There are so many people who invest offshore in Hong Kong. Since it is a famous offshore region (an area with almost no taxation) in Asia, it is easy for beginners to invest offshore.

However, because it is an overseas investment, there are some people who fall victim to fraud. Even though you are using the offshore investment to increase your precious money, there are people who try to cheat you.

So, for those who want to invest offshore in Hong Kong, we will explain not only the advantages, but also how to find an IFA (Independent Financial Advisor: agency) in Hong Kong.

There are many people who do not know how to invest in Hong Kong. So, let’s understand not only the advantages, but also the disadvantages, and invest offshore in Hong Kong.

Table of Contents

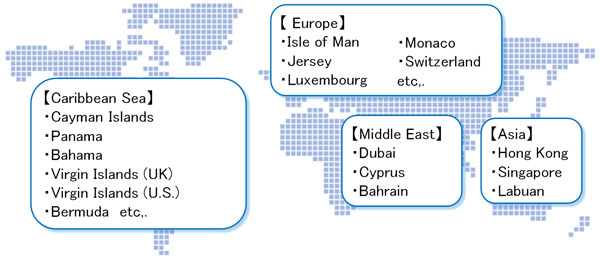

Important Offshore Areas in Asia (Tax Havens)

Hong Kong is a very famous offshore region in Asia. Hong Kong is also a country where finance is a major industry, so there are many excellent financial products available.

The offshore investment itself can be made while you are living in your country. When you invest in a foreign insurance company (financial institution), investing in Hong Kong is very popular, especially for people living in Asia, who can go there immediately if a problem occurs.

Opening a Bank Account Is Easy in Hong Kong

In addition to purchasing financial products, you can also open a bank account in Hong Kong. Many countries do not allow you to open a bank account with a travel visa, but in Hong Kong, anyone can open a bank account. One of the advantages of opening a bank account in Hong Kong is that you can deposit money in many currencies.

When investing in offshore insurance and mutual funds, one of the disadvantages is the currency risk. However, if the money is held in US dollars in a tax haven, there is no exchange rate risk.

For example, when traveling abroad, you can withdraw local currency at ATMs. Even if you have deposited in US dollars in Hong Kong, what comes out is the local currency.

Also, when an offshore insurance policy or an offshore mutual fund matures, you can receive the increased money in US dollars and reinvest it in US dollars to increase your money again in a tax haven.

It is a great advantage to be able to open a bank account in Hong Kong in order to diversify your risk by holding US dollars in a tax haven instead of your home currency.

Hong Kong Is a Good Choice for Offshore Life Insurance

Mutual funds are investment products that allow you to invest while living in your home country, without having to travel to a tax haven. Mutual funds are a way to accumulate money. By paying with a credit card, you pay money to an insurance company (financial institution) that has its head office or branch in a tax haven such as Hong Kong to manage your assets.

In contrast, in offshore investment, offshore insurance is also widely available. Life insurance is offshore insurance, and asset management through life insurance in tax havens is effective.

Although your money will grow if you invest in life insurance in your country, the size of the asset management is small compared to life insurance sold in tax havens. On the other hand, with life insurance in an offshore country, it is normal for your assets to increase tenfold or more (if you purchase at age 35). Also, at a minimum, your assets will double in about 20 years.

However, even if you are thinking of purchasing life insurance in a tax haven, most of them require that you live in the target country. For example, in order to purchase life insurance in Singapore, which is known for its offshore region, you must be a resident of Singapore.

On the other hand, people from all over the world can purchase life insurance even if they do not live in Hong Kong (except for Americans). Therefore, Hong Kong is an important choice when you want to buy offshore life insurance.

How to Identify an IFA for Offshore Investment in Hong Kong

How can we get offshore insurance or mutual funds in Hong Kong? Whenever you invest in an offshore fund, you must ask an agent, called IFA, to take care of the procedure.

Financial institutions do not sell products directly to their clients. They only introduce their products to IFAs, so it is essential to ask an IFA to help you with your offshore investment.

However, there are many IFAs, and many people may not know which IFA to ask. Since you will be investing abroad, it is natural to be confused. In such a case, please pay attention to the following items to determine the best IFA for you.

- Check if they are an authorized agent.

- Are they licensed?

- Do not send money to accounts other than the financial institution.

We will explain each of these in detail in turn.

You Should Check for Authorized Agents and Licenses from Hong Kong Monetary Authority

Make sure that the IFA you are applying for is an authorized agent. Some IFAs have not authorized agents. Avoid applying from these unauthorized agents.

Since offshore investment involves dealing with foreign financial institutions, some people become victims of fraud if they apply through non-authorized agents. Some financial institutions disclose their official IFAs. You should use this information to check whether it is a good IFA or not.

-Do They Have a License from the Hong Kong Monetary Authority?

A good IFA has a license from the Hong Kong Monetary Authority. Therefore, when choosing an authorized agent to deal with financial products in Hong Kong, you can check this license to determine whether they are a good IFA or not.

For example, in Hong Kong, an IFA is considered good if it has the following licenses.

- Type 1: Dealing in Securities

- Type 4: Advising on Securities

- Type 9: Asset Management

These are issued by the Hong Kong Monetary Authority, and you should choose an IFA based on whether or not they have this license.

How to Avoid Being a Victim of Fraud in Offshore Investment in Hong Kong

If you invest in Hong Kong, you can increase your money many times over, but there are some people who fall victim to scams.

So, here are some tips on how to avoid getting scammed in offshore investment. If you feel a little suspicious, don’t sign up for it right away.

-Do Not Transfer Money to Accounts Other Than the Financial Institution

Offshore investments are made by asking an IFA to apply to a fund (financial institution). Therefore, the IFA is only an agent, and the money is handled by you and the fund. It is the fund, the insurance company, that you send money to.

However, there are some unscrupulous IFA who say that they will keep your money at the IFA. But this is a scam, so be careful. You will not send money to anyone other than the fund.

There are other cases where they hold expensive inspection tour seminars in Hong Kong. However, except for offshore insurance, there are a number of offshore investment products for beginners that can be purchased living in your country. Nonetheless, it is not appropriate to make you pay a lot of money for a seminar.

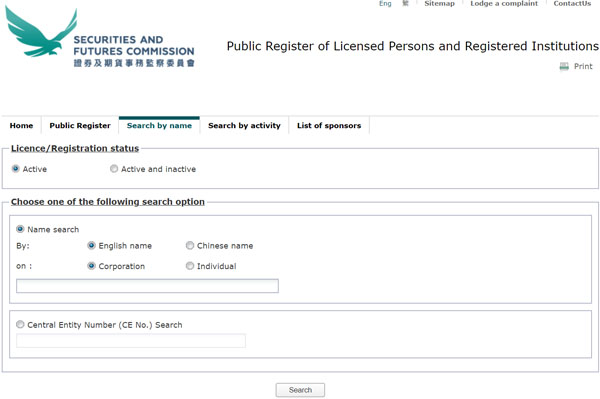

-Check the SFC (Securities & Futures Commission) for IFAs in Hong Kong

In addition, there are cases where the details of some financial products themselves are inferior. Even if the product looks good at first, it may be a scam.

In this regard, in Hong Kong, there is a way to determine whether an IFA is a scam or not: check the information of the IFA with the SFC (Securities & Futures Commission). A good IFA is always registered with HKMA (Hong Kong Monetary Authority), and if the IFA is registered here, there is almost no possibility that they are dealing with fraudulent products or cheating you.

If you find a financial product that looks good when you invest offshore in Hong Kong, you should first make sure that the IFA handling that financial product is registered with the HKMA. To find out, you can visit the search page on the SFC official website.

If the IFA is registered here, it is not a fraudulent product. This is because IFAs are only allowed to sell proper financial products, and if they sell fraudulent products, they will be punished by the Hong Kong Monetary Authority.

The key to avoiding failure in foreign investment is to be careful not to become a victim of fraud yourself. Although there are excellent offshore insurance and mutual funds in Hong Kong, it is also important to understand how to avoid scams in order to invest offshore correctly.

Investing Abroad in Hong Kong Is Easy

Hong Kong is a famous tax haven and is also one of the largest offshore financial centers in Asia. Therefore, there are many excellent financial products in Hong Kong, and it is an investment region that is an option for those who are considering investing overseas.

If you are considering offshore life insurance or mutual funds, you can start with regular investments in Hong Kong. Hong Kong is a very easy place to invest because you can do it without traveling there.

Of course, you can also go to Hong Kong to purchase offshore life insurance. There are also many people who open bank accounts in Hong Kong so that they can receive their money in US dollars in a tax haven.

However, since you will be transferring money abroad, you should be careful about fraudulent products. Make sure it is an authorized agent and check if it is an IFA registered with the Hong Kong Monetary Authority before investing. Once you have understood these things, all you have to do is actually invest in Hong Kong and grow your money many times over.