We can make a lot of money by investing in hedge funds. Even if you are a retail investor, you can invest in hedge funds.

Most institutional investors (pension funds), family offices, and other rich people invest in hedge funds. This is because hedge funds offer significant advantages compared to investing in stocks and bonds.

On the other hand, there are some disadvantages to investing in hedge funds. When ordinary people invest in hedge funds, they need to understand not only the advantages but also the disadvantages. It is a fact that many people lose money by investing in hedge funds.

If you do not understand the right way to invest, you will not be able to increase your money by investing in hedge funds. Therefore, I will explain the advantages and disadvantages of investing in hedge funds.

Table of Contents

High Yield Is the Biggest Benefit

The reason why many rich people invest in hedge funds is simple. It is because they can increase their money more efficiently than investing in stocks and bonds.

If you are a professional investor, you can buy and sell stocks privately. On the other hand, if you are an amateur investor, you can increase your money more efficiently by having a professional manage your assets. The two major options are as follows.

- Invest in index funds

- Invest in hedge funds

One of the most famous indexes is the S&P 500. It is widely known that the S&P 500 is an index that invests in 500 leading American companies and has an average annual interest rate of 7-9% in the past. As shown below, stock prices continue to rise over the long term.

However, when investing in indexes, it is possible to earn about 10% per year, but it is impossible to achieve a higher yield. Therefore, many wealthy people invest in hedge funds.

Hedge funds invest in stocks, bonds, forex, and futures. They take short positions (selling) as well as long positions (buying). Hedge funds use all of these methods to increase their clients’ assets.

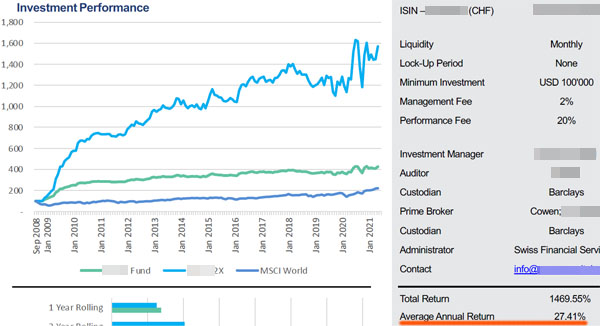

For example, the following is a fact sheet on high-risk, high-return hedge funds.

This hedge fund has an average annual interest rate of 27.41%. In addition, after 12 years of investment, the assets have increased about 16 times. While it is impossible to achieve this rate of return by investing in an index, it is possible with a hedge fund.

Of course, you need to invest in a hedge fund with excellent performance to achieve this annual return. However, if you invest in the proper hedge fund and wait for a long period of time, your assets will increase tenfold or more.

You Can Increase Your Assets Regardless of the Economy

In addition to being able to increase your assets significantly, there is also the advantage of not being affected by the economy. When you invest in stocks or bonds, your assets will always be affected by the economy. During a recession, stock prices tend to fall. Also, every few years, there is a major recession, and the stock price drops by more than 50%.

On the other hand, when you invest in hedge funds, they take short positions as well as long positions, as mentioned above. Therefore, you can make a profit even when the stock price is falling.

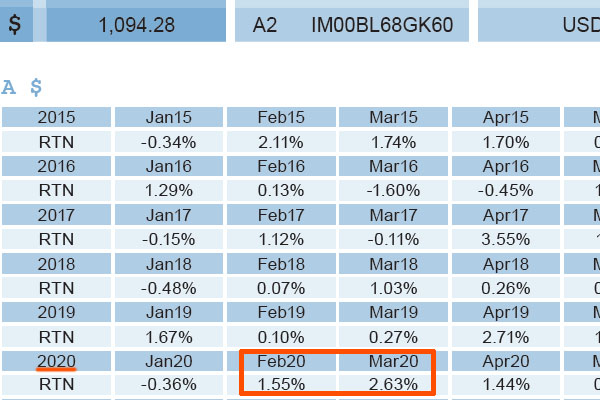

There are also hedge funds that do not invest in stocks or bonds. Investing in these hedge funds is also independent of the economy. For example, here is a fact sheet for a hedge fund that deals in nursing home real estate.

As you can see, the yield is excellent in February and March of 2020. These were the months when the coronavirus pandemic occurred, and stock prices crashed. Even in those months, the returns were positive.

Many people fail in the stock market because they cannot withstand a major crash. On the other hand, investing in hedge funds is not affected by the economy, so even amateur investors can continue to invest for a long time.

Annual Interest Rate of 10% Is Possible with Low-Risk Investments

Although there are high-risk, high-return hedge funds, it is also possible to invest in low-risk hedge funds. Hedge funds that do not invest in stocks or bonds, as explained earlier, fall into this category.

These hedge funds invest in bridge loans, real estate, and microfinance, etc. Since there is no price movement like in stocks and bonds, and the hedge fund earns interest income, it is low risk. While it is impossible to earn 20-30% annual interest, it is possible to earn about 10% annual interest with low-risk investments.

The reason why many people prefer to invest in low-risk hedge funds rather than index funds is that they can earn a stable annual interest rate of about 10% without being affected by the economy. For example, the following is a loan fund that lends money to foreigners who want to invest in real estate in Australia.

Even after fees are deducted, the average annual interest rate is 9.27%. You can earn a high-interest income regardless of the economy, and your money will grow with compound interest.

The Disadvantage of Needing More Than US$30,000

If you understand what I have described so far, you will understand why institutional investors and family offices around the world are investing in hedge funds. The reason is that hedge funds can provide high yields regardless of the economy.

However, despite these advantages, there are some disadvantages. One of the major disadvantages is that an individual investor needs to have at least US$30,000 in spare cash to invest.

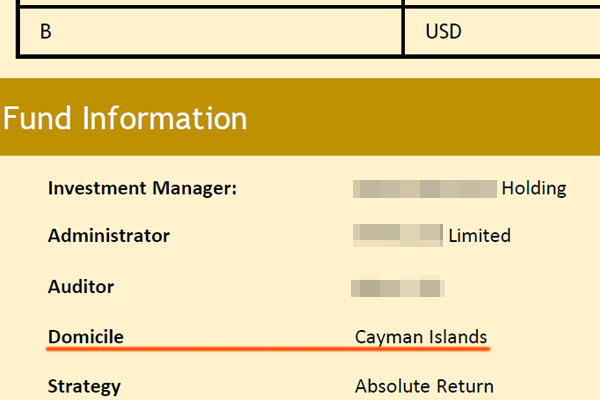

In order to invest in hedge funds, you must open an investment account in an offshore tax haven. For example, the Cayman Islands, Dubai, and Singapore are famous tax havens.

The minimum investment required for a retail investor to open an offshore investment account is $30,000. Therefore, poor people cannot invest in hedge funds and must have enough money to spare. However, if you can invest a lump sum of US$30,000 or more, you can invest in a hedge fund right away.

Fees Are Extremely High for Investing in Hedge Funds

Another disadvantage of investing in hedge funds is the high fees. If you invest in an index fund, the fee is about 0.1% to 1% of your assets as an annual management fee. Compared to this, the management fee is high, and in addition, there are other fees that you have to pay to the hedge fund.

For example, the following is the fee structure of a high-risk, high-return hedge fund.

As you can see, there is a management fee of 2%, a performance fee of 20%, and a subscription fee of 5%. Compared to index funds that charge an annual management fee of about 0.1% to 1%, the fees are overwhelmingly high.

However, the fact sheet shows the figures after fees are deducted. Therefore, if the performance of the numbers in the fact sheet is excellent, there is no need to worry so much about the fees.

Investing in Tax Havens, Requiring Overseas Remittances

As mentioned earlier, investing in hedge funds means that you have to use tax havens. Most countries in the world have financial regulations, and you cannot invest in hedge funds in your country of residence. On the other hand, in tax havens where there are almost no taxes, there are no regulations on where to invest since finance is the main industry.

In addition, even non-resident foreigners can open an investment account. Therefore, you can open an offshore investment account using an investment company (insurance company) that is registered in a tax haven.

However, when you invest offshore, you need to send money to the investment company overseas. In other words, you have to send money overseas.

Many investment products allow you to pay by credit card for offshore investments. However, among offshore investments, you cannot pay by credit card when opening an offshore investment account. You will have to send money overseas directly from your country of residence to the investment company in the tax haven.

It is important to understand that the transfer of money is not completed in your country, so it may be a bit complicated to send money.

There Are a Lot of Scam Hedge Funds, and Many People Are Being Cheated

One of the biggest disadvantages of investing in hedge funds is that there are many people who do not understand how to invest in hedge funds properly. Therefore, many people are deceived by fraudulent hedge funds.

The reason why so many people fall for scams is that they try to find hedge funds in their country of residence. However, there is no excellent hedge fund in your country. There is no fund manager who runs a hedge fund in a country with strict financial regulations and high tax rates.

For example, the following is a hedge fund registered in the Cayman Islands.

If you check the fact sheets of hedge funds with excellent performance, you will notice that they are all registered in tax havens. In addition, to protect investors, these hedge funds are audited by external agencies and are required to provide bank deposits and investment histories, making it impossible to create false fact sheets.

On the other hand, for hedge funds in your country of residence, there is no external audit, and they can create false numbers. Also, the clients are only people in your country of residence, the money is not segregated, and they collect money through private placement. In other words, it has all the elements of a scam.

It is a big disadvantage that many people do not understand how to invest in hedge funds correctly, and as a result, many people get scammed.

You Need to Find a Good IFA to Invest

It is not always true that offshore investments in tax havens can provide excellent returns. This is because investment companies registered in tax havens only provide investment accounts.

As for the securities companies in your country, you have to decide where to invest after opening the account. There are various investment options such as global equities, US stocks, developed country stocks, real estate, and gold.

Similarly, after you open an offshore investment account, it is up to you to decide which hedge fund you invest in.

However, as an amateur investor, it is difficult to know which hedge fund is the best. This is why you need to find a good IFA (Independent Financial Advisor) who has information on hedge funds and can provide you with fund fact sheets.

It is also impossible to open an offshore investment account and invest in hedge funds without going through an IFA. This is because investment companies in tax havens do not offer their products directly to clients.

I have invested in several hedge funds with good performance, and this is because I know a good IFA. In fact, there are many bad hedge funds with negative returns. So in order to invest in a good hedge fund, you have to look for an excellent IFA.

Learn the Advantages and Disadvantages of Hedge Funds

Every investment method that has its advantages also has its disadvantages. When you invest in hedge funds, you have the advantages of large returns and being independent of the economy.

On the other hand, not everyone can invest in hedge funds, and you need to have at least US$30,000 to spare. However, if you have more than $30,000, you can invest in hedge funds right away. Although you will need to send money overseas and find an IFA, you can use hedge funds to increase your money.

Just be careful of fraudulent funds. If you are looking for a hedge fund in your country, there is a 100% chance that you will be scammed. All good hedge funds are registered in tax havens.

Understand that there are these advantages and disadvantages. Although investing in hedge funds has great advantages, you will lose money if you do not understand the right way to invest. After learning the advantages and disadvantages of offshore investments, you should look for a good IFA and start investing in hedge funds.