When considering overseas savings investments, one of the well-known companies is RL360°. When you use these overseas financial institutions to purchase insurance products, one of the things you may be concerned about is the interest rate and yield. In other words, we think about how effectively we can manage our assets.

However, in reality, the investment performance differs completely depending on the IFA (Independent Financial Advisor) you apply to. Therefore, there is no point in researching how much yield is available with RL360°.

In short, the IFA you sign up with is the most important factor. To understand why you need to learn about how RL360° works.

So, I will explain how you should think about IFAs and how you can invest offshore with RL360°.

Table of Contents

Investment Performance Varies Among IFAs

It is true that you can aim for an annual interest rate of over 10% with offshore investments. However, many people make the mistake of thinking that if they invest to RL360°, they will get the same investment performance profit for everyone who invests.

First of all, RL360° does not manage assets. Instead, you can choose to invest in any of the funds that RL360° has.

For example, when you invest through a brokerage firm, you can choose from a variety of products, including global stocks, emerging country stocks, real estate, and gold. Also, among emerging market stocks, there are many funds (financial products) such as Mexican stocks and Brazilian stocks.

You choose the funds you want to invest in from among these. The same concept applies to RL360°, which has more than 200 funds. From these funds, you can choose which financial instruments you want to invest in at will.

However, it is difficult for amateur investors to choose foreign financial products. Therefore, an IFA will choose and invest in the funds on your behalf.

Because of this system, the investment yield will vary greatly depending on which agency you sign up through. Naturally, if you sign up with an IFA that is not good at managing assets, your assets will become negative.

Even if you can manage your assets in an offshore tax haven where taxes are almost non-existent, you must sign up with a good agency. Since annual interest rates vary depending on the IFA, it does not make sense to check the investment performance of RL360°.

Recognize that RL360° is a financial institution to manage your account. The IFA will give you all the instructions for which funds to purchase.

The Simulations Presented by IFAs are Meaningless

Whenever you invest in RL360°, you need to sign up with an IFA. Many IFAs are located in tax havens.

Before you sign the contract, you will be given an explanation, and you may be presented with a document that simulates an investment with an annual interest rate of about 10%.

However, it is important to consider that the actual performance will not be that. Even if you are aiming for an annual interest rate of 10% or more, it does not mean that you will be able to achieve 10% investment yield every year. Frequently, the performance will be lower than that.

It also does not mean that the IFA will be able to achieve excellent investment performance. You need to understand the actual portfolio and past performance of the IFA, not just imaginary numbers.

A Bad Agency Doesn’t Manage Assets Well

As a matter of fact, there are many cases where an IFA only works hard to solicit clients for commissions but has little or no investment performance afterward. When I had no knowledge about offshore investment, I was also faced with a bad IFA.

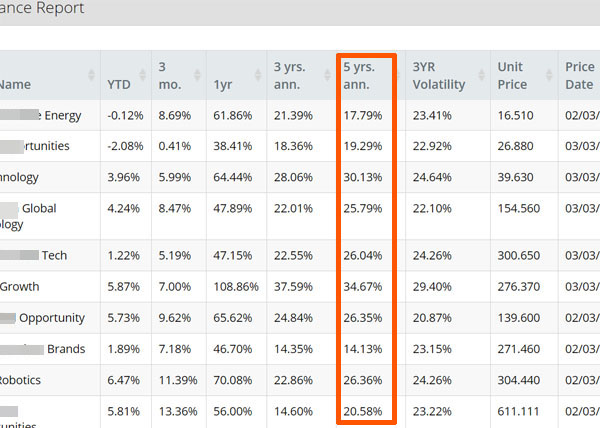

I have also had a friend who signed up with a scam IFA. Here is the actual performance when he invested in RL360°.

*He is Japanese, so the investment performance report is in Japanese.

Checking the actual investment performance, the total cumulative yield over the 5 years from 2015-2019 is 26.18%. In other words, the annual yield is about 5.24%.

What is important is the fact that 2015-2019 was a booming period. Nevertheless, the annual yield is only about 5.24%. What’s more, RL360° has very high fees; the charges are about 3% per year. In other words, taking fees into account, he has increased his assets slightly through offshore investments.

If you apply from an IFA that is not good at asset management, you will get such a bad investment performance. This is not mean that RL360° is bad. It’s just that the IFA he applied to was poor at asset management.

For your reference, here is the performance of my offshore investments.

Thus, I am diversifying my investments across 10 funds with an average annual yield of 24.1% over 5 years. Although my insurance company is not RL360°, I am able to achieve this investment result by applying for an excellent IFA.

As for him, he left a poorly managed IFA and switched to another good agency. This frequently happens in offshore investments. Even if you have invested in RL360°, if the agency only focuses on solicitation and the investment performance is bad, the asset management performance will be poor.

Cancellation or Withdrawal Before Maturity Will Result in Loss of Principal

Due to these facts, the most important point when making a regular investment with RL360° is which IFA you sign up with.

However, in reality, RL360° has frequently been used as a solicitation tool to deceive people, such as being widely introduced in multi-level marketing. Therefore, you need to sign up from someone you trust.

If you are considering subscribing to regular investments, you must check the past asset management performance of the IFA and make sure that they properly explain the risks of mid-term cancellation and withdrawal.

There is the main principle in offshore investments. The principle is that you need to continuously accumulate the amount of money you have decided at the beginning until maturity comes. If you don’t do this, you will lose your principal with a high probability.

First of all, if you cancel your account before maturity, you are sure to lose your principal because RL360° has high fees. RL360° offers a loyalty bonus for those who continue until maturity. When the loyalty bonus is paid out, you will be able to offset the commission.

However, if you cancel your account before maturity, not only will you not get most of your money back, but also you will not receive the loyalty bonus, resulting in a decrease in your assets.

Likewise, if you withdraw your money in the middle of the term, the fee rate will increase, and as a result, you are more likely to lose your money and principal.

Therefore, you must not sign a contract with an agency that recommends stopping or withdrawing in the middle of the contract. This is because they are encouraging you to lose money.

Consider the Risk of Losing Contact

In this sense, it is very risky to sign up from someone who is a multi-level marketer or someone you just know a little. When it comes to offshore investment, you have to apply from an excellent introducer.

The reason for this is simple: there is a very high possibility that you will lose contact with them during the process. In fact, I haven’t kept in touch with the person who first introduced me to offshore investment at all.

Moreover, the IFA’s asset management was not good in my case. So I changed my IFA in the middle of the process, and I got the excellent investment results that I just showed above. In your case, you need to apply through a good agent from the beginning.

Also, in many cases, when you reach maturity or terminate your account with RL360°, you will need to ask your referrer to withdraw your funds. Therefore, if you cannot contact your referrer, there is a high possibility that you will not be able to withdraw your assets.

In order to avoid this situation, it is very important to choose the right introducer when you start regular investment.

Investment Yield and Principal Loss Depend on the IFA

I’ve explained how you should think about IFA and how you should invest offshore with RL360°.

As for the interest rate, although we can aim for an annual interest rate of over 10%, it is not always possible to achieve that level of investment performance. In addition, RL360° is a place to deposit assets and should be considered an insurance company that is similar to a brokerage firm. Therefore, the most important factor is the IFA.

Your investment performance with RL360° depends entirely on the IFA. Depending on the IFA, your investment performance may be good or poor. Also, at maturity, you will withdraw your assets. Therefore, avoid signing up from an introducer who may not be able to contact you at the time of maturity after 15 or 20 years.

It is important to understand these points and then decide which agency you apply to.