Many people invest in indexes. Mutual funds allow you to invest in indexes, and the most famous indexes for US stocks are the S&P 500 and Nasdaq.

There are also mutual funds (ETFs) that invest in these indices with leverage. The most famous leveraged ETFs are the leveraged S&P 500 (SPXL) and the leveraged Nasdaq (TQQQ).

It is excellent to use these ETFs for short-term investments. On the other hand, it is risky to use leveraged investments for savings or long-term investments. The reason for this is that asset values may fall below 10% due to recession and asset values return slowly.

While leveraged investment has the advantage of gaining profit in short-term investment, it also has the risk of reducing the asset value to almost zero in long-term investment. Therefore, when investing using SPXL or TQQQ, understand both the advantages and disadvantages beforehand.

Table of Contents

SPXL and TQQQ Are Well-Known Leveraged Mutual Funds

Leveraged ETFs are the ones that allow you to achieve high yields. These mutual funds invest in an index with a leverage of 2 or 3 times.

For example, if the stock price rises by 1%, the stock price will rise by 3% in the case of 3x leverage. On the other hand, if the stock price goes down by 1%, the stock price will go down by 3%. Leveraging is a high-risk, high-return investment.

Among leveraged ETFs, the following are some of the most popular mutual funds.

- SPXL: 3x leveraged S&P 500

- TQQQ: 3x leveraged Nasdaq 100

The S&P 500 and Nasdaq 100 are both US indexes and are known to offer excellent annual returns. For this reason, many people use SPXL or TQQQ.

Of course, there are other leveraged ETFs as well. But other than SPXL and TQQQ, their performance is poor. Therefore, the leveraged mutual funds you should use are limited to SPXL or TQQQ.

Short-Term Investments Provide Greater Returns

One situation where you should use leveraged ETFs is in short-term investments. Even in a booming economy, stock prices do not keep rising. There will always be a 5-10% drop at some point.

For example, when stocks drop by 7-10%, investing in SPXL or TQQQ is an excellent strategy. The S&P 500 and Nasdaq 100 have been rising for a long time. So, when the stock price declines temporarily, you should invest in SPXL or TQQQ instead of the S&P 500 or Nasdaq 100.

In that case, you can get a significant return in a month or two, as shown below.

If you buy after the stock price has fallen and sell when it returns to its original price, you can get a 30-40% return. If you use this method during a booming economy, you will have a high probability of making a large yield. Leveraged ETFs are an excellent choice if you want to earn a large yield in the short term.

No Debt and Margin Call Is an Advantage

Also, even if you invest during a recession and the stock price keeps falling, there is no debt to pay. If you use margin trading or CFDs, the value of your investment will become negative due to the decline in stock prices, and you will have to pay additional margin due to debt, or you will be forced to cut your losses.

Leveraged ETFs, on the other hand, do not need to worry about this. For example, if you invest in the S&P 500 and apply 3 times leverage, the price movement will be as follows.

| S&P500 | CFD | SPXL |

| $100 | $100 | $100 |

| $90 (-10%) | $70 (-30%) | $70 (-30%) |

| $80 (-11.1%) | $40 (-42.9%) | $46.7 (-33.3%) |

| $70 (-12.5%) | $10 (-75%) | $29.2 (-37.5%) |

| $60 (-14.3%) | $-20 (Stop-loss) | $16.7 (-42.9%) |

When using margin trading or CFDs, the price moves three times against the stock value. Therefore, there will be additional margin due to debts or forced stop-loss due to falling stock prices.

On the other hand, in the case of leveraged ETFs, the daily price movement is tripled. Therefore, unless the daily decline is more than 34%, the price will not become negative (-34% × 3 = -102%).

Also, in the US, there is a circuit breaker system that temporarily halts stock trading when stock prices plummet. Therefore, a stock price drop of more than 34% in one day is definitely impossible. Therefore, when using leveraged ETFs, you will not incur any debt even though the stock price falls to almost zero.

The fact that there is no additional margin or no forced cut your losses due to debt is one of the advantages of using leveraged mutual funds.

Leveraged ETFs Are Not Suitable for Regular and Long-Term Investments

Although leveraged ETFs are suitable for short-term investments, they are not suitable for savings and long-term investments. If you are using SPXL or TQQQ for your regular investments, you should stop right now. The reason is that there is a risk that the value of your assets will become zero.

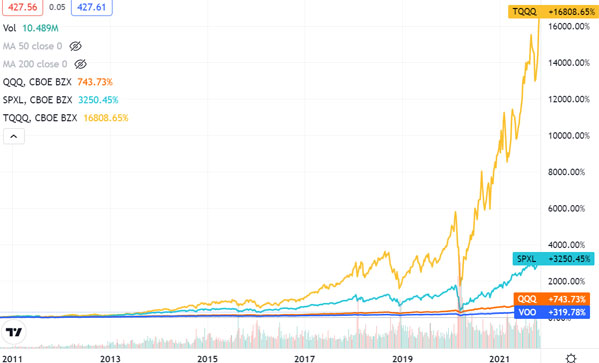

Many people who are trying to make a lot of money using leveraged ETFs refer to stock prices during economic boom periods. For example, the following is the result of investing in TQQQ from 2010 to 2021.

As you can see, the stock price has increased more than 195 times. Checking the yield, the annual interest rate of TQQQ is about 60% per annum.

For reference, the Nasdaq 100 is known to have a better yield than the S&P 500. Below is a chart comparing the respective stock prices.

- TQQQ: Yellow line

- SPXL: Green line

- Nasdaq 100 (QQQ): Orange line

- S&P 500 (VOO): Blue line

As you can see, when investing in SPXL or TQQQ, the results are better than investing in the S&P 500 or Nasdaq 100. Especially when investing in TQQQ, the yield is higher.

Nevertheless, why shouldn’t you use leveraged ETFs for long-term investments? The reason is that there is a risk that the stock price will drop to almost nothing during a major recession. Also, stock prices depreciate with long-term investment.

The Decline in Stock Price in a Boxed Range Is a Major Disadvantage

As mentioned above, leveraged ETFs allow you to triple the price movement in one day. However, it does not mean that the price will triple in the long term. In the case of a boxed range, where prices rarely change, the price of a leveraged ETF will be decreased. This is stock price depreciation.

For example, let’s simulate TQQQ when the price of Nasdaq100 (QQQ) fluctuates as follows.

| QQQ | TQQQ | |

| Day 1 | 100 | 100 |

| Day 2 | 110 (+10%) | 130 (+30%) |

| Day 3 | 90 (-18.2%) | 59,1 (-54.5) |

| Day 4 | 100 (+11.1%) | 78.8 (+33.3%) |

The price of the stock has tripled in one day. However, even though the price of Nasdaq 100 is back to its original value after a few days, the price of TQQQ is low. In this way, the stock price gradually declines due to depreciation.

There are some years when the price of the S&P 500 or Nasdaq 100 changes very little. If you invest in such a year, the value of SPXL will drop significantly, even though the price of the S&P 500 has not changed. Understand that the price can triple in one day, but not in the long term.

Profitable in Rising Stock Prices, But Slow Return of Value in Falling Stock Prices

When using leveraged mutual funds, it is easy to profit in situations where the stock price continues to rise. This is why they are suitable for short-term investments. If you use a leveraged ETF in a situation where you can expect the stock price to rise with high probability, you will get an excellent yield.

As an example, let’s check the chart when the Coronavirus shock occurred in 2020. It is as follows.

- SPXL: Green line

- S&P500 (VOO): Blue line

In the Coronavirus shock, the stock price bottomed out in March 2020; based on March 2020, the stock price increased in July 2020 as follows.

- SPXL: 175.27%

- S&P 500 (VOO): 45.9%

As you can see, the value of SPXL is greater than 3x. Although the value depreciates when using leveraged ETFs, if the number of days the stock price increases is large, the return is superior to 3x.

On the other hand, if the stock price falls significantly, the opposite phenomenon occurs. This is because, although there is no additional margin or no forced stop-loss due to debt, the value of the asset is rapidly reduced by the decline in stock prices. Next, let’s check the chart based on February 2020, when stock prices plummeted due to the Coronavirus shock.

- S&P500 (VOO): Blue line

- SPXL: Green line

As you can see, the decline in SPXL is much larger than that of the S&P 500, and recovery after a stock price drop is slower.

- S&P500 (VOO): -7.89%

- SPXL: -43.6%

As mentioned above, leveraged ETFs lose value over time. In addition to that, if the price continues to fall, the stock price will decrease at a faster rate. Therefore, when stock prices fall due to a recession, investing in leveraged ETFs will result in a slower return of stock prices.

Stock Prices Plummet in a Recession

Another major reason why leveraged ETFs are not suitable for long-term investment is that they lose most of their value during a recession.

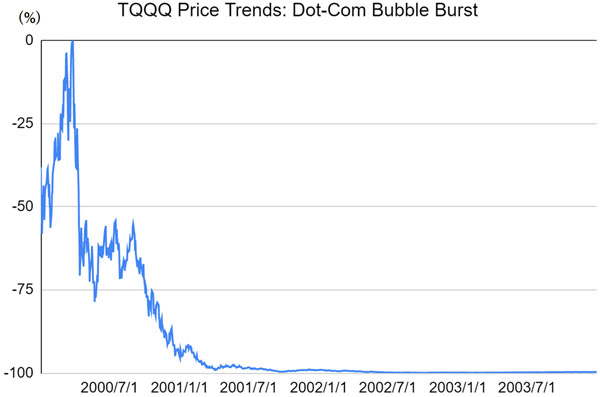

You need to understand how stock prices fluctuate during a recession, not during a boom. For example, the following is a simulation of investing in TQQQ during the dot-com bubble that occurred in 2000.

If you had invested in TQQQ at this time, the value of your assets would be reduced to less than 1%.

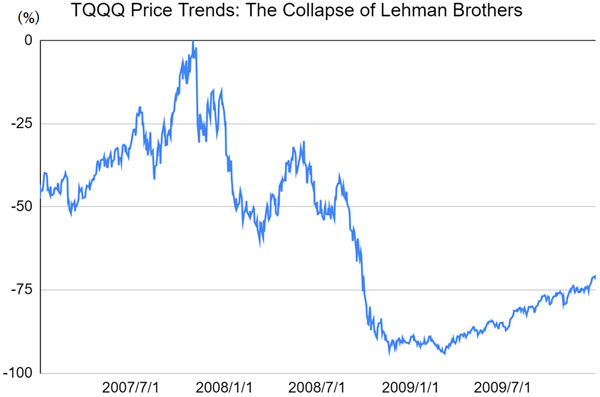

So what about in other recessions? The chart below shows the stock price movements during the Lehman Brothers bankruptcy.

Thus, the stock price falls by more than 94%. By investing in SPXL or TQQQ, the stock price could increase by more than 100 times. However, we must understand that there is a risk that a major recession will reduce the stock price to almost nothing.

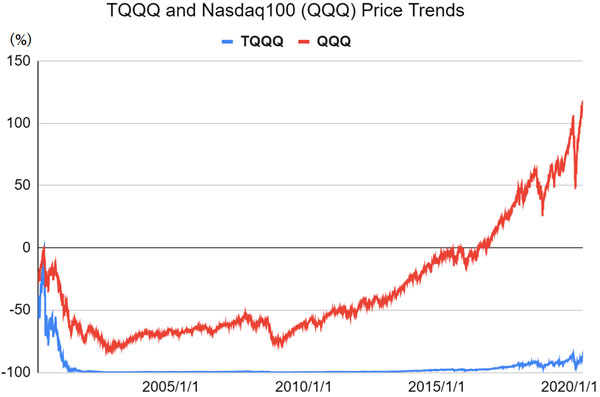

For reference, here is a simulation of investing in the Nasdaq100 (QQQ) and TQQQ from 2000 to 2020.

If you are not leveraged, the stock price has increased significantly. On the other hand, if you invest in TQQQ, the stock price has declined significantly.

This is why you should not use leveraged ETFs for regular investments. A major recession always happens every few years. During a major recession, leveraged ETFs lose almost all of their asset value. Even if your assets have grown a lot, you will lose a lot of assets during a recession.

When using leveraged mutual funds, there is a risk of losing almost all of your assets due to a recession. Because of this risk, long-term investments using leverage should be avoided.

Understanding the Use and Risks of Leveraged Mutual Funds

Mutual funds that can give you excellent returns in a short period of time are SPXL and TQQQ. They are very famous leveraged ETFs, and there are many people who use them.

However, be sure to utilize them for short-term investments. As a short-term investment, you can earn a 30-40% yield in a month or two. When the economy is booming, the S&P 500 and Nasdaq 100 are known to rise in price, so invest in leveraged ETFs when the stock price temporarily drops by 5-10%.

On the other hand, do not use leveraged ETFs for savings investments. In long-term investment, it is normal for stock prices to plummet due to recession and the value of assets to drop below 10%. Also, after the stock price falls, the speed of returning to its original price is slow.

When investing in leveraged mutual funds, there is a right way to use them. Understand the risks beforehand and use SPXL and TQQQ for short-term investments.