When investing in stocks, bonds, forex, and commodities, it is important to keep up with economic news. One of the most important data released is the US employment statistics.

When investing in stocks, focus on the US employment statistics, not your home country. The US economy has the greatest impact on stocks, bonds, foreign exchange, and commodities. Even if you are not investing in US stocks, it is essential to check the US economic news.

Why does the US employment report have such a big impact on stock prices and forex? And how can we understand the information on employment statistics?

The US jobs report is an important indicator for all investors. I will explain how to read the employment statistics.

Table of Contents

One of the Most Important Announcements in Investing Is the US Jobs Report

The United States is the country with the strongest economy. As a result, almost all countries are affected by the US economy. Most of the major recessions in the past were triggered by the US economy. There is a reason why many investors, even those who are not investing in US stocks, check the US economic information.

In addition to the jobs report, there are several other statistics that show the economic situation in the US. For example, here are some examples.

- ISM Manufacturing Index

- ISM Non-Manufacturing Index

- Consumer Price Index (CPI)

- Real GDP

- Employment Cost Index

Of these, the most important data is the US employment statistics.

Why the US Jobs Report Affects Stocks and Currency Exchange Rates

The reason why the US jobs report is so important is that after the jobs report is released, all kinds of indicators such as stocks, bonds, foreign exchange, long-term interest rates, and commodities can move rapidly. It also has a long-term impact on stocks, bonds, and foreign exchange after the jobs report is released.

In the US economy, consumer spending accounts for 60-70% of GDP. This means that information on individual employment is important for the US economy. The more the employment situation improves, the stronger the US economy becomes.

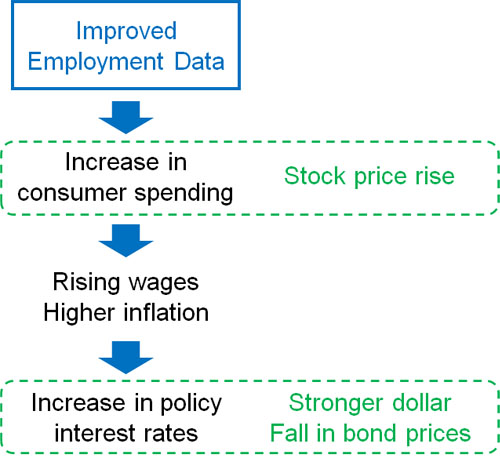

If the employment statistics are good, consumer spending will be strong. In other words, corporate earnings will improve and stock prices will rise. Also, as inflation rises due to economic expansion, the Fed will consider tightening monetary policy. In other words, the Fed will consider raising the policy rate.

If interest rates rise, investing in the US dollar will provide a higher yield. In other words, the US dollar will be bought, and the dollar will appreciate.

On the other hand, if the yield when investing in US government bonds becomes higher due to a rise in the policy rate, bonds (government bonds, corporate bonds, etc.) will be sold. In other words, a good employment report will lower the value of bonds. Without going into too much detail, bond prices and interest rates are inversely correlated.

The opposite phenomenon is likely to occur if the result of the jobs report is bad.

One way to judge whether the employment data is good or bad is to compare it with the forecast. Before the employment statistics are released, estimates are always given. If there is a big difference between the forecast and the actual data, stock prices and exchange rates are likely to fluctuate significantly.

The policy rate has a great impact on stocks, bonds, and currency. It is the Fed that decides the policy rate in the US, and the Fed considers easing or tightening monetary policy based on the monthly employment statistics. For this reason, the US employment figures are important.

The Key Data Are Nonfarm Payroll Employment and Unemployment Rate

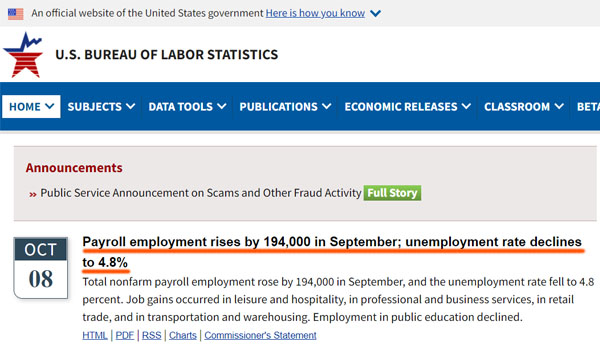

The US Department of Labor Bureau of Labor Statistics (DOL) releases employment statistics.

There are multiple data releases in the jobs report. The main indicators released in the employment statistics are as follows.

- Nonfarm payroll employment

- Unemployment rate

- Weekly hours worked

- Average hourly earnings

- Employment by industry

- labor force participation rate

Of these, the most important are the number of non-farm payroll employment and the unemployment rate.

By checking the number of non-farm jobs, we can see how much employment has increased or decreased in the US. The unemployment rate tells us how many people are out of work.

When comparing the number of non-farm payroll employment and the unemployment rate, the number of non-farm payroll employment is more important. The unemployment rate includes people who do not want to work. There are many people who do not intend to work for several months but are receiving unemployment benefits.

Therefore, the unemployment rate, which is a vague measure of willingness to work, is not as important as the number of people employed.

-It Will Be Released on the First Friday of Every Month

When is the US employment report released? The US jobs report is released on the first Friday of every month (rarely on the second Friday).

The jobs report is released at 8:30 a.m. New York time.

High Employment Numbers Do Not Always Lead to Higher Stocks and a Stronger Dollar

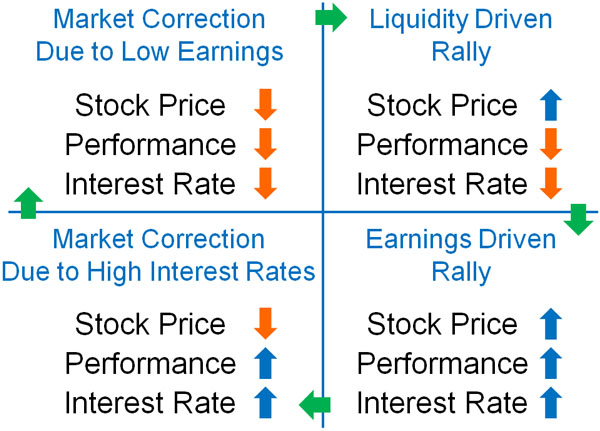

It is not always the case that a good jobs report will lead to higher stock prices or a stronger dollar. It is quite common for stocks to fall and the dollar to weaken despite a good jobs report. On the contrary, a bad jobs report can lead to a significant rise in stocks.

As mentioned above, the Fed decides the policy rate. Specifically, the Fed decides its policy at a meeting called the FOMC. If the results of the employment statistics are good, the Fed will tighten monetary policy after the FOMC meeting. However, when interest rates rise, corporate earnings will suffer.

When interest rates are high, companies have to pay a lot of interest. This leads to less business investment and less profit for the company. Also, interest rates on mortgages will rise, and consumer spending will fall. Therefore, when employment data is good, and it is expected that the Fed will raise its policy rate, stock prices will fall.

Even if the jobs report is good, stocks frequently fall and the dollar weakens. Improved employment and a strong economy do not necessarily lead to higher stock prices.

You Need to Understand the Market Conditions to Invest

Therefore, when you invest in stocks, bonds, forex, and commodities, make sure you understand the market conditions. If you understand what is going on in the market today, you will be able to predict the movement of stocks, bonds, and forex depending on the results of the employment report.

The economy always repeats the following cycle.

For example, after a major recession, there is always a liquidity-driven market. In a liquidity-driven market, the policy interest rate is low and corporate performance is poor. However, stock prices rise. The more bad news comes out, the more the government has to ease monetary policy. Therefore, in a liquidity-driven market, the worse the result of the employment statistics, the higher the stock prices will rise and the weaker the dollar will be.

When the results of the employment statistics are bad, we can predict that the economy is in bad condition, corporate earnings are getting worse, and stock prices will go down. However, the opposite phenomenon occurs in a liquidity-driven market that occurs after a major recession.

This is the reason why when you invest in stocks, bonds, or foreign exchange, you need to check what is going on in the world. That way, you will be able to predict the impact of the employment statistics on the prices of stocks, bonds, forex, and commodities.

Inflation Is a Factor in the Fed’s Monetary Policy Decisions

There are two main missions of the Fed. These are as follows.

- Increase employment as much as possible.

- Keep the annual inflation rate at 2%.

The more monetary easing, the more people will be employed. Therefore, when the number of people employed is high enough, the Fed will consider tightening monetary policy. If there are signs of monetary tightening, interest rates will rise and, as mentioned above, the value of stocks and bonds will fall. Also, the dollar will appreciate.

However, even if the number of employees is low, if the inflation rate is high, the Fed will hold an FOMC meeting and decide to tighten monetary policy in order to control the inflation rate. Therefore, stocks may fall and the dollar may rise after the release of the jobs report.

In addition to the number of people employed and the unemployment rate, the average hourly wage is also announced in the employment statistics. If the number of new hires is low, but the unemployment rate is low and the average hourly wage is increasing, inflationary pressure is strong and there is serious concern about future inflation. Therefore, even if the number of new jobs is low, stock prices will fall and the dollar will appreciate.

The Jobs Report Will Have a Big Impact on the FOMC Discussion

All investors, not just those who invest in US stocks, check the US jobs report. The reason for this is that the US economy has the most influence on the prices of stocks, bonds, currencies, and commodities.

The Fed makes monetary policy decisions at the FOMC meeting, and one of the most important factors discussed at the FOMC meeting is the jobs report. The Fed has the important task of improving employment and maintaining inflation at 2%, both of which must be achieved.

Since the jobs report has a great impact on the Fed’s decision, it has a strong influence on stock prices and forex. In fact, it is normal for stock prices and currency values to fluctuate significantly after the release of employment statistics.

So check the jobs report every month. As an investor, you need to check the important data in order to make profits. Also, even if the employment statistics are not good, it is frequently the case that the stock market rises or the dollar depreciates. So make sure you also recognize what the condition of the economy is.