There are many people living in the Philippines, either as local residents or as expatriates. The Philippines has a larger population than any other country in Southeast Asia, and the economic growth rate is high. So how should people living in the Philippines invest?

As a matter of fact, many residents and expatriates in the Philippines make mistakes in their investment methods. This is because most of them think of buying financial instruments in the Philippines or investing in stocks of Philippine companies.

This way, your assets will not grow. In asset management, if you understand the right way, your money will grow.

The most efficient way for residents and expatriates in the Philippines to increase their assets is to invest abroad. This means that you have to invest outside the Philippines. I will explain why you should avoid investing in the Philippines and invest overseas.

Table of Contents

Investing in the Philippines Is Not Attractive

People want to support the country they are currently living in. That’s a great idea, but when it comes to investment, you have to make a decision based on whether or not your assets will grow. It is meaningless if your assets do not increase despite your investment.

Also, when you invest, developing countries are known to be very risky places to invest. Naturally, investing in the Philippines is high risk. In addition, the returns are low. It is common knowledge that investment in developing countries is high risk and low return.

When investing in the Philippines, what kind of asset management is generally available? In general, the following investment methods are known.

- Fixed deposit at a bank.

- Investing in stocks of Philippine companies.

These are the most common investment methods that anyone can do. There is also another method called real estate investment. However, the number of people who can invest in real estate is limited.

The Interest Rate on Bank Deposits Is About 1%

The most common way to invest in assets is through fixed deposits at banks. There are banks in every country, and you can make a fixed deposit. In the Philippines, you can make a fixed deposit in Philippine pesos.

In general, the interest rate on fixed deposits at major banks in the Philippines is lower than 1% for one year. The interest rate on fixed deposits changes from year to year, and the interest rate on fixed deposits in the Philippines is low.

If you use a small bank, the interest rate will be higher than that of a large bank. However, for fixed deposits in emerging countries, it is common to use a large bank.

Even if you use a smaller bank, the interest rate on your fixed deposit will not be higher than 6-7%. On the other hand, if you manage your assets correctly except for fixed deposits, an annual interest rate of 6-7% is easy to achieve. Compared to this standard, fixed deposits in the Philippines are extremely inefficient in terms of asset management.

Philippine Stock Prices Are Not Growing

On the other hand, many people are thinking of investing in Philippine stocks. One of the most popular ways to manage assets is to invest in stocks, and many people buy stocks.

However, people who invest in Philippine stocks are amateurs. Anyone who understands how to properly manage assets will not invest in Philippine companies. The reason is simple: the Philippine stock market is not growing.

For your reference, below is the price movement of the Philippine Stock Exchange Composite Index (PSEi) over 10 years.

As you can see, the stock market has not grown significantly in the past decade. This is the reason why you should not invest in Philippine stocks.

When investing in stocks for asset management, it is common sense to invest in US stocks. For example, in the case of US stocks, the stock price has more than tripled in the past 10 years (in the case of the S&P 500) when compared to the same period of time.

When investing in Philippine stocks, the stock price may go up, but the probability of it going down is also very high. Therefore, it is risky and not suitable for asset management. Investing in Philippine stocks is not a good idea for the purpose of growing your money.

Investing in Philippine Pesos Is Risky

In addition, there are other disadvantages to using financial institutions in the Philippines. That is, you must invest in Philippine pesos.

When investing in the Philippines, you can invest in real estate and life insurance, in addition to fixed deposits in banks and investing in stocks. However, all of these investment methods are risky. This is because you will be investing in Philippine pesos.

As is the case with all currencies of emerging countries, the credit rating of these currencies is low. In other words, the value of the currency is low. Also, when there is a global recession, the currencies of emerging countries tend to lose value.

The US dollar, on the other hand, has the highest market share in the world and is trusted. Since the US economy is the strongest in the world, the dollar may lose value in the short term, but it will not weaken in the long term. This is the reason why investors around the world invest in US dollars.

Money Can Only Be Received in Philippine Banks

Therefore, you have to invest in US dollars, not Philippine pesos. You should not invest in untrustworthy currencies, but in US dollars, which are highly trusted.

Also, when using financial products in the Philippines, not only will you be investing in Philippine Pesos, but you will be receiving your money in Philippine Pesos as well. In short, only banks in the Philippines can receive your money.

If you live in the Philippines all the time, that’s fine, but in reality, there are many people who live outside the Philippines. For example, it is common for people to live abroad to earn money. If you are an expatriate, you will always have to move to another country at some point.

In this case, when you want to return the money you invested, only banks in the Philippines can receive it, and you will be in trouble because you will not be able to use the money freely. If you invest in the Philippines, not only will your money not grow, but you will also have trouble when you stop investing and return your money.

Offshore Investments Can Be Made in US Dollars

Therefore, Philippine residents and expatriates should always choose to invest abroad when managing their assets. Overseas investment is an efficient way for Philippine residents to increase their assets.

One of the most effective ways to invest overseas is through offshore investments. There are regions around the world, such as Singapore and Hong Kong, where there are almost no taxes. These regions are called offshore tax havens. Offshore investment is a way to manage assets in tax havens.

When you invest offshore, you are investing in the US dollar, which is the key currency.

When you want to transfer the money you have invested to your bank account, you can receive it at any bank in the world. The currency you receive is not limited to the US dollar but can be any currency such as Philippine peso, Japanese yen, Thai baht, etc.

People all over the world buy financial products sold in tax havens. Therefore, it is natural that you can invest in US dollars, and the investment company will transfer the funds to all banks in the world.

You Can Manage Assets at Over 10% Annual Interest

What kind of investments is possible in offshore investments? There are many types of offshore investments. Some are risk-free and principal protected, while others aim for high yield.

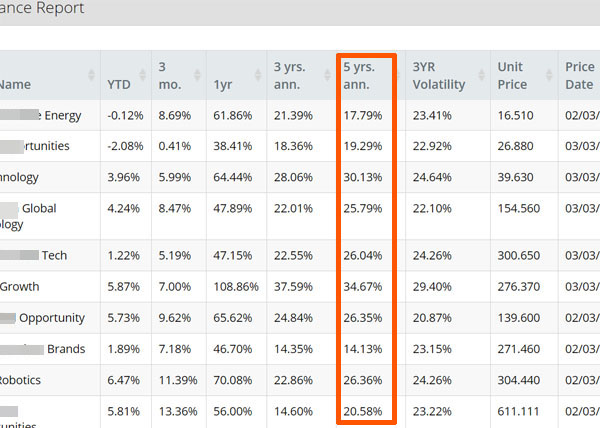

In the case of high-yielding investment products, annual interest rates of 10% or more are possible. For example, in my case, I have been investing offshore with an offshore insurance company. The following are the actual investment results.

Averaging the annual interest rate of the fund, the average annual interest rate has been 24.1% over the past five years. It is impossible to achieve this kind of yield by investing in the Philippines, but it is possible by investing offshore.

In general, offshore investment is a regular investment. On the other hand, there are some offshore investments that can be invested in a lump sum. For those products, you can invest in hedge funds to manage your assets.

For example, the following is a hedge fund that invests in real estate in Australia.

As you can see, the average annual interest rate is 9.27%. Since it is an investment in real estate, it is not affected by the economy. In other words, even if there is a global recession, the yield will not be low.

Of course, there are hedge funds that offer high-risk and high-return investments with annual interest rates of 20-30%. On the other hand, there are hedge funds that can earn about 10% annual interest with low risk like this.

When investing overseas, it is difficult to achieve high returns by opening an account with a securities company and investing in foreign stocks. On the other hand, if you invest in funds that are registered in tax havens, you will be able to achieve a higher yield.

Philippine Residents Should Invest in Offshore

Many people who live in the Philippines think of investing within the Philippines. As a result, they are not able to invest their assets correctly. In some cases, investing in Philippine stocks will reduce your assets.

Therefore, you must invest overseas. If you invest abroad, you can invest in US dollars instead of Philippine pesos. You can receive your money not only in Philippine banks but also in all banks around the world. You can also choose the currency you want to receive.

In addition, offshore investment is one of the most efficient ways to increase your assets. So, increase your assets by investing in tax havens.

Do not invest in the Philippines. Philippine residents and expatriates should purchase financial products overseas, not in the Philippines.