest rate of 10% per year because professional investors build their portfolios and decide where to invest.

The same is true for individual investors. Unless you are a professional investor, the probability of getting good results by investing in individual stocks (stocks of specific companies) is low. Even active funds are well-known to perform worse than indexes such as Nasdaq, and amateurs are unlikely to make money by investing in individual stocks.

Therefore, retail investors have a better chance of making more money if they hire professionals to manage their assets, just like Harvard University. By opening an offshore investment account in a tax haven where there is almost no taxation, individual investors can invest in hedge funds and have their assets managed by professionals.

Also, when investing in stocks, it is better to invest in indexes such as Nasdaq or S&P 500 instead of investing in individual stocks to increase your assets.

Long-Term Investment Is the Basis of Endowment Investing

Another feature of endowment investment is that it allows for long-term investment. As mentioned above, endowment investing is a way to manage assets using donations. Therefore, there is no need to return the money, and it can be invested for a long period of time.

The reason why many investors lose money is that they make short-term investments. On the other hand, most investors who have made large fortunes are long-term investors. One of the most famous long-term investors is Warren Buffett. Similarly, the Harvard University Foundation has grown its assets through long-term investments.

The high percentage of alternative investments means that they are investing for the long term. Unlike stocks and bonds, alternative investments have the disadvantage of poor liquidity of money. For example, when investing in hedge funds, it is common to invest for five years or more. Also, when investing in real estate, you cannot sell the property immediately.

However, because they are using money that does not need to be repaid, they earn stable returns every year through long-term investments. Similarly, individual investors can increase their assets by investing for the long term instead of the short term.

Individual Investor Should Imitate the Investment Methods of a Prestigious University

After understanding the endowment investing that the Harvard University Foundation does, individual investors should try to imitate it.

- Diversify your investments outside of stocks and bonds.

- Invest in hedge funds.

- Entrust asset management to experts.

- Manage your assets through long-term investments.

Many people invest only in stocks and bonds. They also think about increasing their money in the short term instead of the long term. By rethinking this way of thinking, you will be able to increase your money at an average annual interest rate of 10%.

Some Investments Should Not Be Invested in, Such as PE and Commodities

However, it is important to note that there are some investment methods that individual investors should not imitate, even though the Harvard University Foundation does. Specifically, retail investors should not invest in the following.

- Private equity (PE)

- Commodities

Private equity refers to investing in unlisted companies. However, when investing in a company that is not publicly traded, the liquidity of the money is extremely poor. In addition, you can only convert your investment into cash if the company you invest in goes through an M&A (mergers and acquisitions) or goes public. In other words, the risk is high.

Also, because the University Endowment is an investor with more than US$100 million in the capital, it receives offers from good private companies. For private companies, raising $100,000 or so can be done by borrowing money from a bank. There is no need to ask individual investors to invest in the company. Therefore, individual investors cannot invest in good private companies.

Also, investing in commodities is highly challenging for retail investors. This is because you will be trading in commodity futures and options.

There are different types of commodities such as gold, silver, soybeans, and oil. This means that you have to predict whether the future price of soybeans will go up or down. It is difficult for amateurs to predict the future prices of these commodities.

The Harvard University Endowment, with professionals managing its assets and a huge amount of money, has been successful in growing its capital by investing in private equity, natural resources, and commodities. However, it is important to understand that these investments are not suitable for individual investors.

Mimic Endowment Investing and Increase Your Assets

Universities in the US receive large amounts of donations. They invest this money to generate research funds and scholarships. Harvard University, in particular, is known for its excellent investment performance through endowment investment.

Mimicking endowment investing is important for retail investors. Many individual investors only invest in stocks and bonds. Therefore, investing in hedge funds can help them diversify their investments. In addition, alternative investments are inevitably long-term investments, and even in a recession, you can increase your assets.

However, it is important to understand that there are some endowment investments that individual investors should not imitate. Private equity and commodities are not suitable investments for retail investors.

If you learn endowment investing and entrust the management of your assets to a professional, you can increase your assets at an annual interest rate of 10%, even if you are an amateur.