It is possible for ordinary people to invest in hedge funds. However, investing in hedge funds is different from general investments and is always a long-term investment. When investing in hedge funds, no one considers short-term investments.

The reason for this is that short-term investments incur high fees. Hedge funds do not like investors who buy and sell in the short term. Therefore, when you invest in hedge funds, you will lose money if you trade in the short term. When using hedge funds, always consider a long-term investment.

On the other hand, if you invest for the long term, your assets will increase due to the compounding effect. Hedge funds offer absolute returns, and your assets will compound regardless of economic downturns.

So how should you think about investing in hedge funds over the long term? How many years should you invest for at least? These are some of the questions I will discuss in this article.

Table of Contents

Using Hedge Funds Is Based on Long-Term Investment

In the general investment method, you open an investment account with a securities company. After that, you can invest in stocks and bonds. You can invest as little as US$100, and you can buy and sell at any time.

There are many people who engage in day trading in stocks, bonds, forex, and commodities. It is also usual for people to sell their investments after less than one year.

Investing in hedge funds, on the other hand, is based on long-term investment. In other words, no one invests in the short term.

Super-rich people and institutional investors are actively investing in hedge funds. They also use their unused surplus funds to make long-term investments. As for retail investors, they also have to invest for the long term in hedge funds, just like the ultra-high net worth individuals.

Due to Commission Issues, No Frequent Trading with Short-Term Investments

Why do we invest in hedge funds for the long term? The reason is that the fee structure when investing in hedge funds for a short period of time increases the probability of losing money.

In most cases, the fees for investing in hedge funds are as follows.

- A 5% purchase fee is charged when you invest.

- There is no purchase fee, but a 5% fee is charged for early termination.

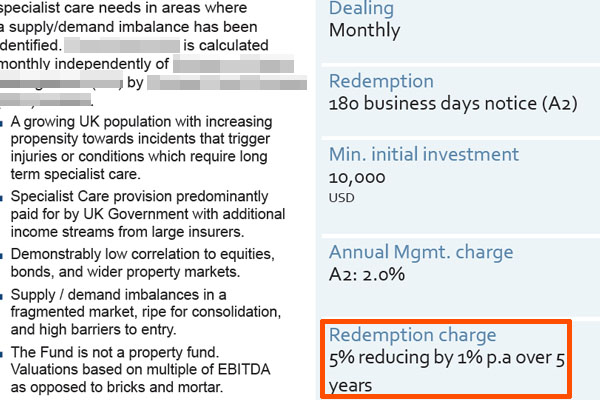

For example, the following hedge fund has a surrender fee.

While there is no purchase fee, there is a 5% surrender fee. However, the surrender charge decreases by 1% every year, and after five years, the surrender charge will be zero.

This is the reason why you need to invest for the long term rather than the short term when using hedge funds. Short term investments have high purchase or surrender charges, and the probability of losing money is high.

Offshore Investment Accounts Must Be Held for a Long Time

When you invest in a hedge fund, there are not only purchase and surrender fees that you need to pay. You also have to take into account the surrender charges for offshore investment accounts.

Normally, individual investors can hold a brokerage account without any fees. You can open an account for free, although you will have to pay a purchase fee for buying and selling stocks, bonds, and mutual funds (ETFs). Most online brokerages also offer no account maintenance fees.

On the other hand, if you want to invest in good hedge funds, you will have to open an investment account in an offshore tax haven where there are almost no taxes. You cannot invest in hedge funds with a brokerage account in your home country. If you want to invest in good hedge funds, you must open an account in a tax haven.

Although the specifications of offshore investment accounts vary from a financial institution to a financial institution, in many cases, you will be charged a hefty surrender fee if you close the account in less than 5 or 10 years.

In other words, if you terminate your account early, you will have to pay fees not only to the hedge fund but also to the financial institution in the tax haven that offers the offshore investment account. The reason why you should not invest in hedge funds for a short period of time is that you will be charged a lot of fees.

As for offshore investment accounts, the surrender charges are reduced year by year if you invest for a long time. Therefore, if you invest for a long time, you can make a lot of profit.

You Should Consider Investing for More Than 5 or 10 Years

If you understand what I have said so far, you will realize why short-term investments are not suitable for hedge fund investments. Unlike investing in stocks, bonds, and mutual funds, hedge funds have purchase or surrender fees. There are also high fees for offshore investment accounts if you cancel your account in a short period of time.

Therefore, when investing in hedge funds, it is advisable to invest for at least five years, no matter how short it is. Also, in general, you should invest for 10 years or more.

When investing in hedge funds, you should use surplus funds that will not be used for more than 10 years. The reason for this is that the fee structure is not suitable for short-term investments.

-Only Invest in a Lump Sum, Not in Regularly

Investing in hedge funds is not a regular investment but a lump sum investment. To open an offshore investment account, you need to invest a lump sum of US$30,000 or more, which means that you need to invest a large amount of money to increase your assets.

Although dollar-cost averaging is not available, hedge funds provide absolute returns, and as mentioned above, assets will grow even in a recession. Therefore, there is no need to worry even if you invest a large sum of money in a lump sum.

The Compounding Effect Can Increase Assets with Low Risk

Investing a large sum of money in a lump sum in long-term investments is one of the advantages of using hedge funds. When you make a savings investment, you invest little by little, and since you do not invest a large amount of money at the beginning, you lose opportunities. On the other hand, hedge funds allow you to invest large amounts of money and thus manage your assets efficiently.

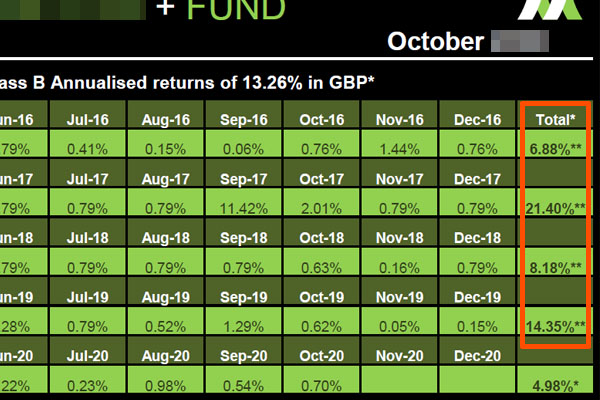

Also, when investing in stocks or mutual funds, it is normal for the asset value to be reduced to less than half in a recession. On the other hand, if you invest in hedge funds, you can invest with low risk. For example, the following is a hedge fund that provides mortgage loans in the UK.

Since it does not invest in stocks or bonds, this hedge fund is low risk and has not had any negative return years in the past. Also, the average annual interest rate is 13.26%. Regardless of a recession, your money will grow at this annual interest rate.

When investing in stocks, many people are not able to increase their assets at 10% annual interest. On the other hand, if you invest in hedge funds, you can earn 8-13% per year, even with low-risk hedge funds.

The disadvantage of investing in hedge funds is that you need to invest a lump sum of at least US$30,000, and you have to invest for a long period of time. However, if you want to increase your money with compound interest through long-term investment, hedge funds are excellent for low-risk asset management.

Simulation of the Compounding Effect of Long-Term Investment

How much will your money increase by compounding interest when you invest for a long time using hedge funds? Let’s take a look at a simulation.

If you invest $30,000 in the hedge fund mentioned above, your money will increase by compound interest as follows.

| Number of Years | Amount of Assets |

| 10 years | $104,204 |

| 20 years | $361,953 |

| 30 years | $1,257,239 |

| 40 years | $4,367,004 |

Since your money will grow through the compounding effect after you invest a lump sum, the amount of your assets will grow over time. Although the annual interest rate varies depending on the investment, this is the result when calculated using compound interest.

With hedge funds, it is easy to create an asset of US$1million or more. All you have to do is invest your money and then leave it for a long period of time. After you have invested for a long time, you can withdraw your money freely without any cancellation fees. By using an offshore investment account, you can withdraw money while increasing your money through asset management.

Use Hedge Funds to Invest for the Long Term and Grow Your Money

When investing in stocks, mutual funds, and bonds, short-term investments are possible. In many cases, opening a brokerage account is free of charge, and there are no account maintenance fees.

On the other hand, when you invest in hedge funds, there is a fee for purchasing or cancellation. Also, if you want to close the account in a short period of time after opening an offshore investment account, you will be charged a cancellation fee. Therefore, if you invest in hedge funds for a short period of time, you are sure to lose money. So, when investing in hedge funds, you should always invest for the long term.

When you invest in hedge funds, you should invest for at least five years. It is also advisable to invest in hedge funds for 10 years or more using an offshore investment account. This way, you will not be charged high surrender fees, and you will be able to increase your assets significantly through compounding.

Because of the surrender charges, be sure to invest for the long term when investing in hedge funds. It is impossible to make money with short-term investments, so you must invest for the long term when using hedge funds.