There are many people who want to make money through system trading, whether in stocks or forex. In the case of people who want to profit from automated trading, they simulate the results by backtesting and calculate the past returns. However, consider that these results are meaningless.

No one has ever achieved excellent results with fully automated trading of stocks or forex. The reason for this is that AI is not capable of predicting future price movements. Also, computers cannot figure out the exceptions that frequently occur in the financial markets.

There are reasons why the majority of people who trade using systems fail. This is because most of them use past backtesting results instead of actual trading results.

Why is it impossible to make money with system trading? I will explain the reason for this.

Table of Contents

Many People Simulate Yields by Backtesting

When thinking about earning money through system trading, most people use past fluctuations in stock prices or currency values as a reference. By backtesting, they simulate the yield.

For example, forex is known as speculation and is the least probable way to make money among investment methods. In the case of stocks, the stock price will rise over the long term. In addition, dividends are paid out. Therefore, if you invest in stocks for a long time, it is easy to increase your assets. For example, the following is the historical price trend of Nasdaq.

On the other hand, it is difficult to predict the future value of currencies. For example, here is the value of the US dollar and the Japanese yen.

So, in system trading, the idea is to make money through automated trading by AI, without involving human emotions. Also, in order to check whether the system trading can make money or not, backtesting is done by using past data.

Backtesting Past Results Is Meaningless

However, backtesting using past stock charts or currency value trends is meaningless. This is because they are past data, not future data.

Even an amateur can use past data to design a system that will provide excellent yields. However, even if you use the past returns calculated by simulation, you will not be able to achieve the same excellent yield in the future.

As an example, let’s consider forex system trading, which is known as a zero-sum game, where the sum of the winners and losers equals zero. For this reason, there are almost no people who make money from forex alone.

Winning in Forex is like tossing a coin. You toss a coin and try to predict whether it will come up heads or tails. Using historical data, it is possible to create a system with a winning rate of 80% or more. However, since tossing a coin is a zero-sum game, it is obvious that even if you create a system using past data, the future winning rate will not be high.

This is the reason why it is meaningless to use backtesting to simulate and calculate past returns.

There Is No Fully Automated Trading System

Another reason why automated trading systems for stocks and forex are meaningless is that it is impossible to create a fully automated trading system in the first place. In fact, there is no one in this world who is making money through fully automated trading.

If they were making money from system trading, it would be big news. It would attract huge amounts of investment money from all over the world, and the hedge fund would continue to make huge profits.

However, in reality, there is no such hedge fund. If you understand the fact that there are no funds that make money in stocks or forex through fully automated trading, you cannot make money through system trading using backtesting.

It Is Impossible to Predict Important Decisions and Market Trends

So why doesn’t system trading work? The reason is that AI cannot predict important decisions and market trends. Of course, not only AI, but we also cannot perfectly predict the future situation.

The value of stocks, bonds, and currencies is greatly affected by the following factors.

- The FOMC meeting in the US

- Movement in the 10-year Treasury yield

- Major government decisions

For example, in the past, the Chinese government has imposed a series of new regulations and fines on its giant corporations.

This caused Chinese stocks to plummet. Of course, it is impossible to predict what kind of policies the Chinese Communist Party will come up with. The value of stocks, bonds, and currencies is greatly affected by these market conditions. The reason why most investors focus on economic news is that it affects the fluctuation of their asset value.

On the other hand, simulations using historical data do not reflect the news. The simulation is based only on past price movements of stock charts and currency values. Therefore, even if the results are excellent in backtesting, there is a high probability that you will lose money in actual asset management.

Backtesting Cannot Predict Exceptions in Financial Markets

In addition, automated trading cannot predict exceptions that frequently occur in financial markets. In the financial markets, there is always a major stock market crash and a major recession every few years. For example, the following.

- 1987: Black Monday

- 2000: Dot-com bubble

- 2008: The collapse of Lehman Brothers

- 2020: Coronavirus Shock

What is important is the fact that the reasons why financial crises occurred are different. For example, in 2000, the bubble burst when the stock prices of IT companies plunged at a time when the Internet was not so popular.

The collapse of Lehman Brothers in 2008 was caused by the plunge in housing prices due to subprime loans, and the Coronavirus shock in 2020 was caused by the Coronavirus in China.

Financial crises occur for reasons that many people do not expect. Since there are no past examples, not only humans but also AI cannot predict them. Even if we refer to past cases by backtesting, automated trading cannot predict financial crises that will occur in the future.

LTCM’s Collapse Is a Good Example of Fully Automated Trading Not Working

The most obvious example of why fully automated trading does not work is the collapse of LTCM, which was called the dream team of Wall Street because its management team included winners of the Nobel Prize in Economics and a former vice-chairman of the Federal Reserve.

LTCM was a hedge fund that traded in bonds and had a low-risk asset management strategy called bond arbitrage. The investment strategy was to sell overvalued bonds and buy undervalued bonds. It also uses fully automated trading, with a computer deciding where to invest.

However, LTCM went bankrupt five years after its establishment. At the time, LTCM was the world’s largest hedge fund, managing over US$100 billion in assets, and it went bankrupt.

The reasons for LTCM’s collapse were the Asian financial crisis in 1997 and the Russian financial crisis in 1998. LTCM invested in Russian bonds, and LTCM had estimated that the probability of Russian government bonds defaulting was three times in a million years. However, the Russian bonds defaulted, and LTCM went bankrupt with high losses.

Exceptions frequently occur in the financial markets. AI can learn methods from the past, but it cannot predict the future. If you understand the LTCM case, you will see that it is impossible to make a profit through fully automated trading.

There Are Hedge Funds That Are Using AI to Do Semi-System Trading

However, there are several hedge funds that are generating significant returns through systematic trading. How do these hedge funds generate superior returns? These funds do not make money by fully automated trading, but by humans constantly feeding information to computers.

As mentioned earlier, the prices of stocks and bonds are affected by a variety of factors, including government decisions and important meetings. Therefore, hedge funds that trade on a systematic basis collect the latest news and keep updating their data. In other words, they are constantly uploading the latest information by humans.

If people update their data, AI can avoid the subprime mortgage problems that occurred in 2007-2008. Also, if we tell AI the news of a coronavirus pandemic in Wuhan, China in 2020, and that Wuhan has been put on city lockdown, we can avoid a stock market crash due to coronavirus shock.

AI cannot predict new exceptions in the financial markets. However, a human being can predict and understand the latest news. This means that hedge funds with automated trading that are producing excellent results have programmers constantly teaching the AI the latest information and data.

Actual Results Are More Important Than Simulated Past Returns

When you understand this fact, you will realize that hedge funds that have excellent results from system trading are not fully automated. They are semi-systematic traders because programmers need to constantly update the data.

Fund managers understand that if they create a system using only past backtesting results, it will not work. That is why they keep providing the latest data to the AI.

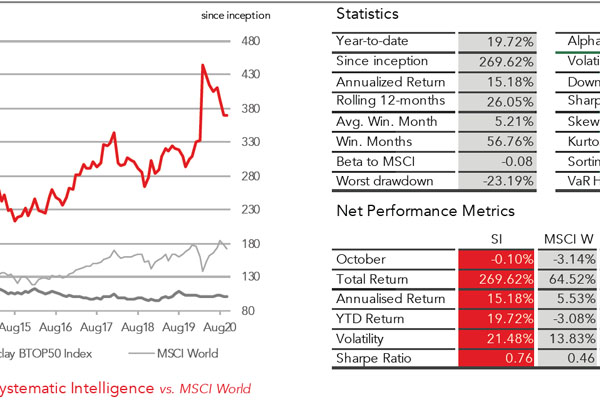

Therefore, when investing in a hedge fund that using an automated trading system, make sure to check the actual trade results, not past simulations. For example, the following is a fact sheet for a hedge fund that systematically trades commodity futures.

This hedge fund has an average annual interest rate of 15.18%. Volatility is as high as 21.48%, making it a high-risk, high-return hedge fund.

The fact sheet shows actual trade results, not backtesting simulations. Retail investors must refer to these actual trade results, not backtesting, to decide whether they should invest or not.

There Are No Hedge Funds That Make Money Only in Forex

For your reference, hedge funds that make money from system trading invest in stocks, bonds, or commodity futures; there are no hedge funds with automated trading that invest in forex alone. This fact shows that it is impossible to make money with forex system trading.

The hedge fund I mentioned above is registered in a tax haven and is also registered with Bloomberg, and the information in the fact sheet does not lie.

Hedge funds are required to undergo external audits because they receive investments from institutional investors and family offices. Therefore, they cannot provide false information. Also, since investment funds are segregated, hedge funds cannot use clients’ funds for any other purpose than investment.

If it is possible to make money through forex system trading, there should be a number of hedge funds specializing in forex. However, if you understand the fact that there are no hedge funds specializing in forex, you will realize that it is impossible to make money with automated forex trading.

Even with semi-systematic trading, where people input the latest data, the investment must be in stocks, bonds, or commodities in order to generate a superior yield.

Making Money with Systematic Trading Is Highly Difficult

You can understand whether or not you can make money with automated investments by checking the facts. If you find that there are no funds that are making money with fully automated trading, you will know that it is very difficult to make money with system trading.

In the first place, there is no point in simulating by backtesting. Even if you can produce excellent yields using past results, you cannot apply them to the future.

The prices of stocks, bonds, currencies, and commodities are greatly affected by economic news. Also, exceptions occur frequently in the financial markets, and a major recession comes every few years. Backtesting is useless because it does not take into account these unexpected market conditions.

All hedge funds that have achieved excellent results with automated AI trading have programmers constantly inputting the latest data. In other words, they are doing semi-system trading, not fully automated trading. Understand this fact and check the actual trade results, not the backtesting results, when investing.